Uniswap holds a clear lead in trading activity and fee generation. SushiSwap relies on new features and multi-chain reach to gain ground.

Which DEX between Uniswap vs SushiSwap shows stronger momentum before the next upgrades arrive?

Uniswap has earned about $985M in protocol fees from Jan to Oct 2025, while SushiSwap trails with much lower revenue. A simple look at volume, fees, and upgrades gives a clear picture of where each platform stands today.

RELATED: Uniswap (UNI) Vs Aave (AAVE): Who Leads The Next DeFi Surge?

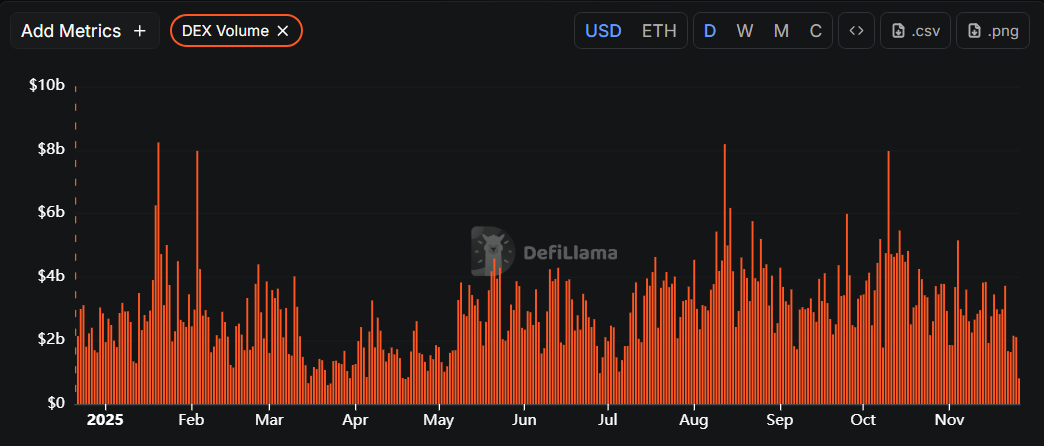

Uniswap vs SushiSwap: Volume And Market Share

Uniswap continues to attract the most trading activity across Ethereum and major L2 networks. It processes billions in monthly volume, which creates steady fee flow for liquidity providers and the protocol.

SushiSwap operates on many chains, so users can access it almost anywhere. This helps Sushi attract niche communities, but it also spreads liquidity thin.

Although Sushi sees activity spikes around specific listings, its monthly volume stays well below Uniswap’s. Since higher volume typically leads to higher revenue, Uniswap’s size gives it a noticeable advantage.

RECOMMENDED: Is Uniswap (UNI) Ready to Rebound in 2025? 5 Reasons Investors Are Paying Attention

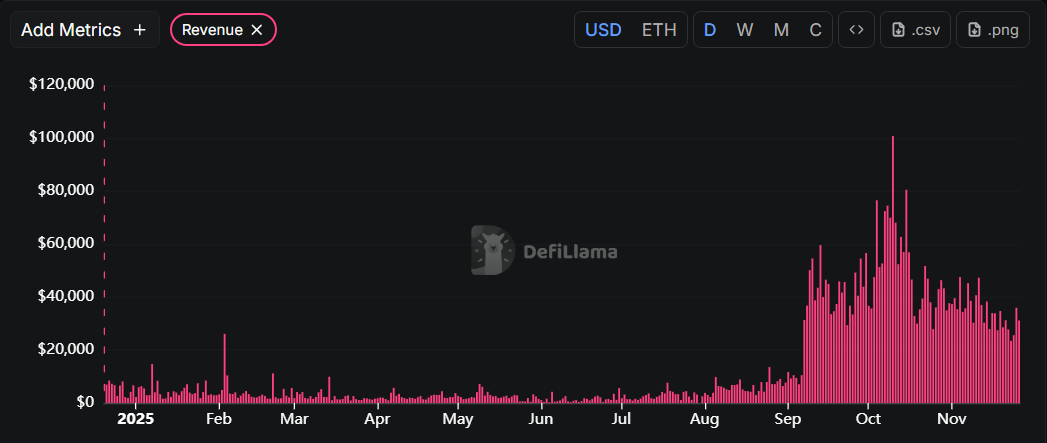

Fee And Revenue Mechanics

Uniswap’s roughly $985M in protocol fees from Jan to Oct 2025 highlights how large its trading base has become. SushiSwap, by comparison, reports revenue in the low tens of millions, depending on the quarter and the chain.

Uniswap earns through swap fees at large scale. Sushi adds staking features through xSUSHI, which shares some fee income with token holders. This creates different incentives for users, but Uniswap’s larger activity pool results in stronger and more predictable fee generation.

ALSO READ: Uniswap Price Prediction: $1,000 Investing in Uniswap Could Be Worth What in a Year?

Upgrade Roadmaps And Short-Term Catalysts

Uniswap’s V4 upgrade includes modular hooks, flexible fee options, and better gas efficiency. These changes aim to improve trading quality and help liquidity providers earn more.

SushiSwap continues to add tools such as limit orders, DCA functions, and routing upgrades. These features encourage repeat use across multiple chains.

Short-term signals to monitor include new governance decisions, shifts in TVL after upgrades, and changes in monthly fee revenue.

Conclusion

Uniswap currently shows stronger momentum thanks to higher volume and higher fee generation. SushiSwap still has room to grow if its new tools bring more consistent liquidity. The key signals to follow are monthly revenue trends and how each protocol’s upgrades affect TVL.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

-

Proprietary 15-indicator methodology developed over 15+ years of market research.

-

Proven track record of spotting major turning points before markets move.

-

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

Act today and join the original crypto research service — still live and stronger than ever since 2017.

- Why This Bounce Matters (30 Crypto Charts) (Nov 23rd)

- What’s Going On With Bitcoin & Alts?(Nov 16th)

- This Is What We Want To See The Next 72 Hours(Nov 9th)

- The Next 2 To 3 Weeks …(Nov 2nd)

- A Successful Test of Bitcoin’s 200 dma? (Oct 26th)

What Our Readers Say

“I got to tell you, you guys and your charting and your predictions are AMAZING! I don't know how people can even give you a hard time when you make pullback predictions. Markets cannot go up forever!”

“I LOVE how you talk about the ‘buy the dips’ times vs the ‘sell for profit’ times to get more free coins. You have been right sooo many times — it’s actually amazing!”

— Newsletter Subscriber

“Your team puts a huge amount of work into the newsletters and the analyses. You’ve been doing this for so many years already, and the passion is still there. Respect.”

“Because of your research, I’ve become a much more patient investor. And ‘more patient’ basically means ‘better.’ Over the past few years, my capital has often just stayed unused rather than constantly invested — and it has paid off.”

“Now that my perspective is strictly long term, I have far more peace in my life. Nothing is more stressful than constantly wondering what your crypto might do the next day. After seeing firsthand that long-term investing outperforms trading, the difference is night and day.”

— Crypto Research Subscriber

“As a faithful follower, I really miss the commentaries — the wisdom, the thoughts, the analysis. Truly appreciate the knowledge you share.”

— Long-Time Follower