XRP offers high-reward upside in 2025, while Ethereum provides steady, ecosystem-driven growth fueled by ETF inflows and institutional support.

As an investor, you are probably hunting for the next millionaire-maker—a crypto that turns a modest stake into a fortune. Both XRP and Ethereum (ETH) have historic rallies behind them, but which one can realistically triple‑digit your portfolio in the coming year?

This article compares their recent momentum, real-world usage, and future upside using the latest data to help you make a decision.

Price Momentum & Technical Trends

XRP is trading above $2.20 and recently cleared its 200‑day EMA, reflecting renewed bullish momentum. Daily technicals show an RSI around 50 and a bullish trend line near $2.10, with analysts eyeing resistance at $2.25–$2.30 and potential upside to $2.55 or even $5.50 by late 2025.

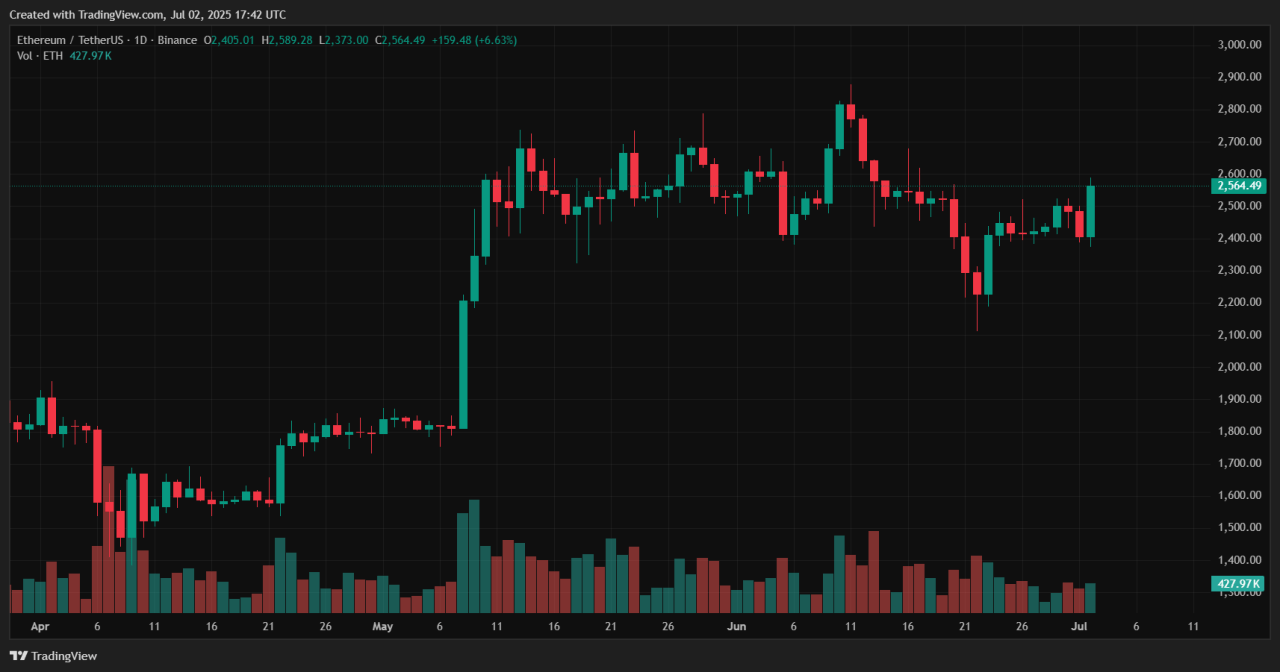

On the other hand, Ethereum hovers just over $2,520, held within a tight range of $2,425–$2,750. But whale accumulation is hitting multi-year highs, coupled with steady ETF inflows and on-chain staking, pointing to a breakout toward $3,500–$5,800.

However, recent dips from large exchange inflows signal possible short-term consolidation.

Ecosystem Utility & Structural Strength

Ethereum remains the backbone of DeFi, NFTs, Layer‑2 scaling, and staking, especially with institutional adoption via spot ETFs—Q1 2025 saw over $1.2 billion in ETH ETF inflows.

Its deflationary emission post‑merge enhances scarcity. Meanwhile, XRP has carved a niche in cross-border payments, powered by a protocol-level AMM and partnerships with 300+ financial institutions. Its escrow-controlled supply reduces volatility.

Upside Scenarios & Wealth Potential

XRP forecasts are bold—some analysts see $6.50–$10 if legal clarity and adoption trends accelerate, representing 3×–5× gains from today’s ~$2.20 . ETH projections are equally grand: ETF inflows and whale buying could propel it toward $5,000–$10,000 in 2025, implying 2×–4× growth from current levels.

Conclusion

Short-term, XRP offers high-volatility, high-reward potential—catch a breakout around legal or partnership catalysts and a 5× gain could be in reach. Ethereum, in contrast, delivers broader, institutional-backed growth via its ecosystem and ETF momentum, though reaching millionaire status may demand larger initial capital.

Ultimately, risk-takers focused on rapid upside might lean XRP, while long-term believers in decentralized infrastructure will favor ETH. Choose based on your timeline, risk appetite, and whether you want a sprint or marathon.

Our latest crypto alerts – instantly accessible

This is how we are guiding our premium members (log in required):