KEY TAKEAWAYS

- RippleNet connects more than 300 institutions, creating recurring XRP settlement flows.

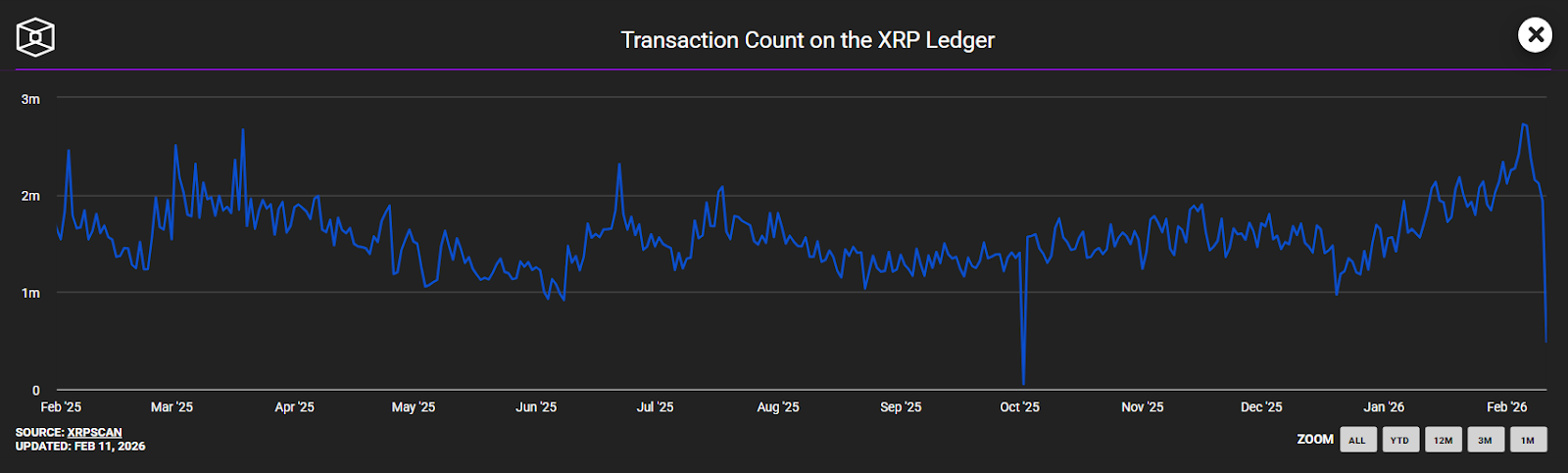

- Daily payment transaction counts reveal usage trends better than raw dollar volume.

- Monthly escrow releases and re-locks influence circulating supply.

- Leveraged liquidations can overpower payment demand in the short term.

XRP demand does not only come from traders. Cross-border payment flows and escrow cycles quietly affect supply, liquidity, and price stability.

XRP often trades like a speculative asset, but a large share of activity happens for practical reasons. Financial institutions use Ripple’s On Demand Liquidity system to move money across borders without pre-funding accounts.

This creates repeat buying and selling of XRP for settlement purposes. At the same time, Ripple’s monthly escrow releases add another supply variable.

When you combine corridor payment flows, escrow mechanics, and exchange liquidity, you get a clearer explanation for why XRP sometimes holds firm and sometimes drops fast.

How much will your XRP be worth?

Based on your prediction that the price of XRP will change at a rate of 8% every year, calculate your price prediction return on investment below.

RECOMMENDED: Could Central Banks Quietly Be Testing XRP For Settlement?

How On Demand Liquidity Creates Real XRP Demand

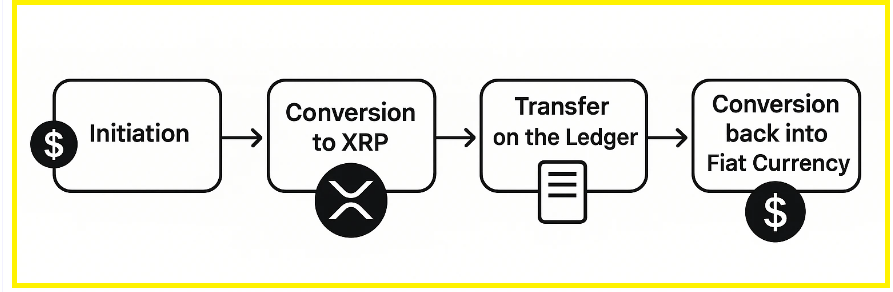

On Demand Liquidity, or ODL, uses XRP as a bridge between two currencies.

Instead of parking money in foreign bank accounts, institutions buy XRP, transfer it across the ledger in seconds, and convert it into the destination currency. This process repeats throughout the day across multiple corridors.

Ripple has reported hundreds of network partners globally. Not all of them use XRP directly, but ODL corridors generate recurring settlement flows where XRP acts as temporary liquidity.

Even if each transaction is small, repetition builds consistent background demand.

The same pool of XRP can settle many transactions in a single day. That means demand does not always show up as a massive net increase in holdings.

Instead, it shows up as constant turnover. This type of usage can support price stability when speculative selling is limited.

RECOMMENDED: Banks Bet On XRP Again – Which Institutions Are Quietly Accumulating?

Where XRP Payment Activity Happens

Most active payment corridors involve remittance heavy regions in Asia and other cross-border hubs.

Remittance companies and fintech firms rely on fast settlement and lower capital requirements. Liquidity providers and exchanges supply XRP when needed and absorb it after conversion.

On chain, this activity appears as steady payment transactions rather than large exchange inflows. Many transfers happen between institutional wallets, custodians, and exchange gateways. Retail traders rarely see these flows in real time.

This separation explains why XRP’s ledger activity can rise even when exchange trading volume looks flat.

Payment usage and speculative trading operate on parallel tracks.

When corridor activity expands steadily, it creates a structural layer of demand that differs from short term trading interest.

ALSO READ: Top 10 Richest XRP Whales: Who Owns the Most XRP in 2026?

What XRP On Chain Data Really Shows

Raw transaction value can be misleading. A single large transfer can inflate daily dollar totals.

Instead, payment transaction counts offer a clearer signal. When the number of daily payments trends higher over weeks, it suggests consistent usage rather than isolated moves.

Escrow mechanics also influence supply. Ripple releases a fixed amount of XRP from escrow each month.

A portion typically returns to escrow if unused. The difference between what gets released and what gets re locked affects net circulating supply.

Lastly, exchange netflows provide another useful data point and insight.

If large amounts of XRP move to exchanges while futures open interest spikes, speculative pressure may rise.

If exchange balances fall while payment counts increase, operational demand may be absorbing supply.

When you connect these metrics, price moves look less random. Strong payment counts combined with stable exchange balances often align with steadier price action.

Sharp exchange inflows paired with rising leverage often precede volatility.

How Payment Demand Can Affect XRP Price

Payment flows create a steady rhythm in the background. They can form a base layer of liquidity that supports price during calm market conditions.

If corridor usage expands and escrow returns remain disciplined, circulating supply growth stays controlled.

However, crypto markets still react quickly to macro stress and leverage unwinds.

During rapid liquidations, speculative selling can overwhelm payment demand within hours. ODL flows operate continuously, but they do not scale instantly to counter aggressive futures selling.

Over longer periods, recurring settlement activity can influence how deep corrections go and how durable recoveries become. It does not eliminate volatility, but it can reduce the intensity of extended selloffs when usage trends upward.

YOU MIGHT LIKE: XRP vs SWIFT: How Ripple Cuts Global Transfer Fees

Conclusion

XRP price behavior makes more sense when you look beyond trading charts. Cross-border settlement flows, escrow cycles, and exchange liquidity interact every day.

Payment transaction counts show whether real world usage grows. Escrow activity shows how supply evolves. Exchange flows reveal speculative pressure.

When these forces align, XRP finds stability. When leverage surges, volatility takes control. Understanding both sides gives a clearer picture of where price strength truly comes from.

Should You Invest In XRP Now?

Before you invest in XRP, you’re going to want to read our next premium crypto alert which will be published in the coming days. We will reveal key crypto assets to consider in 2026 with explosive potential.

Read our latest premium crypto alert here: A Harmonic Setup in BTC Indicates a Bottoming Area Is Forming(Feb 8th)

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.