This is a practical guide to buying XRP cheaply and fast in the UK.

We compare exchanges, payment methods, wallets, fees, and give you a rundown of crypto tax rules in the UK.

If you want to buy XRP in the UK, the platform and payment method you use dramatically influences how quickly and cheaply you can complete your purchase.

In practice, UK buyers typically choose between:

- Instant card/Apple/Google Pay purchases – fastest access but higher fees.

- GBP bank transfers (Faster Payments) – cheaper but may take slightly longer.

Once you’ve bought XRP, consider whether you want to hold it on the exchange (convenient but custodial) or send it to an XRPL-native wallet or hardware wallet for greater self-custody.

In 2026, further UK tax reporting rules under the Cryptoasset Reporting Framework (CARF) mean exchanges must collect and, starting in 2027, report detailed transaction data (including amounts and tax residency) to HMRC for UK users.

This doesn’t change your tax obligations, but it does mean you should keep clear records of your buys and sells for capital gains purposes.

RELATED: How to Buy XRP in Canada: Fast, Safe & Simple Steps

Where to Buy XRP in the UK – Best Exchanges For XRP

Before you can buy any XRP in the UK, you need to choose the right crypto platform for you.

Below are common exchanges to buy XRP in the UK:

eToro

eToro lets UK users buy XRP with GBP deposits and debit cards and shows trade costs before you confirm your order.

It’s FCA-registered, supports Faster Payments and debit/credit methods, and integrates with the eToro Money wallet for outbound transfers, though conversion fees and spreads apply.

Best For:

- Beginners seeking a simple app with GBP on-ramps and easy wallet access.

Pros

- FCA-regulated and widely used in the UK.

- Accepts GBP via Faster Payments and card.

- Integrated wallet for crypto management.

Cons

- 1 % spread/fee built into prices.

- FX conversion may apply for GBP → USD.

RECOMMENDED: eToro Review 2025: Is It Safe, Legit & Worth It?

Coinbase

Coinbase UK supports XRP trading with GBP deposits via Faster Payments and card purchases, offering a clean web/mobile experience and strong liquidity for reliable fills.

Its fee structure includes spreads plus trading fees that vary by payment method so costs can be higher on instant buys.

Best For

- Users who want a trusted brand with intuitive UX and solid liquidity.

Pros

- Easy GBP deposits and card options.

- Simple trading interface for beginners.

- Broad asset selection and support.

Cons

- Higher fees/ spreads on card buys.

- Fee complexity may confuse new users.

Kraken

Kraken lets UK users buy XRP with GBP via bank transfers and Faster Payments, offering competitive spot trading fees and more order types than basic brokers.

It’s also FCA-registered with transparent fee tiers, making it a strong choice for cost-conscious traders comfortable with a more advanced interface.

Best For

- Intermediate traders who want lower fees and robust trading tools.

Pros

- Competitive maker/taker fees.

- FCA-registration and strong security.

- GBP deposits via Faster Payments.

Cons

- Interface can feel dated for novices.

- Instant buys still include convenience fees.

Bitstamp

Bitstamp supports XRP/GBP markets with Faster Payments and clear fee schedules – free FPS deposits and modest trading fees for retail volumes make it cost-efficient.

It’s one of the longest-running and trusted crypto exchanges in the UK.

Best For

- Users who want transparent GBP rails and low-fee trading.

Pros

- FPS support with low-cost GBP deposits.

- Simple fee structure.

- Longstanding reputation.

Cons

- Trading fees still apply above certain volumes.

- Interface feels basic vs pro platforms.

CEX.IO

CEX.IO offers XRP trading with GBP deposits including Faster Payments and debit/credit cards, with competitive maker/taker fees via the exchange interface and an instant buy option.

Card/instant purchases may attract higher fees within the price.

Best For

- UK buyers wanting multiple payment options plus transparent order book trading.

Pros

- GBP deposits including Faster Payments.

- Competitive maker/taker fees on exchange orders.

Cons

- Instant buy fees can be high.

- Fee complexity for card deposits.

RECOMMENDED: 10 Regulated FCA-Approved Crypto Exchanges In The UK (2025)

How To Buy XRP In The UK On eToro: Step-By-Step

Now that you have chosen an exchange, it’s time to buy XRP.

You can use any platform you like that works in the UK, but for the purposes of illustration, we will use eToro.

Here are the steps to buy Ripple’s XRP on eToro.

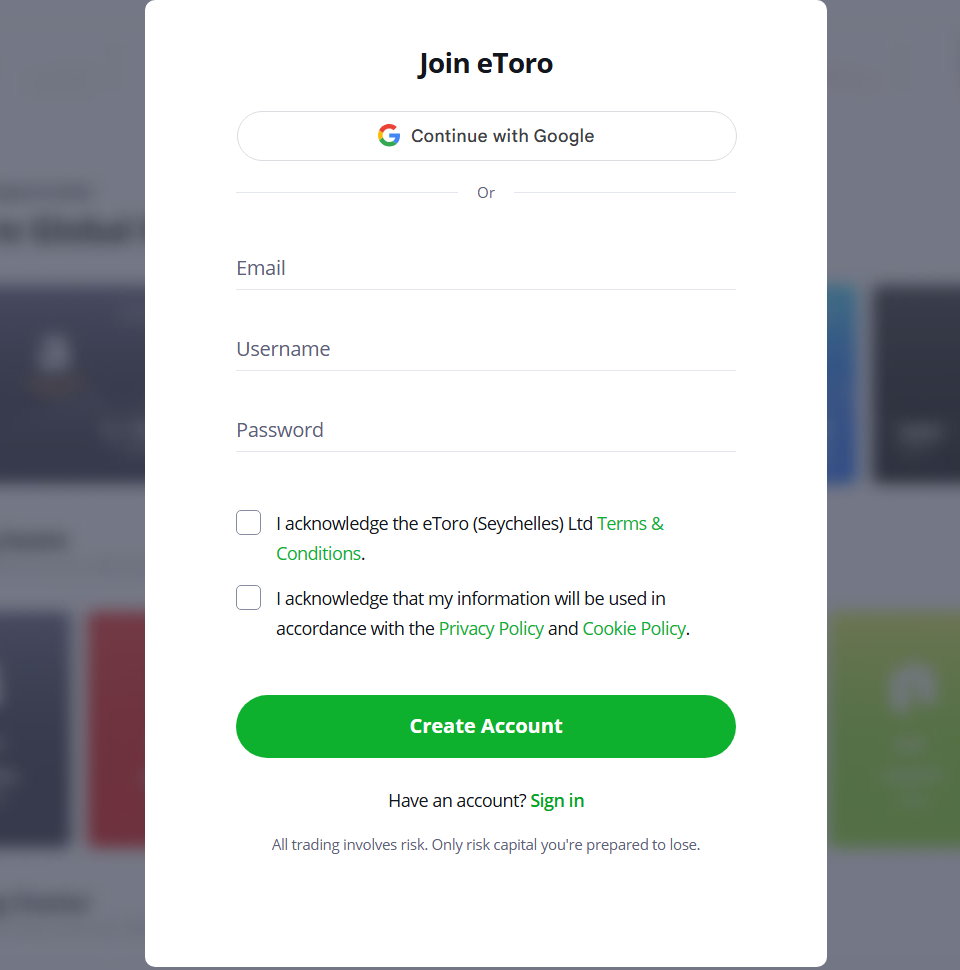

1. Open And Verify Your Account

Start by creating an eToro account and completing identity verification.

You will need a valid ID and proof of address.

Verification is required before you can deposit GBP or trade crypto.

Once approved, eToro shows the payment methods available to you based on your location in the UK.

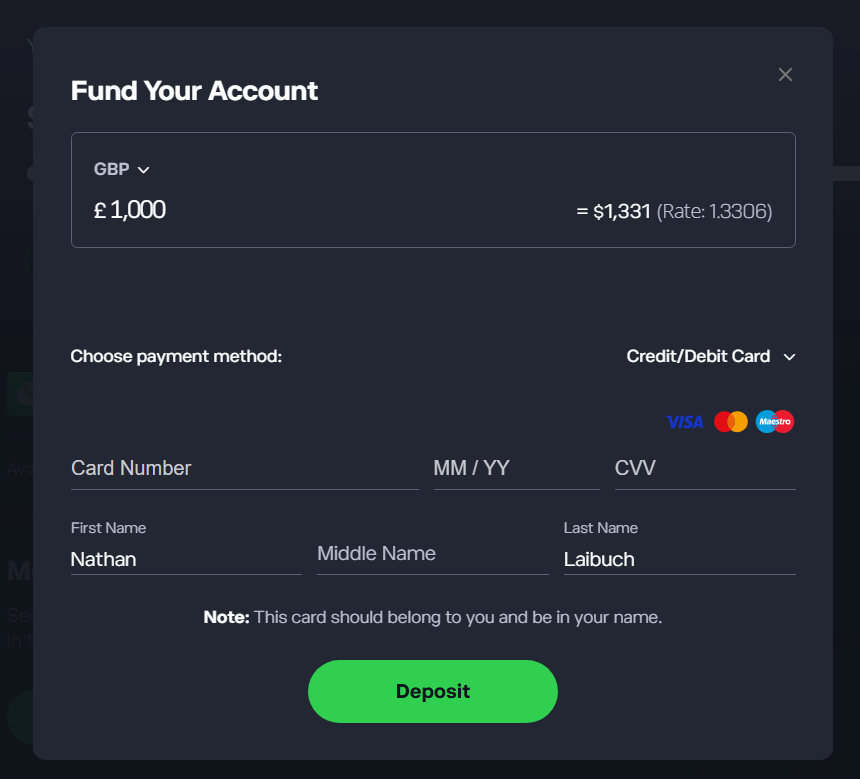

2. Choose A GBP Funding Method

Next, fund your account in GBP. For lower overall cost, use a bank transfer through eToro Money, which supports fast UK transfers.

Bank transfers usually take longer than cards but avoid extra charges.

Debit/credit cards and PayPal give instant access to trading, but they usually come with higher fees.

The method you choose directly affects your final XRP cost.

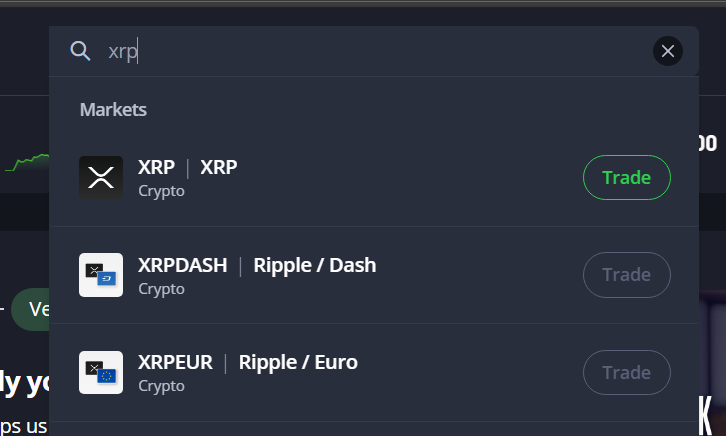

3. Buy XRP

Search for “XRP” and open the XRP market by clicking ‘Trade’.

Enter the amount you want to buy in GBP or XRP, review the price, then confirm the trade.

eToro applies a standard crypto commission of about 1%, which is clearly shown on the trade screen before you place the order.

There are no hidden trading fees beyond what you see at confirmation.

4. Decide Where To Hold Your XRP

After buying, you can keep XRP on the eToro platform for easy trading or move it to the eToro Money crypto wallet or an external wallet for self-custody.

Transfers out are supported, but moving XRP from eToro to eToro Money may include a platform transfer fee plus the XRP Ledger network fee.

Always check the live fee estimate before sending.

5. Check Address Details And Total Cost

When sending XRP to any wallet or exchange, confirm both the address and destination tag. Missing or incorrect tags can delay or block deposits.

Also, before you buy, review the full cost: deposit fees, the eToro crypto commission, and any withdrawal or network fees.

FULL GUIDE: An In‑Depth Review of Buying XRP on eToro

Where To Store XRP: Best Wallets For XRP In The UK

You will need to keep your XRP in a wallet that matches your needs.

This means you should decide whether you want fast access for trading, daily use, or strong long-term security.

There are four main wallet types you can choose from:

- Custodial exchange wallets

- Non-Custodial (Software) Wallets

- Hardware wallets

Custodial Exchange Wallets

Custodial wallets live on exchanges or brokers; the platform holds your private keys, handles security, backups, and GBP rails.

They make buying, selling, and withdrawing to GBP simple and quick.

This makes them ideal for trading or frequent bank access, but they carry counterparty risk since you don’t control the keys.

Pros

- Instant trading and GBP deposits/withdrawals.

- Platform manages security and backups.

- Simple UX for beginners.

Cons

- You don’t control private keys (custody risk).

- Exchange failure could risk funds.

Recommended Custodial Wallets

- eToro (with eToro Money wallet)

- Coinbase (custodial XRP balance)

- Kraken (regulated platform with GBP rails)

Non-Custodial (Software) Wallets

Non-custodial software wallets store your private keys on your own device, giving you full control over your XRP.

They are ideal for everyday use like sending, receiving, and interacting with XRPL apps.

Choose XRPL-native wallets to avoid destination tag issues and to access full XRP Ledger functionality.

Pros

- You fully control your private keys and funds.

- Fast and convenient for regular XRP use.

- Supports core XRPL features such as payments and DEX access.

Cons

- Device loss or malware can compromise funds.

- You are responsible for securing seed phrase backups.

- Less secure than hardware wallets for large balances.

Recommended Wallets

- Xaman (formerly Xumm) – XRPL-native, audited, and feature-rich.

- Exodus – beginner-friendly interface for everyday XRP use.

Hardware Wallets

Hardware wallets keep your private keys offline on a dedicated device.

You connect only to sign transactions, reducing exposure to online attacks.

Best for large or long-term XRP holding.

You can pair these wallets with XRPL clients to unlock full network features and convenience.

Pros

- Very strong protection against remote hacks.

- Ideal for long-term, large holdings.

- Can pair with mobile/desktop wallets for ease.

Cons

- Upfront cost and initial setup required.

- You must protect seed phrase offline.

- Slightly slower for frequent small transfers.

Recommended Wallets

- Ledger Nano X / S Plus / Flex / Stax – widely supported hardware options for XRP via Ledger Live + XRPL apps.

- Other certified hardware wallets that list XRP support (verify vendor docs).

RECOMMENDED: Top 10 Richest XRP Whales: Who Owns the Most XRP in 2025?

Crypto Regulation & Taxes in the UK

HMRC treats crypto as property for Capital Gains Tax (CGT).

You must report taxable events – such as selling, swapping, spending, or gifting crypto – on your UK self-assessment if gains exceed allowances; losses can offset gains.

Starting 1 January 2026, exchanges and providers collect and report detailed transaction and user data to HMRC under the Cryptoasset Reporting Framework (CARF), improving automatic compliance checks.

The FCA oversees certain crypto firms and classes of products in the UK.

This means platforms without FCA registration may lack regulatory oversight.

So, always check whether a wallet or service provider is reputable, read its asset safeguarding terms, and keep records of dates, GBP values, fees paid, and transaction IDs to simplify reporting.

For complex cases or frequent trading, we recommend professional tax advice.

Tips For Buying XRP In The UK

Buying XRP efficiently in the UK isn’t just about picking the cheapest trading fee.

To keep costs down and avoid surprises, think holistically: deposit fees, trading fees, withdrawal charges and on-chain network fees all add up.

For example, a platform may advertise low trading fees, but card or instant buy deposits can be expensive, adding a percentage markup before your trade even executes.

Always check the total cost from GBP deposit to XRP receipt before committing.

Follow these tips to avoid common cost and transfer mistakes.

- Compare Total Cost, Not Just Trading Fees: Add together deposit fees (card vs bank transfer), the buy fee or spread, withdrawal fees, and the XRP Ledger network fee. A low trading fee can still result in a high total cost if card deposits add a markup. GBP bank transfers usually reduce overall cost.

- Use Fast Bank Transfers For Lower Fees: Platforms that support Faster Payments often allow free or very low-cost GBP deposits. This route usually gives the cheapest XRP purchase. Card and instant buys are faster but almost always cost more.

- Test With A Small Transfer First: Send a small amount of XRP before moving larger sums. This confirms the address and destination tag work correctly and prevents costly errors.

- Keep Clear Records For Tax: Save dates, GBP values, fees, and transaction IDs. From 2026, exchanges share data with HMRC, so accurate records are important.

ALSO READ: 5 Major Companies Quietly Acquiring XRP

FAQs

Can I Buy XRP In The UK?

Yes. Major UK-accessible exchanges list XRP and support GBP deposits, so UK residents can buy XRP through regulated platforms.

What Is The Cheapest Way To Buy XRP?

The usual lowest-cost route is depositing GBP via Faster Payments to an exchange with low/no deposit fees, then placing a spot order for XRP.

What Is The Fastest Way To Buy XRP?

Debit/credit card purchases or instant buy features on exchanges give immediate access, though at a higher cost than bank transfers.

Do I Need To Pay Tax On XRP Gains?

Yes. HMRC treats crypto as an asset for Capital Gains Tax; you must report disposals that create gains on your self-assessment form.

Will Exchanges Report My Activity To HMRC?

Yes. Under CARF, exchanges must report user transaction data; reporting obligations started 1 Jan 2026 and will expand internationally in 2027.

How Do I Send XRP To A Wallet?

Copy the exact XRP address and include the correct destination tag if required. Send a small test amount first to confirm accuracy and avoid loss.

Bottom Line

When you buy XRP in the UK, think about the whole process from GBP deposit to XRP in your wallet.

Using a GBP bank transfer into an exchange that supports Faster Payments often cuts costs compared to instant card buys.

Always check every fee – deposit, trading, withdrawal, and network charges – before you confirm a purchase.

Send a small test amount first, and keep accurate records for HMRC reporting under the Cryptoasset Reporting Framework (CARF), which took effect on 1 January 2026.