XRP’s inclusion in S&P’s new crypto index gives it greater visibility, steady institutional demand, and a stronger place among leading digital assets.

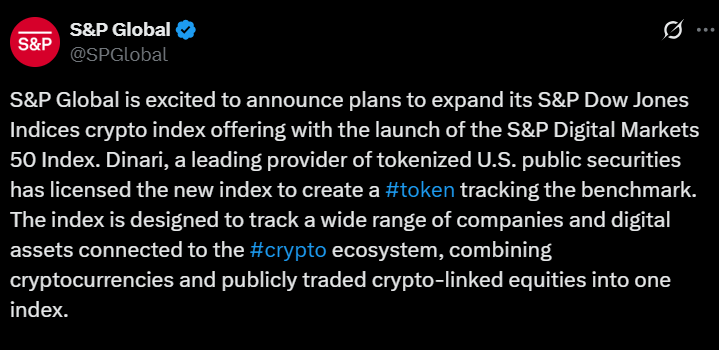

S&P Global has launched the Digital Markets 50 Index, a new benchmark that tracks both cryptocurrencies and crypto-related stocks.

XRP is among the 15 tokens selected, placing it alongside Bitcoin, Ethereum, and other top assets. This move signals growing recognition for established digital currencies and opens new channels for institutional investors to gain exposure.

ALSO READ: 1 Reason Why XRP Could Sky Rocket

What The S&P Digital Markets 50 Is And Why XRP Qualified

The S&P Digital Markets 50 combines 15 cryptocurrencies and 35 publicly listed crypto-linked companies to create a single, diversified benchmark. To qualify, tokens must have a market cap above $300 million, while related stocks must exceed $100 million.

Each asset is capped at 5% of the index, with quarterly reviews to maintain balance. XRP met these standards because of its strong liquidity, large market cap, and active ecosystem.

Its inclusion confirms its position as a major token within the digital asset space and makes it easier for funds to include XRP in regulated investment products.

RECOMMENDED: 5 Major Companies Quietly Acquiring XRP

How Index Inclusion Can Impact XRP’s Market

When a cryptocurrency becomes part of a benchmark index, investment products that track it often buy that asset to match the index’s composition. In this case, XRP may benefit from additional demand as tokenized and fund-based versions of the index roll out.

The 5% cap prevents excessive weighting, but quarterly rebalancing can still create steady inflows.

This activity improves liquidity and price stability over time. For investors, it signals that XRP is becoming part of the broader financial landscape rather than being treated as a standalone speculative token.

RECOMMENDED: XRP Price Prediction: Will October Bring a Spot XRP ETF Surge?

Why It Matters For Crypto Blue Chips

Inclusion in a mainstream index is a sign of maturity. It means cryptocurrencies like XRP are being evaluated using the same standards applied to equities and other assets.

For long-term investors, it also means easier access through regulated platforms. Over time, these developments could help shape the market for crypto “blue chips” by improving trust, transparency, and investment access.

RECOMMENDED: Is XRP Worth Investing Today?

Conclusion

XRP’s addition to the S&P Digital Markets 50 highlights its growing relevance in global markets. The index sets a new benchmark for crypto inclusion, paving the way for broader institutional participation and more consistent capital flows.

The easiest way to buy Cryptocurrencies is through a trusted crypto exchange like Moonpay, Coinbase, or Uphold. These platforms allow users to purchase and trade crypto instantly from any device, including smartphones, tablets, and computers.

Buy Crypto NowCrypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here.

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

-

Proprietary 15-indicator methodology developed over 15+ years of market research.

-

Proven track record of spotting major turning points before markets move.

-

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

👉 Act today and join the original crypto research service — still live and stronger than ever since 2017.

This is how we are guiding our premium members (log in required):

- ATH in BTC = Alt Season 2025 Catalyst? (Oct 5th)

- Crypto Consolidation: When Will Bullish Momentum Return? (Sept 28)

- Is Meme Season Underway? (Sept 19th)

- Alt Season Is Brewing, In Silence. These 3 Charts Tell The Crypto 2025 Story. (Sept 10th)

- Is A Trendless Crypto Market Good or Bad? The Current and Emerging Winners Look Awesome. (Sept 7th)

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)