BNB, Solana, and Arbitrum stand out for strong usage data, clear supply controls, and growing network activity in a volatile market.

February opens with sharp price swings and selective buying across major altcoins.

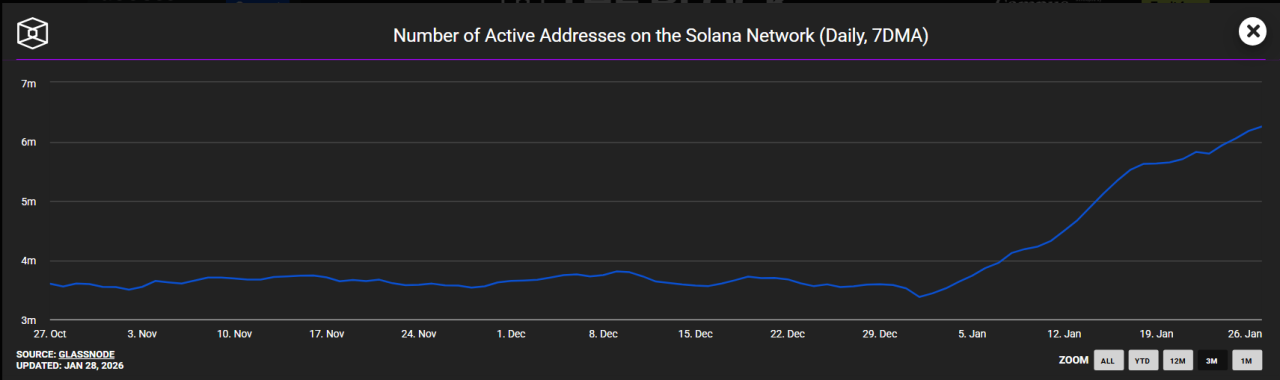

January data shows Solana’s active addresses more than doubled, Binance completed a 1.37 million BNB token burn, and Arbitrum remained one of the most used Ethereum scaling networks.

These trends point to projects with real users, steady demand, and visible growth paths.

1. BNB: Exchange Utility And Supply Control

BNB remains one of the most reliable large-cap altcoins because of its role inside the Binance ecosystem.

Traders use it for fee discounts, payments, and access to platform services.

In January, Binance removed about 1.37 million BNB through its quarterly burn, reducing circulating supply and supporting long-term value.

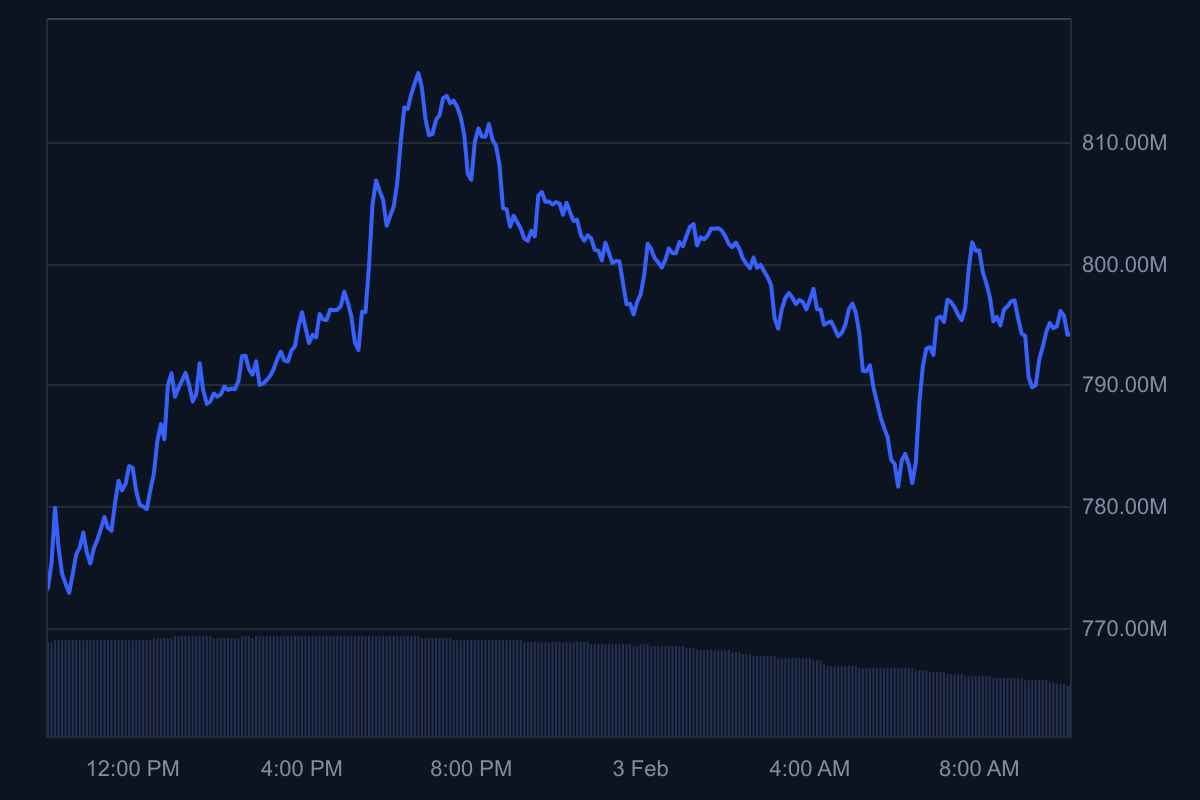

High trading volume on Binance also supports steady demand for the token.

This combination of utility and supply reduction makes BNB suitable as a core holding in February.

The main risk comes from regulatory news, which can trigger fast price moves.

You should monitor exchange volume and official burn reports to manage timing.

RECOMMENDED: 5 Powerful Reasons to Buy BNB in 2026

2. Solana: Growing Users And Developer Activity

Solana posted strong usage growth in January, with daily active addresses rising by about 115% and frequently exceeding 5 million.

This growth shows rising interest in DeFi apps, NFT platforms, and payment tools built on the network.

Higher activity leads to more transaction fees and stronger staking participation.

These factors support long-term network health.

Solana still faces occasional technical concerns, so price swings remain common.

Ensure to keep track of active addresses, new application launches, and total value locked to confirm that momentum continues.

RECOMMENDED: Is It Worth Buying Solana In 2026?

3. Arbitrum: Layer-2 Growth Opportunity

Arbitrum focuses on helping Ethereum scale at lower cost and higher speed.

ARB trades with a market cap below $1B, yet supports a large share of Layer-2 transactions and DeFi activity.

As more users move from Ethereum mainnet to rollups, Arbitrum can gain market share. This creates upside potential in recovery phases.

However, security risks and competition remain.

RECOMMENDED: 5 Strategic Reasons To Buy Arbitrum In 2026

Conclusion

Market swings may dominate the headlines, but the deeper story is unfolding on-chain.

January’s data reveals a shift toward networks that combine practical utility, disciplined token management, and expanding user participation.

BNB continues to draw strength from its embedded role within the Binance ecosystem and its ongoing supply reduction program.

Solana’s surge in active users signals renewed momentum across applications and developer activity.

Meanwhile, Arbitrum is steadily capturing Layer-2 demand as Ethereum users migrate to faster, lower-cost environments.

These signals point to more than short-term speculation. They reflect ecosystems with traction, measurable engagement, and structural growth drivers.

In periods of uncertainty, focusing on assets backed by real network activity and transparent token dynamics can offer a clearer framework for decision-making than reacting to price volatility alone.

Should You Invest $1,000 In BNB, SOL or ARB Now?

Before you invest, you’re going to want to read our next premium crypto alert which will be published in the coming days. We will reveal key crypto assets to consider in 2026 with explosive potential.

Read our latest alert here: Major Support Being Tested in Crypto – This Is The Point For a Bounce to Develop

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.