Chainlink dominates the oracle market, connects multiple blockchains through CCIP, and offers staking rewards that tighten supply.

One altcoin that could realistically rally from current levels, would be Chainlink (LINK). It isn’t the flashiest name in crypto, but it’s one of the few projects with consistent, real-world demand.

With a market cap around $10.7B and a growing list of integrations, LINK sits in that sweet spot, large enough to be credible but still early enough to grow fast.

Here is why Chainlink is a top contender for the best crypto to buy now

RECOMMENDED: How To Buy Chainlink in the USA

Why Chainlink Could Be The Top Crypto To Buy Now

Most blockchains depend on Chainlink for data. In simple terms, it’s the bridge that feeds real-world information into smart contracts; prices, interest rates, and other essential data.

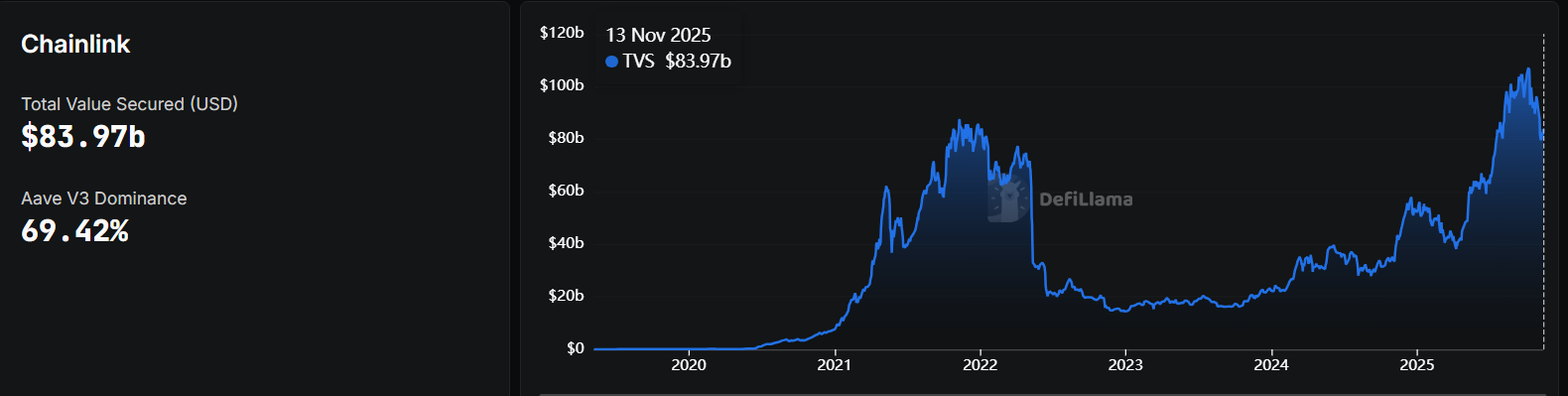

Chainlink currently secures over $80B across DeFi and has nearly 70% of the oracle market. That kind of dominance gives it a lasting advantage.

Chainlink’s cross-Chain Interoperability Protocol (CCIP) is expanding. More chains are connecting through CCIP, allowing assets and data to move seamlessly between ecosystems.

This drives steady demand for LINK as a service token. Add staking and the new Rewards program, and you have a formula that locks supply while keeping holders engaged.

RECOMMENDED: 5 Reasons to Buy Chainlink (LINK) in 2025

What Is Driving Chainlink’s Growth?

The short-term catalysts include more CCIP integrations, partnerships in tokenized real-world assets, and increasing staking participation.

Chainlink’s collaboration with major players like Swift and ANZ Bank is a signal that traditional finance trusts its technology – a rare sign of maturity in the crypto market.

Of course, upside is not a guarantee. Upcoming token unlocks can add selling pressure, and crypto markets can pull back sharply when liquidity tightens.

But you’d rather own a project with real users and income potential than chase hype coins that move only on speculation.

Often, dips after token unlocks are seen as smart entry points for those building long-term positions.

RECOMMENDED: Where Will Chainlink (Link) Be In 5 Years?

How To Position

You may want consider accumulating LINK gradually instead of buying it all at once. A simple dollar-cost averaging approach smooths out volatility.

Consider keeping risk low, about 1–5% of your portfolio, set clear profit targets around 2x, and consider staking a portion for extra yield. It’s a patient trade, not a quick flip.

ALSO READ: Is Now a Good Time to Buy Chainlink

Conclusion

Chainlink stands out as a top crypto to buy now because it’s useful, trusted, and still undervalued compared to its influence. If you want a crypto with real-world relevance and a clear path to doubling, LINK is the one you should be looking at right now.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Don’t Miss the Next Big Move – Access Alerts Instantly

Join the original blockchain-investing research service — live since 2017. Our alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience. You’re following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.