A draft rule could remove the security label from certain tokens tied to U.S. ETFs.

XRP jumped into focus as traders connected the dots fast.

A single sentence buried in the recently introduced Clarity Act has sent XRP which is trading around (2.08 , back into the spotlight.

The clause includes language that could place XRP in the same legal category as Bitcoin.

It links legal status to whether a token becomes the main asset of a U.S.-listed ETF by Jan 1, 2026

Once the language surfaced, XRP trading activity picked up and online debate exploded, as investors tried to gauge whether this could finally ease years of legal pressure.

RECOMMENDED: Forget BTC & ETH – Here’s Why Experts Are Calling XRP The Hottest Crypto Of 2026

What The Clause Actually Says

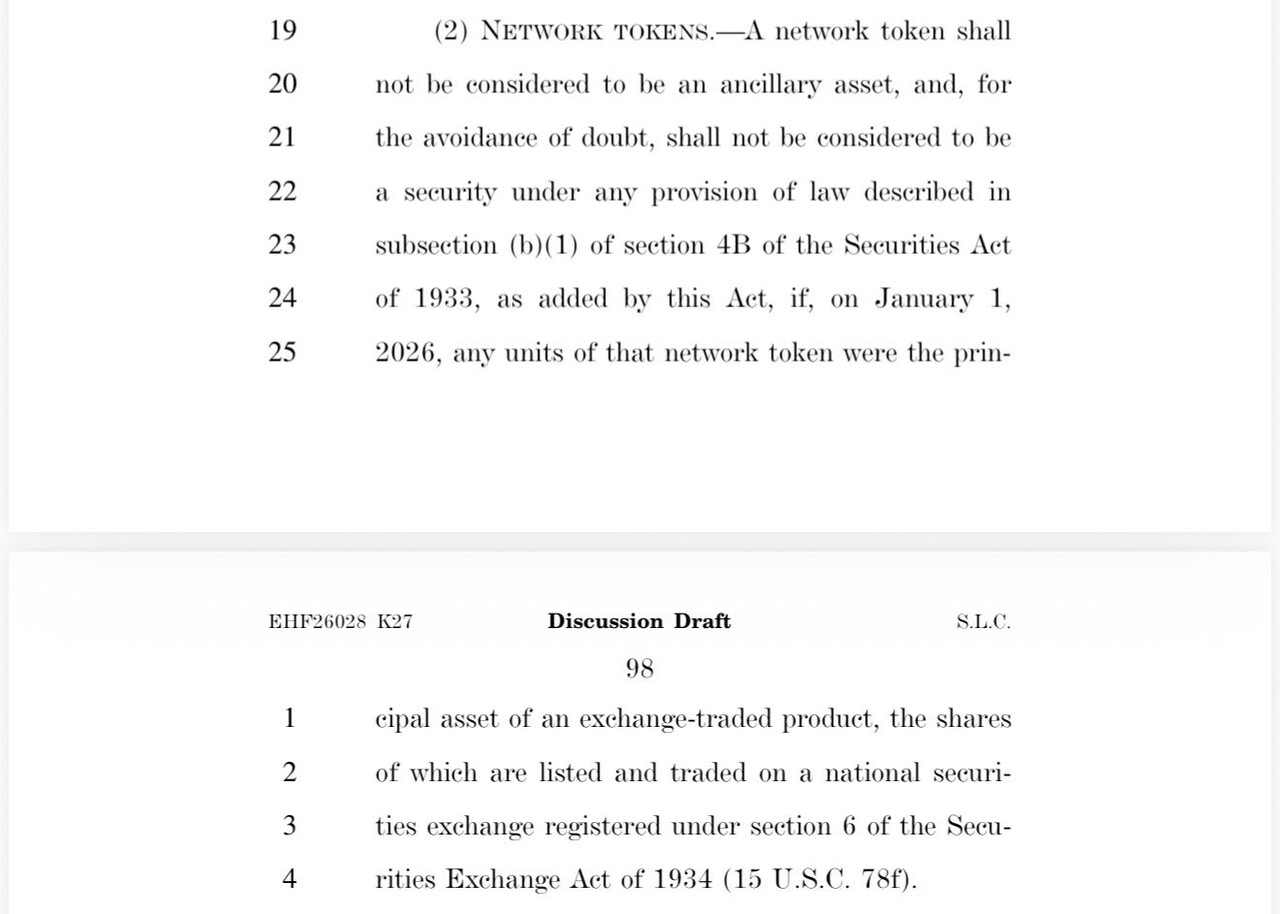

The draft introduces a carve-out for “network tokens” that serve as the primary asset of a registered U.S. ETF.

If a token meets that condition by the 2026 deadline, the bill would treat it as non-security for specific regulatory purposes.

Here is part of the draft in question:

That matters because the SEC has relied on security status to justify enforcement actions.

Under this framework, ETF inclusion changes the legal lens without rewriting existing court rulings.

RECOMMENDED: Bitcoin, Ethereum, XRP: The 3 Cryptos Dominating January 2026

Why XRP Is At The Center Of The Buzz

XRP stands out because of its long legal history and its size.

It remains one of the largest cryptocurrencies by market value, and asset managers already track it closely.

Reports also mention SOL, DOGE, LTC, LINK, and HBAR, but XRP draws the most attention because a shift in status would mark a sharp contrast from years of uncertainty.

After the clause circulated, XRP trading volumes rose and short-term price moves reflected renewed speculation.

RECOMMENDED: How to Buy XRP in the UK: Cheapest & Fastest Methods (2026)

What This Could Mean For Ripple And Investors

If the clause survives and an XRP ETF launches before the deadline, Ripple would face less regulatory pressure in U.S. markets.

ETF issuers would gain a clearer path to list products, while custodians and brokers could support XRP with lower legal risk.

For investors, this would not guarantee price gains, but it would reduce one of the biggest obstacles hanging over the token.

YOU MIGHT LIKE: Is XRP Dead? Here’s Why Crypto Forums Are Going Crazy

Conclusion

Everything now depends on whether lawmakers keep this clause in the final bill and how regulators apply it in practice.

If the language survives, XRP’s legal standing in the U.S. could shift dramatically, marking one of the most unexpected turns in its long regulatory battle.

Before you invest in XRP, in the coming days we will be publishing our members premium crypto alert where we will reveal our key cryptocurrencies to consider for 2026 with explosive potential.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here