Solana saw enormous trading and activity in 2025, with large spot volume and high app revenue.

This raises a question about Solana’s role in decentralized exchange markets going into 2026.

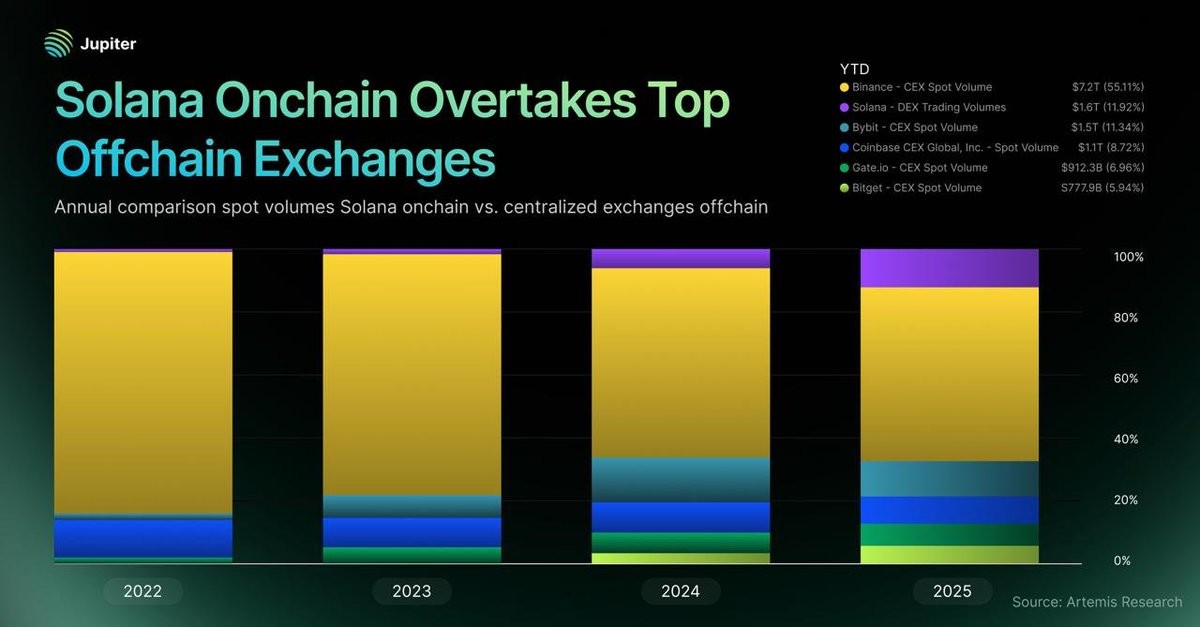

During 2025, Solana’s on-chain spot trading volume reached $1.6 trillion, putting it among the largest trading venues in crypto outside the world’s biggest exchange.

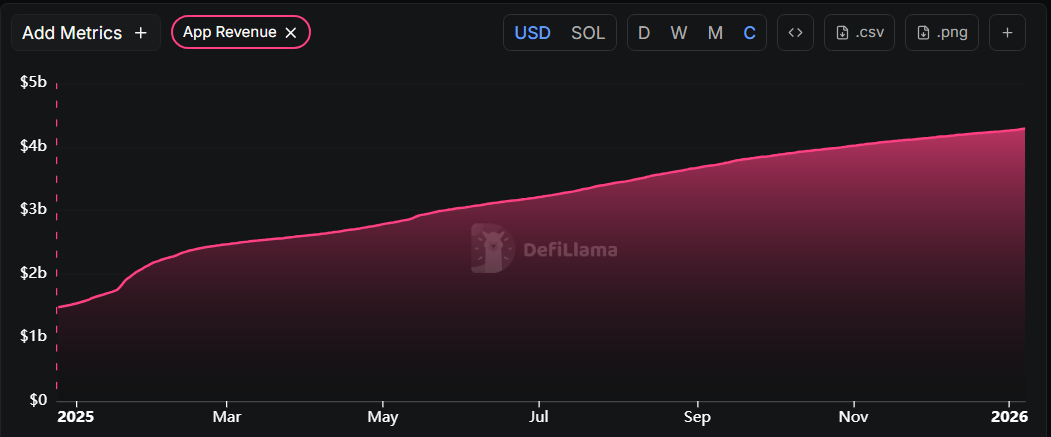

The network also logged $2.39 billion in application revenue and about 33 billion non-vote transactions for the year, showing heavy and sustained use across apps and decentralized markets.

We will be covering Solana’s potential for 2026 in detail in our next Premium Crypto Alert along with a crypto that we believe has 10X potential in 2026

RECOMMENDED: Solana: Is It Too Late to Buy? Latest Market Analysis (2026 Update)

Solana’s Spot Volume Surpassed Most Exchanges

Solana’s reported $1.6T in on-chain spot trading for 2025 placed it ahead of major exchanges like Coinbase, Bitget, and Bybit when measured by total volume for the year.

That figure accounted for about 11.9% of global spot market volume, with Binance still leading but significantly reduced from past dominance.

Solana hit more than $100B in trading volume in nine separate months of the year, indicating consistent activity rather than one isolated peak.

RECOMMENDED: 5 Reasons Solana (SOL) Could Explode in 2026

App Revenue And Network Activity Show Strength

Applications built on Solana generated $2.39 billion in revenue during 2025, up 46% year-on-year. Seven apps earned over $100 million each, while smaller apps together contributed more than $500 million.

The network processed roughly 33 billion non-vote transactions and averaged over 3.2 million active wallets daily, signs of repeated user engagement and demand.

Broader Metrics Suggest Growing Adoption

Solana’s performance went beyond trading volume.

Transaction fees remained low, averaging around $0.017 per transaction, and stablecoin supplies and transfers both reached new highs.

The network also supported a wide range of assets, including tokenized equities and expanded Bitcoin activity, pointing to a versatile and active ecosystem.

RECOMMENDED: Is Solana a Good Investment? 7 Factors Every Investor Should Know

Conclusion

With $1.6T in trading volume, strong application revenue, and billions of transactions processed, Solana’s 2025 data shows robust demand for decentralized markets on its chain.

These figures suggest that Solana could strengthen its position as a major DEX hub in 2026, backed by real, sustained usage.

We just covered Solana, Bitcoin and many others Cryptocurrency assets in our recent Premium members alert

Latest Crypto Premium Alert: The Bounce Is Here, As Expected. A Few Alts That Look Tremendously Powerful. (6th January 2026)

In our next premium crypto alert we will identify the crypto that we think has 10x potential