Our picks for the top cryptos this month are Ethereum, Solana, and XRP. They are forming bullish patterns, signaling potential breakouts fueled by technical setups and institutional momentum.

June 2025 has been a pivotal period for technical breakouts in the crypto market.Three cryptos: Ethereum, Solana, and XRP—are displaying unmistakable bullish formations on their charts.

These patterns are backed by volume trends, confirmed on-chain signals, and macroeconomic momentum. With Fibonacci levels and historical analogs in play, these assets are primed for accelerated moves over the coming weeks.

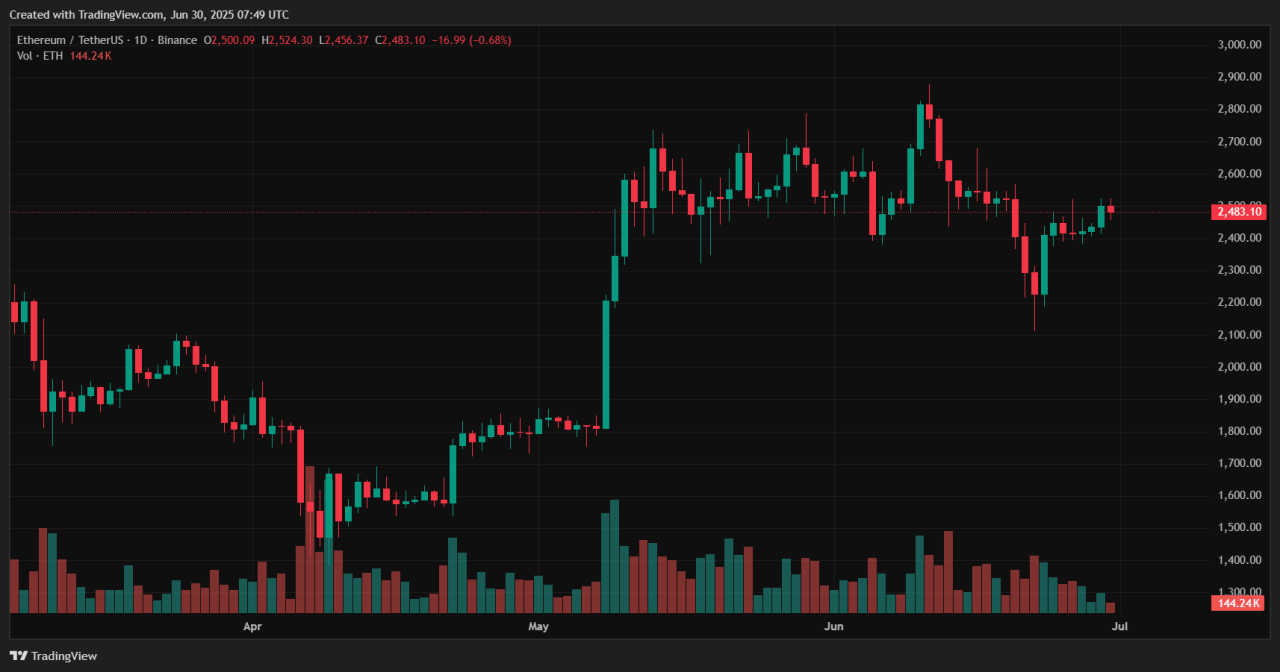

Ethereum (ETH) – Bull Flag Pattern

Ethereum’s price is coiling within a textbook bull flag on both daily and weekly charts. After climbing sharply into the $2,800 region, the flag-shaped consolidation suggests a continuation rally.

Analysts point to a breakout above the flag’s upper boundary, with projected targets ranging from $3,500 to $4,100—based on measured flagpole extensions and Fibonacci retracement.

Volume expansion accompanied by an RSI reset supports the potential for a strong upward move. Additionally, robust institutional inflows into Ethereum ETFs and renewed whale activity underpin the bulls.

Considering present dynamics, a breakout above ~$2,800 could set the stage for a rally toward $3,500 and beyond into July .

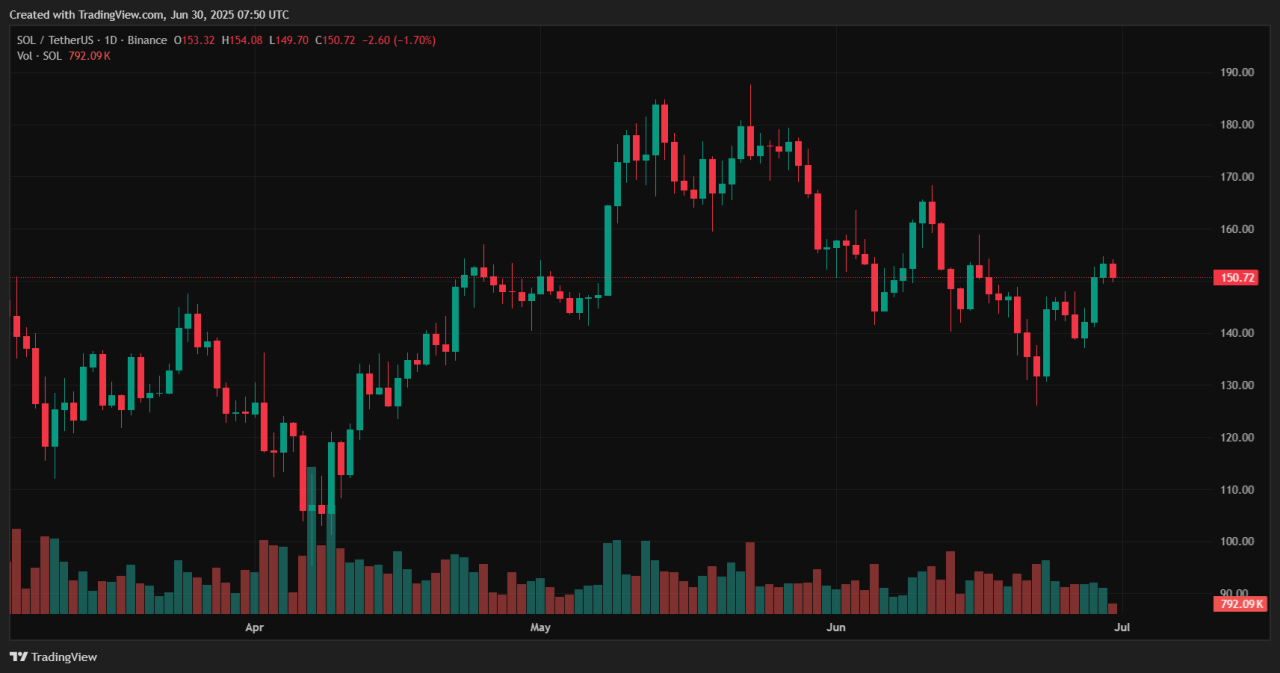

Solana (SOL) – Cup-and-Handle in Formation

Solana’s weekly chart reveals a classic cup-and-handle formation forming after a parabolic recovery. The cup’s neckline sits near $160–$165, closely aligned with rising RSI and impending MACD crossover signals.

Solana’s weekly chart reveals a classic cup-and-handle formation forming after a parabolic recovery. The cup’s neckline sits near $160–$165, closely aligned with rising RSI and impending MACD crossover signals.

On-chain futures open interest has surged above $2.8 billion, reflecting bullish market positioning. Historically, similar formations propelled SOL toward $260 in late 2024, with upside potential reaching $300–$500 if momentum continues.

A decisive breakout above $165 would confirm the pattern and could act as a magnet for altcoin capital flow.

XRP – Symmetrical Triangle Approaching Apex

XRP has been consolidating in a long-standing symmetrical triangle, bounded by resistance at ~$2.35 and support near $2.00. As the apex nears, volatility compression and volume contraction are typical pre-breakout dynamics .

XRP has been consolidating in a long-standing symmetrical triangle, bounded by resistance at ~$2.35 and support near $2.00. As the apex nears, volatility compression and volume contraction are typical pre-breakout dynamics .

Technical measures indicate a projected breakout could send XRP toward $5, with even analysts forecasting targets up to $7–$15 should momentum carry.

SEP-listed XRP ETFs in Canada and increasing institutional interest add further bullish fuel, reinforcing its narrative as a breakout candidate .

Conclusion

ETH’s bull flag, SOL’s cup-and-handle setup, and XRP’s symmetrical triangle each align with technical, on-chain, and macro factors favoring bullish breakouts. Key resistance levels to monitor include ~$2,800 for ETH, ~$165 for SOL, and ~$2.35 for XRP.

If these zones are breached with volume support, traders may witness notable breakout performances led by these three cryptos in June–July surge dynamics.

Our latest crypto alerts – instantly accessible

This is how we are guiding our premium members (log in required):

- Alt Season 2025: The Animals Are Back, This May Be A Very Bullish Signal (June 29)

- BTC And Altcoins About To Hit Big Support Areas (June 22)

- The Alt Season Charts (June 15th)

- Another Test of 106.1k, Is This THE Big One? (June 8th)

- How Much Longer Do We Have To Wait For Alt Season 2025? (June 1st)

- The Bitcoin vs. Altcoin Divergence (May 24th)