Solana remains attractive due to strong usage, staking rewards, and supply controls. Reliability issues and governance risks still require careful consideration.

Solana is currently trading around 136.04 USD and is still one of the best cryptos to buy.

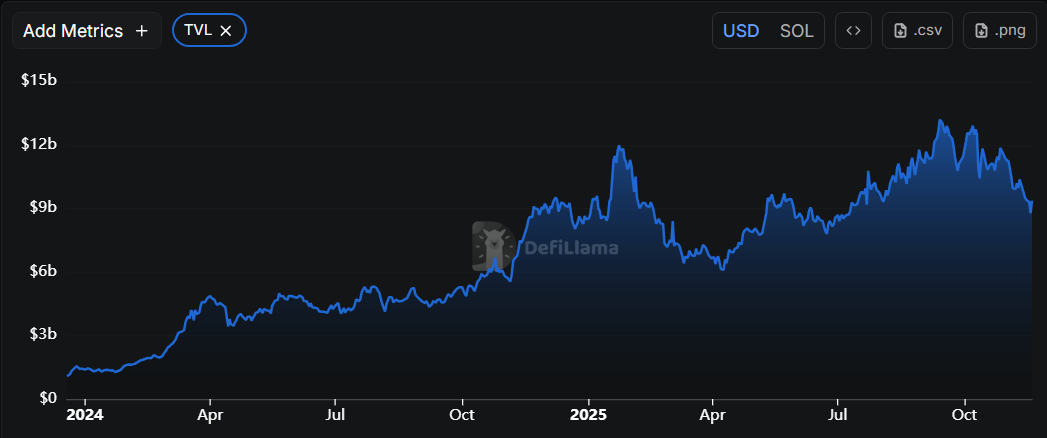

Its fast, low-cost infrastructure appeals to DeFi, NFTs, and payments, making it a long-term bet for most investors. As of September 2025, its Total Value Locked (TVL) hit a record $12.1 billion, showing strong demand in its ecosystem.

That said, Solana is not without risks. The network has had network outages before, and it faces questions about validator centralization and inflation.

So, is it too late to buy Solana? Let’s find out.

RECOMMENDED: 5 Reasons Solana (SOL) Could Explode in 2025

Why Is Solana Still A Good Buy

Solana continues to attract attention because real usage on the network keeps growing. Its rising TVL shows that more builders, users, and capital are choosing Solana for DeFi, trading, and on-chain activity.

This level of organic growth is often a stronger signal than price alone, and it suggests that developers see long-term potential in the ecosystem.

Staking also remains a major draw. More than 60% of all SOL is staked, and rewards usually fall between 4% and 6%, giving long-term holders a steady yield while contributing to network security.

Solana’s inflation design also makes it a good buy. The current inflation rate sits around 4.7% and is programmed to decrease over time, which can help stabilize supply as the network matures.

Half of all base transaction fees are permanently removed from circulation, meaning heavy network activity naturally slows net inflation. During busy periods, this can meaningfully offset new supply coming into the market.

RECOMMENDED: Is Solana a Good Investment? 7 Factors Every Investor Should Know

Key Risks to Consider Before Buying Solana

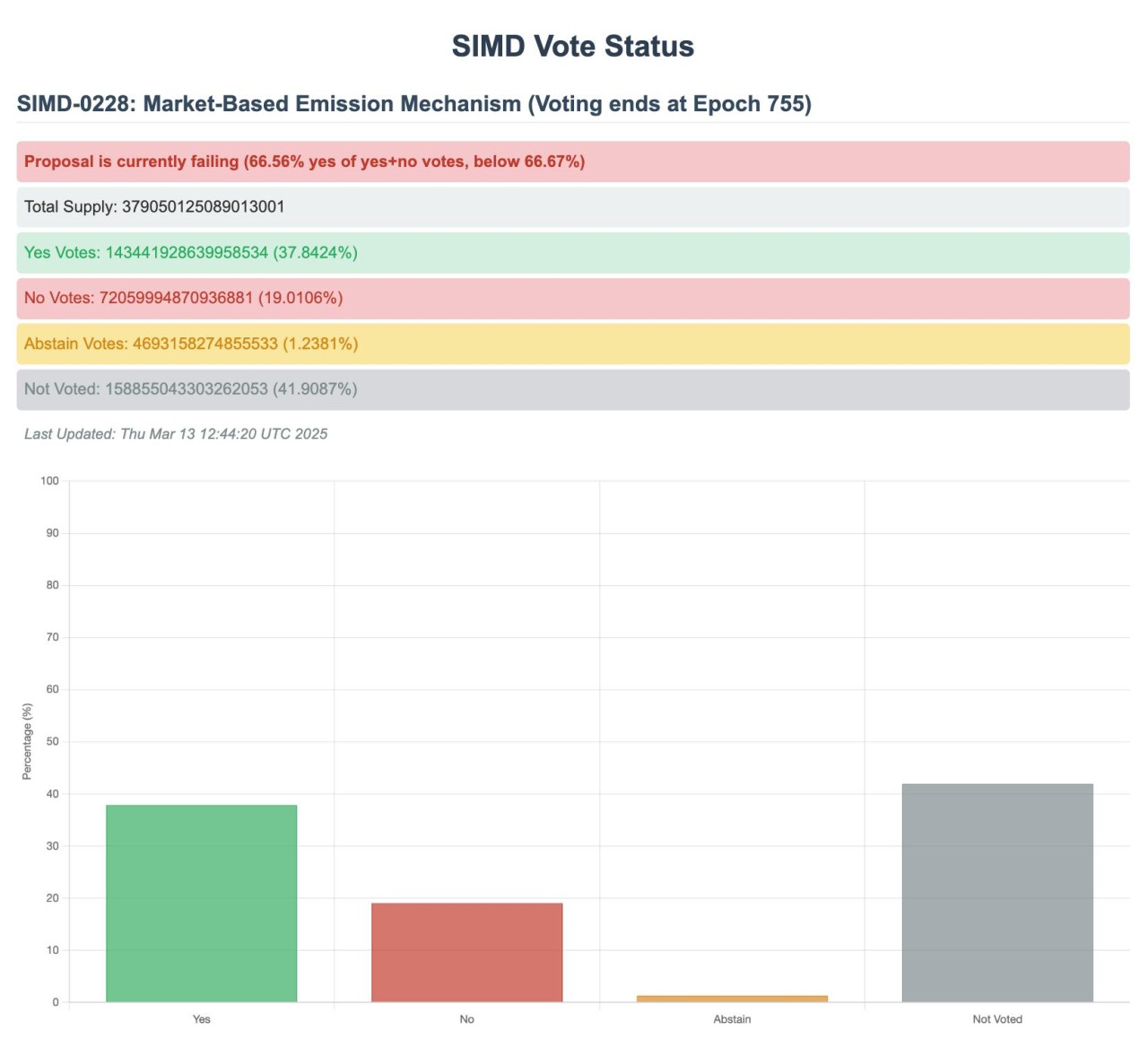

Solana isn’t without risks. A major debate around inflation – including a proposal to cut it from roughly 4.5% to under 1% – failed to win enough validator support. That leaves some investors unsure about the long-term supply path.

Network reliability is another concern. Past outages showed that even high-speed blockchains can face technical issues, and mission-critical applications need consistent uptime.

Validator centralization also remains a pressure point. With a large share of stake concentrated among a relatively small group of operators, governance and security risks become more pronounced.

ALSO READ: Is It Worth Buying Solana In 2025?

So, Is It Too Late to Buy Solana?

If you’re looking at Solana as a long-term play, it’s not too late. The fundamentals – fast network, growing TVL, staking rewards – are still very compelling.

But this isn’t a risk-free investment: inflation and operational issues could drag if things don’t improve

Conclusion

Solana may not be a moonshot anymore, but it’s far from done. If you believe in its ecosystem and are okay riding through bumps, it is not too late to buy; especially for long-term exposure.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

-

Proprietary 15-indicator methodology developed over 15+ years of market research.

-

Proven track record of spotting major turning points before markets move.

-

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

Act today and join the original crypto research service — still live and stronger than ever since 2017.