Large investors and new business tools are beginning to hold more XRP for long periods, potentially reducing how much remains in everyday trading. This trend could reshape supply and demand over time.

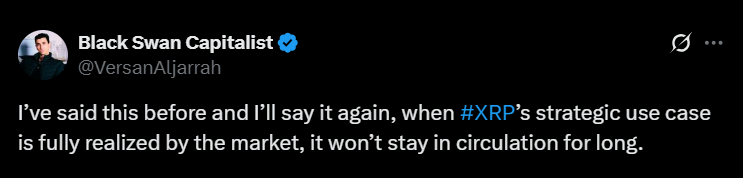

A recent market expert suggests XRP could become harder to find in open circulation as more institutions and companies start holding it for strategic use.

XRP’s current circulation is about 59.98 billion out of a total 100 billion, giving the token a market cap of roughly $145–150 billion. If more of that supply moves into long-term storage, the amount available for trading could shrink.

ALSO READ: Will XRP Hit $5? Three Scenarios for the 2025 Bull Run

Institutional Treasuries and Long-Term Holding

Ripple-backed investment ventures have started setting up large funds aimed at buying and holding XRP. One example is a planned $1 billion raise that targets accumulating the token through a U.S. stock market listing.

When institutions buy large amounts and store them instead of trading, it reduces the number of tokens moving in the market. This can make the asset scarcer and may influence its price over time.

RECOMMENDED: XRP’s Hidden Signal for October The Road to $10 Begins

Business Use and Treasury Software Adoption

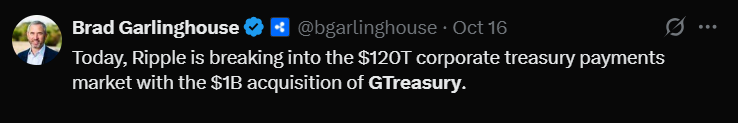

Ripple’s recent $1 billion purchase of GTreasury, a treasury management software provider, shows its goal of getting XRP into corporate systems. The deal allows companies to integrate XRP into their regular cash and payment management tools.

This makes it easier for finance departments to hold XRP directly, rather than relying only on banks or exchanges. If more businesses adopt XRP for liquidity or payments, those tokens may sit idle in company accounts instead of circulating.

Tracking Supply Changes on the Blockchain

Analysts point to several data signals worth watching. Large transfers to custodial wallets, higher holdings among institutional addresses, and inflows to XRP-linked funds can all indicate that supply is tightening.

On-chain activity already shows a slow but steady rise in long-term holdings, suggesting that XRP’s liquid supply could continue to decline.

RECOMMENDED: XRP Joins S&P Digital Markets 50 – What’s Next for Crypto in 2025

Conclusion

Institutional investment in XRP and business adoption are beginning to shift how the token is used and stored.

While this could increase scarcity and support higher value in the future, the long-term effect depends on whether these holdings stay locked or eventually return to the market.

As of October 2025, the balance between adoption and liquidity remains one of the most important factors shaping XRP’s outlook.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

-

Proprietary 15-indicator methodology developed over 15+ years of market research.

-

Proven track record of spotting major turning points before markets move.

-

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

👉 Act today and join the original crypto research service — still live and stronger than ever since 2017.

This is how we are guiding our premium members (log in required):

- The Ongoing Test Of Bitcoin’s 200 dma Will Be Decisive For The Outcome In Crypto Markets (Oct 20th)

- From Failed Breakout to Consolidation: How to Think About Yesterday’s Flash Crash (Oct 12th)

- ATH in BTC = Alt Season 2025 Catalyst? (Oct 5th)

- Crypto Consolidation: When Will Bullish Momentum Return? (Sept 28)

- Is Meme Season Underway? (Sept 19th)

- Alt Season Is Brewing, In Silence. These 3 Charts Tell The Crypto 2025 Story. (Sept 10th)

- Is A Trendless Crypto Market Good or Bad? The Current and Emerging Winners Look Awesome. (Sept 7th)