Disciplined dollar cost averaging can build a $1M XRP position over ten years if price rises sharply. This guide gives precise projections and monthly targets.

Making $1 million with XRP within the next decade is possible if the token’s price climbs sharply and you accumulate consistently.

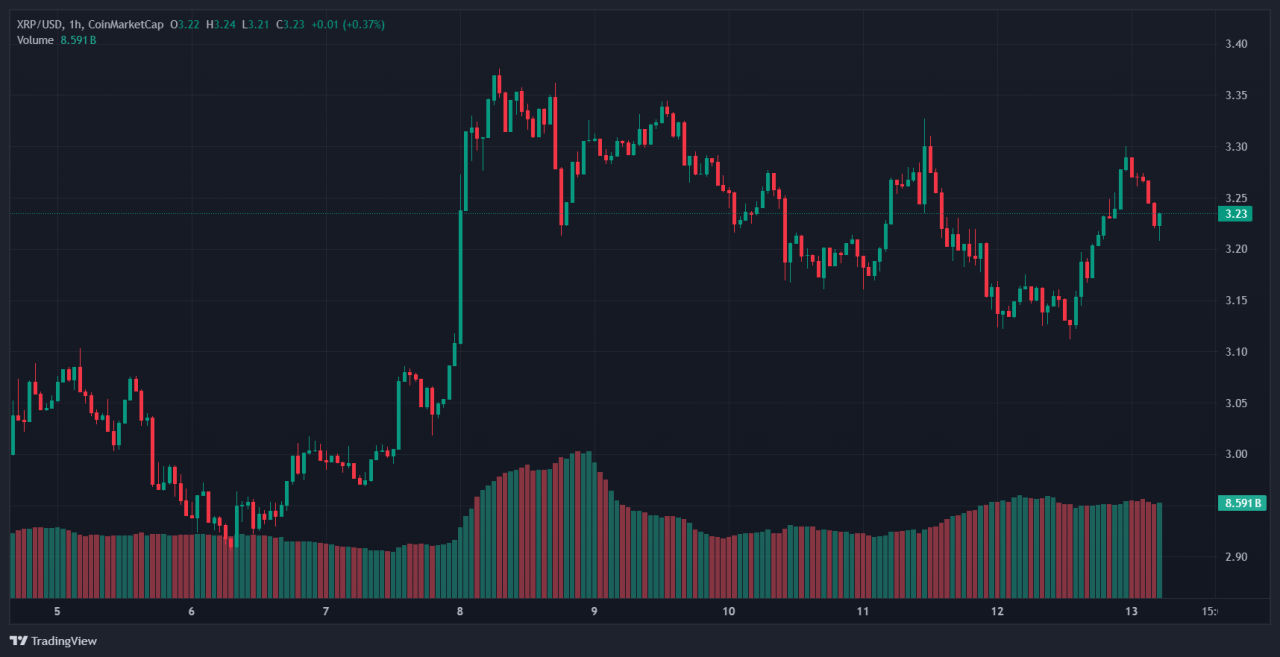

XRP currently trades around $3.2 after strong gains this year, fueled by renewed optimism following its legal settlement.

To reach the $1M target in 10 years, you can use dollar-cost averaging which offers a disciplined way to build holdings steadily while navigating XRP’s frequent price swings.

XRP Long-Term Price Scenarios

Reaching $1 million depends on two variables: how many XRP you own and the price it reaches in the future. If XRP climbs to $20 for instance, you would need 50,000 tokens, costing about $157,400 at today’s $3.23 price point.

At $50, the requirement drops to 20,000 tokens, or roughly $62,950 now. A $100 price would need only 10,000 tokens, costing about $31,475 today. Analysts’ long-term XRP price forecasts range widely, and your personal target should account for the price scenario you believe is most realistic for achieving the $1 million goal.

However, instead of buying all these tokens in a lump sum and hoping they appreciate, we recommend a strategy called dollar-cost averaging.

RELATED: An In‑Depth Review of Buying XRP on eToro

Why Dollar-Cost Averaging Works

Dollar-cost averaging means investing a fixed amount at regular intervals, regardless of token price. This method lowers your average cost over time and removes emotional decisions or attempts to buy at lows when dealing with a volatile asset like XRP.

Studies of long-term investing strategies consistently show DCA delivers returns that match or exceed market-timing methods in many scenarios.

Even in highly fluctuating markets, regular investments smooth out extremes, making systematic accumulation both effective and simpler.

RECOMMENDED: Best Place to Buy Ripple (XRP) In Dubai

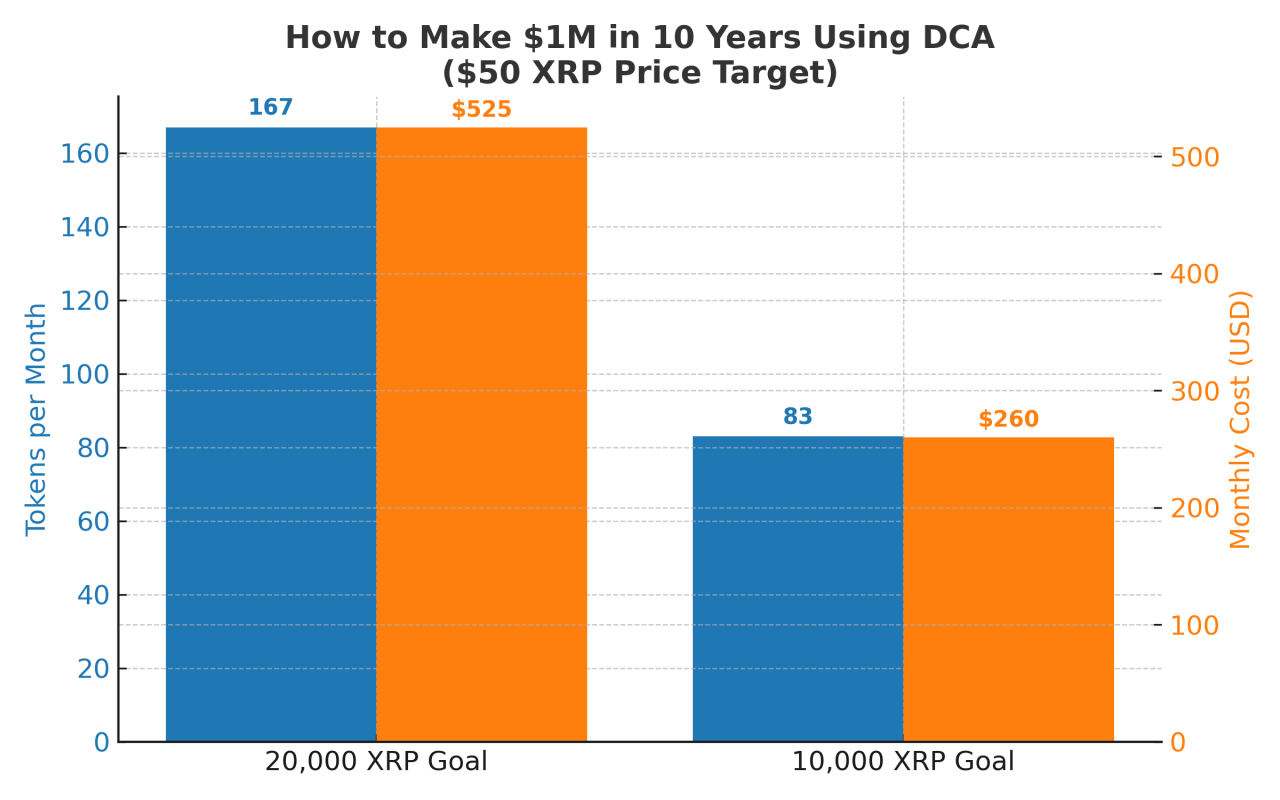

How to Make $1M in 10 Years Using DCA

Let’s use the $50 target as an example. If you have 20,000 XRP in 10-years it will yield $1 million if the price reaches $50. At today’s $3.2 that position costs roughly $62,950.

Over 120 months, that means buying about 167 XRP per month, costing around $525 each month currently. If you aim for just 10,000 XRP, you would spread about 83 tokens per month, costing about $260 now.

As your monthly cost stays fixed in dollars, you buy more tokens when the price dips and fewer when it climbs, lowering your average acquisition cost while steadily building toward your goal.

That said, be ready to adjust as price shifts, and track your cumulative cost basis closely to stay on target.

RELATED: Can You Create Wealth From Ripple XRP?

Making $1M With XRP: Risks & Best Practices

XRP ranks among the top-performing cryptocurrencies in 2025, gaining roughly 47%year-to-date, yet it remains exposed to volatility and regulatory shifts. The recent settlement with the SEC removed a major legal overhang but sparked sharp trading swings, including an 8 percent drop amid institutional profit-taking and $12.4 billion in trading volume .

To stay disciplined, invest only what you can afford to lose and limit crypto exposure to a small portion of your total portfolio. Track your cumulative cost basis and invest consistently.

You can automate your DCA plan so you stay aligned with your goal regardless of price moves. Finally, respond to adverse developments thoughtfully, not emotionally.

Conclusion

With disciplined dollar-cost averaging over ten years, accumulating XRP toward a $1 million target becomes feasible if token price rises sharply.

By setting realistic monthly contributions based on clear scenarios, you build steadily without trying to time the market. Monitor your cost basis, stay aware of the risks, and let time and consistency work toward your financial objective.

Don’t Miss the Next Big Move For XRP

Join the original blockchain-investing research service live since 2017. Our alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience. You’re following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

Click here to read more about Premium Blockchain investing research

This is how we are guiding our premium members (log in required):

- Crypto Shows More Resilience Than Expected. A Bullish Impulse May Be Underway. (Aug 9th)

- Prepare To Buy The Dip In Crypto (Aug 2nd)

- Alt Season 2025 – Progress Update (July 26th)

- This Is What Bullish Basing Patterns Look Like (Hint: Alt Season Starting) (July 20th)

- Is Alt Season 2025 Here? (July 15th)