Chainlink’s expanding oracle integrations and institutional adoption set the stage for robust growth in five years, with forecasts ranging from $30–60, and bullish models predicting up to $80–100+ if Web3 and DeFi adoption accelerates.

Chainlink (LINK), currently trading around $13.02 with a market cap near $8.9 billion, has firmly established itself as the leading decentralized oracle network.

Its core value lies in securely transmitting real-world data—such as price feeds, randomness (VRF), and Proof of Reserves—to smart contracts. With Chainlink feeding over $75 billion in DeFi assets through ~1,000 integrations, we can’t help but wonder; where will it be in five years?

Let’s look at some factors that will drive its growth.

Growing On‑Chain Demand & Strategic Integrations

Chainlink’s Cross‑Chain Interoperability Protocol (CCIP) is gaining remarkable traction. ANZ has piloted CCIP private transactions under Singapore’s Project Guardian for tokenized asset settlements.

Meanwhile, Hong Kong’s HKSAR Monetary Authority tested cross-border CBDC–stablecoin swaps—connecting Hong Kong’s e-HKD with an Australian stablecoin, backed by Visa, Fidelity, China AMC and ANZ—with LINK’s CCIP handling the on-chain bridge.

Further momentum: JPMorgan’s Kinexys recently leveraged Chainlink CRE to settle on a public ledger. These real-world integrations strengthen LINK’s role and reduce available token supply held on exchanges.

Current Technical Picture & Forecasts for the Near Future

LINK remains range‑bound between $13.0–13.5, with bearish sentiment but normalizing trade volume. Short‑term projections vary: Cryptopolitan sees a maximum of $21 in 2025, while Coin Price Forecast estimates LINK will climb to about $17.78 by end‑2025 before rising to $28.31 in 2026.

Our LINK predictions are even more bullish. We speculate the token will hover between $12.3 on the lower end or hit resistance at around $39.2 by the end of the year.

Mid‑To‑Long‑Term Drivers, Risks & 5‑Year Scenario

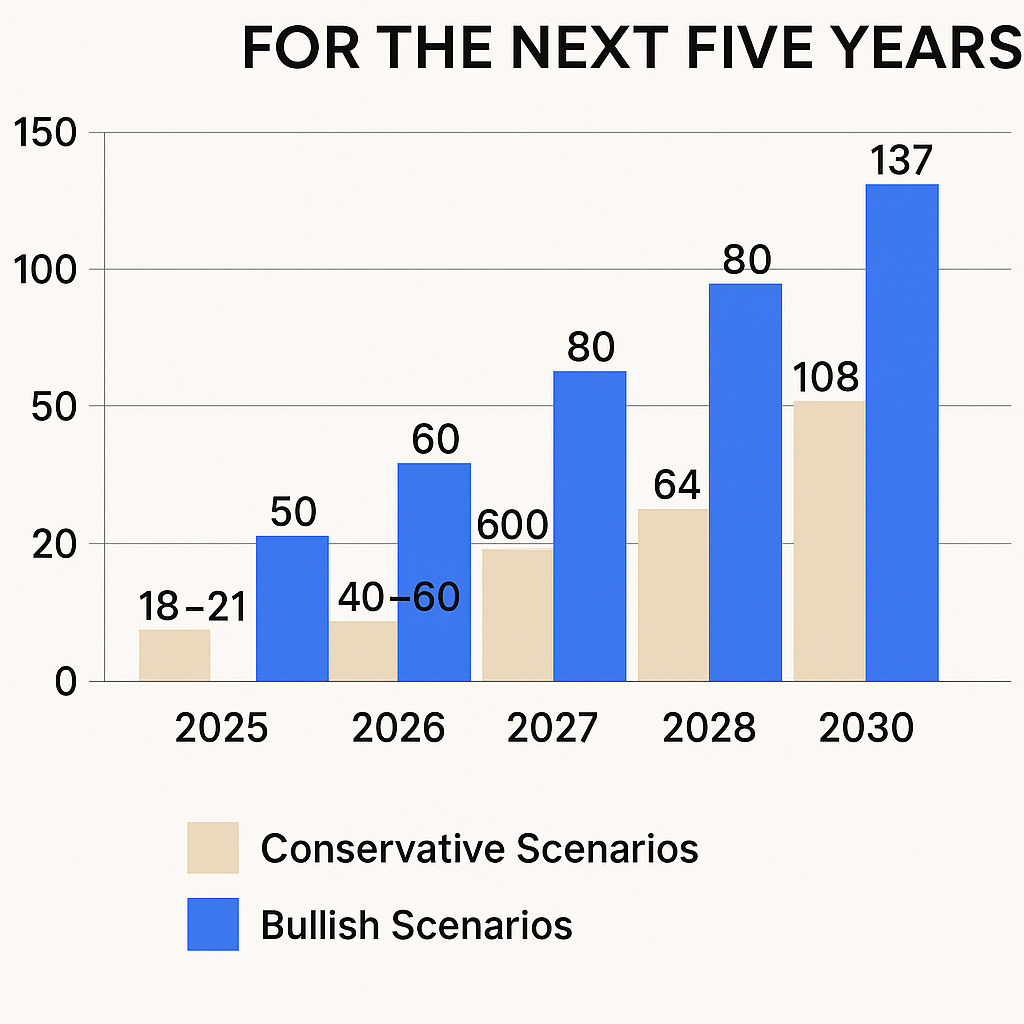

Beyond 2025, continued CCIP adoption and ecosystem expansions underpin bullish cases. The Currency Analytics forecasts LINK could reach $50 in 2026, potentially peaking near $61, and average $64 with highs of $80 in 202. By 2030, we could see average price targets of $108 and $137.

Conservative scenarios from Mudrex suggest LINK could stabilize between $25–40 in 2025, climbing to $40–60 in 2026 and $60–100 in 2027.

Risk factors include rising competition from alternative oracle networks and shifting regulatory policies around tokenized finance.

Conclusion

Chainlink’s current CCIP‑driven integrations with major financial institutions, CBDC pilots, and DeFi workflows position it favorably over the next five years. Technically, immediate upside remains capped near $18–21.

But with ecosystem scaling and institutional alignment, LINK hitting $60–100 by 2027 is plausible—potentially averaging $80–140 by 2030 in balanced scenarios. Ultimately, LINK’s future success depends on execution, macroeconomic conditions, and its edge in oracle supremacy.

Our latest crypto alerts – instantly accessible

This is how we are guiding our premium members (log in required):

- Alt Season 2025: The Animals Are Back, This May Be A Very Bullish Signal (June 29)

- BTC And Altcoins About To Hit Big Support Areas (June 22)

- The Alt Season Charts (June 15th)

- Another Test of 106.1k, Is This THE Big One? (June 8th)

- How Much Longer Do We Have To Wait For Alt Season 2025? (June 1st)

- The Bitcoin vs. Altcoin Divergence (May 24th)