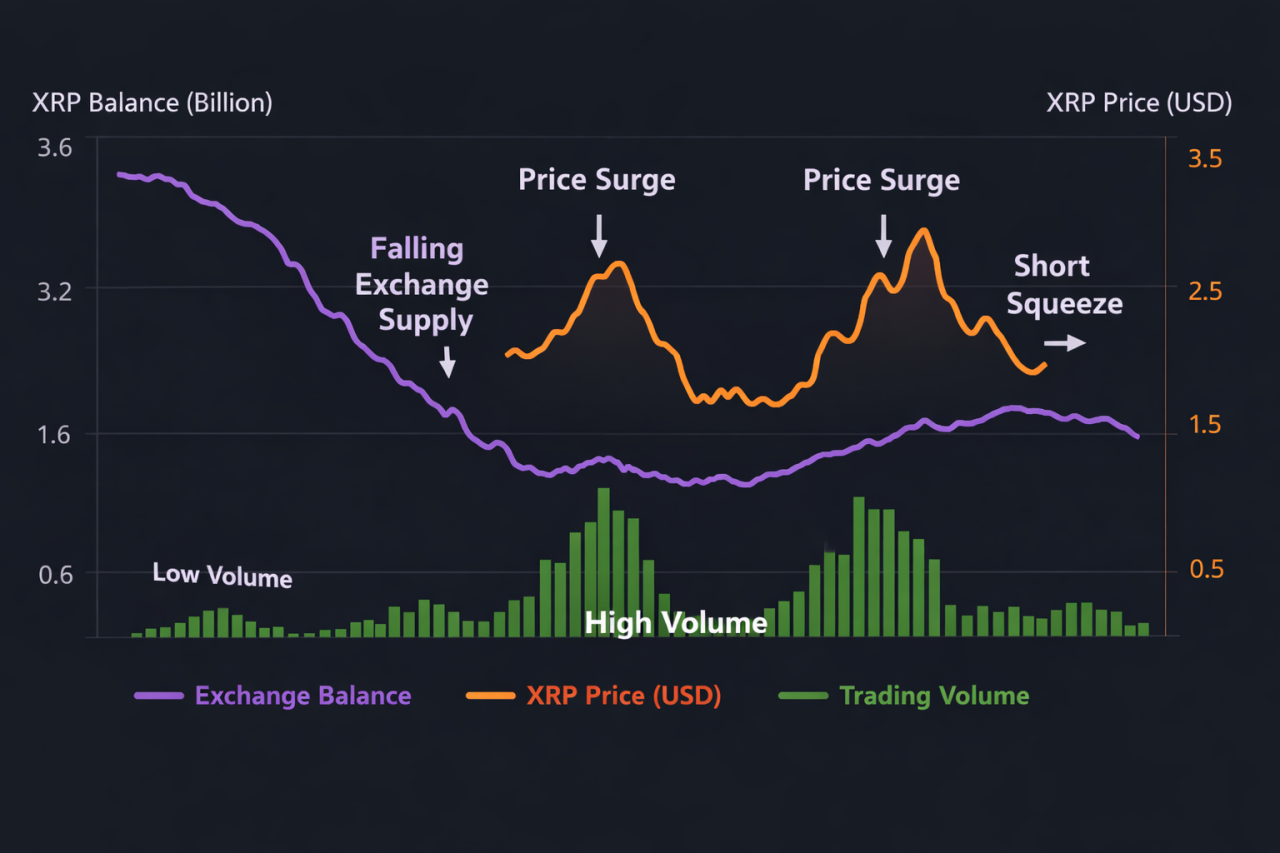

XRP supply on exchanges has dropped sharply, reducing liquid supply and increasing the chance of stronger price swings when demand appears.

XRP exchange balances fell from about 3.76 billion tokens in early October 2025 to roughly 1.66–1.7 billion by early February 2026, based on widely used on-chain data.

That is a decline of roughly 55% in four months.

This shift has changed how easily XRP can be bought or sold on major platforms. While some data providers show higher short-term figures, the broader picture points to tighter liquid supply and a market that may react faster to changes in demand.

RECOMMENDED: Is XRP Dead? Here’s Why Crypto Forums Are Going Crazy

XRP Exchange Balances Today

The most cited data shows XRP exchange balances at multi-year lows. Glassnode data places the figure around 1.66–1.7 billion XRP in early February 2026, down from about 3.76 billion in October 2025. That change removed more than half of the readily available exchange supply.

Other sources paint a slightly different picture. CryptoQuant and some exchange disclosures showed temporary increases, with averages closer to 2.7 billion XRP during parts of February.

These differences come from how platforms label exchange wallets, how often addresses are updated, and whether internal transfers are filtered out.

What stands out is not the exact number, but the instability. Liquidity is no longer evenly spread across exchanges.

Some platforms are holding more XRP, while others are seeing steady outflows. That uneven distribution can increase volatility, because price reacts faster when liquidity pools thin out on large trading venues.

RECOMMENDED: Where To Buy XRP In 2026 – Global Liquidity, Fees & Access

Why Falling Exchange Balances Can Lift Prices

When fewer tokens sit on exchanges, sellers have less inventory ready to unload. If buyers step in, demand can push prices higher more quickly.

This is not theory. Past XRP moves show that price accelerations often followed periods of falling exchange supply.

The key condition is demand. Lower supply alone does nothing if buyers stay quiet.

Price strength appears when shrinking exchange balances line up with rising spot volume and stronger market participation. In those cases, traders compete for fewer available tokens, which drives faster price moves.

Short squeezes can also happen in this environment. Traders betting on lower prices may rush to cover positions when liquidity tightens, adding fuel to upward moves.

These rallies tend to be sharp but can fade if demand does not hold.

Why This Metric Can Send False Signals

Falling exchange balances can also mislead if taken at face value. One major factor is Ripple’s regular escrow activity.

Large transfers move XRP between wallets without any intent to sell, yet they still show up as exchange or non-exchange flows depending on labeling.

Custody also plays a role. Institutional holders often move XRP off exchanges into long-term custody solutions. This reduces exchange supply but does not always signal bullish intent. The tokens may simply be parked, not positioned for active trading.

Data quality may also add confusion. Exchanges periodically relabel wallets, and market makers move inventory to OTC desks. These actions can cause sudden drops or spikes in reported balances that reverse within days.

Finally, falling balances can flip quickly. If sentiment shifts, holders may send XRP back to exchanges to sell, restoring supply just as traders expect a breakout.

RECOMMENDED: 5 Reasons XRP Could Double Your Money In 2026 After The Drop

What To Watch Alongside Exchange Balances

Exchange balances work best when paired with other signals. For instance, spot trading volume can help confirm whether buyers are active.

Rising prices with falling volume often fade. Wallet data is also important because growth in addresses holding more than 1 million XRP often points to longer-term confidence.

Also keep an eye on derivatives metrics. Funding rates and futures basis show whether traders are leaning too bullish or too bearish. Extreme readings often precede reversals.

Finally, watch per-exchange data. Liquidity drying up on a major exchange carries more weight than small declines spread across minor platforms.

These signals will help you understand whether falling exchange balances reflect real supply pressure or temporary shifts.

ALSO READ: XRP on Edge: Will Ripple’s Token Crumble Below $1 This Month?

Conclusion

Lower XRP exchange balances increase the chance of faster and larger price moves by reducing immediate sell supply.

On their own, they do not predict direction. The signal becomes meaningful when demand, volume, and market positioning confirm a true supply squeeze.

Used correctly, exchange balance data helps explain why prices move faster in certain conditions, not where they must go next.

Should You Invest In XRP Now?

Before you invest in XRP, you’re going to want to read our next premium crypto alert which will be published in the coming days. We will reveal key crypto assets to consider in 2026 with explosive potential.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here