Ethereum remains a strong investment opportunity, backed by institutional adoption, network upgrades, and bullish market momentum in 2025.

Ethereum remains the world’s leading smart‑contract platform, despite lagging behind Bitcoin recently.

Key pillars of price, institutional adoption, and ecosystem innovations suggest now could be a prime opportunity to invest in Ethereum. With rising inflows, technical upgrades, and bullish indicators, ETH may be entering its next growth phase.

Strong Institutional & Corporate Momentum

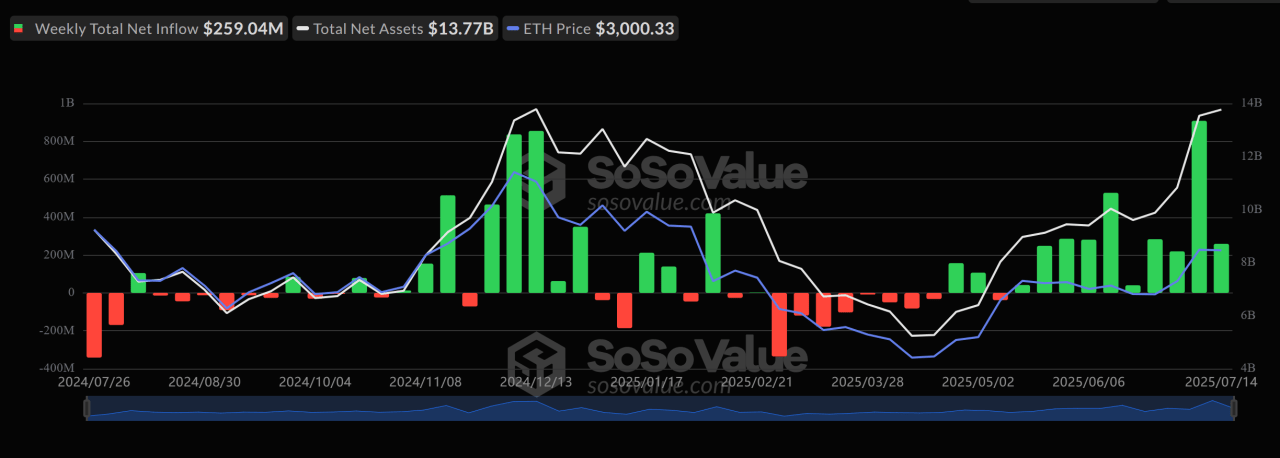

In 2025, Ethereum-focused funds have attracted over $4 billion in inflows, including a record $990 million in one week, making up nearly 20% of total crypto fund assets; double Bitcoin’s share.

Financial institutions like Standard Chartered and BlackRock are expanding Ether services. Standard Chartered now offers regulated ETH spot trading for institutional clients, while BlackRock’s Ethereum ETF holds over 2 million ETH (1.65% of supply).

Public companies such as BitMine, Bit Digital, and SharpLink posted stock surges (up to +400%) after pivoting to Ethereum treasuries and staking, highlighting ETH’s appeal as a productive on‑chain asset.

Network Productivity & Scalability Upside

Ethereum continues evolving beneath the hood. The Dencun upgrade (Mar 2024) and Pectra (mid‑2025) cut Layer‑2 fees and allow flexible staking.

Zk‑rollups now outperform the mainnet in throughput, processing tens of transactions per second. This boosts DeFi, NFTs, and tokenized real‑world assets . With over 35 million ETH staked (29% of supply), investor conviction runs high.

Market Momentum & Price Triggers

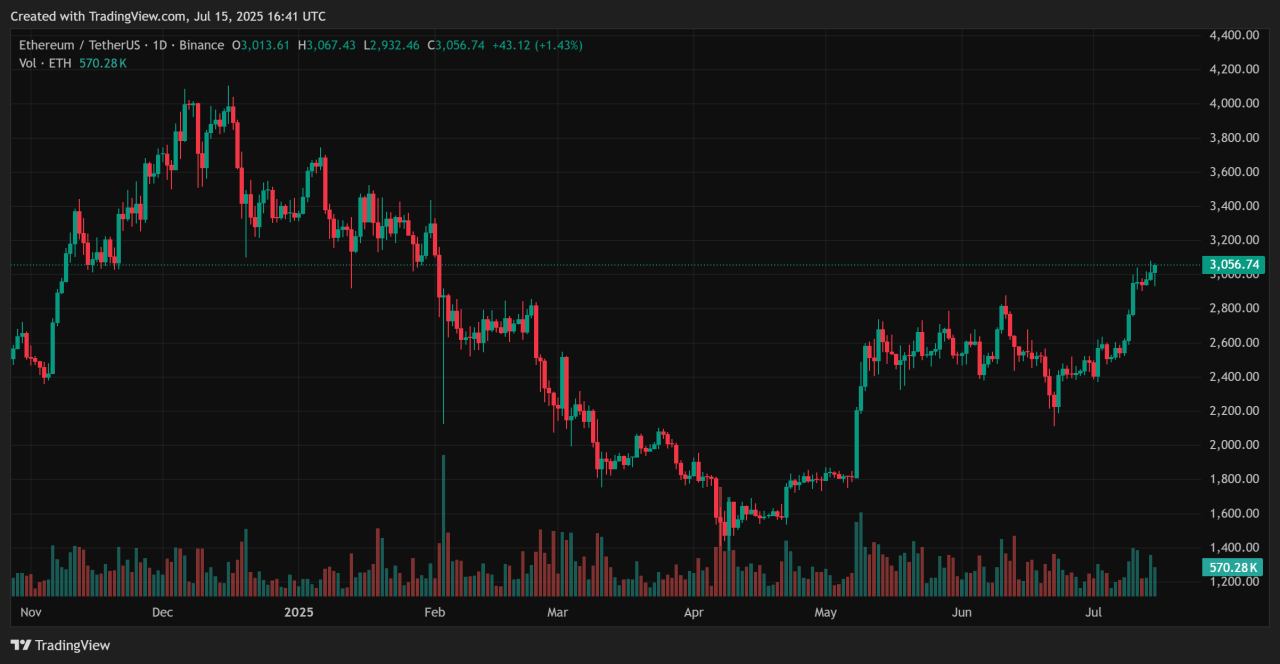

ETH is trading just above $3,000, following a bullish breakout from a classic “cup‑and‑handle” pattern—technicians expect a rally toward $4,000–4,200.

Spot ETH ETF inflows recently reached $383 million in a single day, showing a sustained buyer demand. Analysts foresee continued upside: $3,500 short‑term, $10,000+ by 2026–2027 triggered by staking‑ETF approvals and deepening tokenization.

Conclusion

With rapid fund inflows, institutional and corporate treasuries stacking ETH, significant protocol upgrades, and strong technical momentum, now is far from too late to invest in Ethereum.

The coin’s real world utility and bullish market structure suggests ETH’s next leg could be just beginning. We might see some big moves in the next 12 months.

Our latest crypto alerts – instantly accessible

This is how we are guiding our premium members (log in required):

- Is Alt Season 2025 Here? (July 15th)

- Alts Breakout Happening Now. These Are Price Time Combinations To Watch. (July 11th)

- Crypto Charts Are Improving, Just Have A Look At These 3 Leading Indicators (July 6th)

- Alt Season 2025: The Animals Are Back, This May Be A Very Bullish Signal (June 29)

- BTC And Altcoins About To Hit Big Support Areas (June 22)

- The Alt Season Charts (June 15th)

- Another Test of 106.1k, Is This THE Big One? (June 8th)