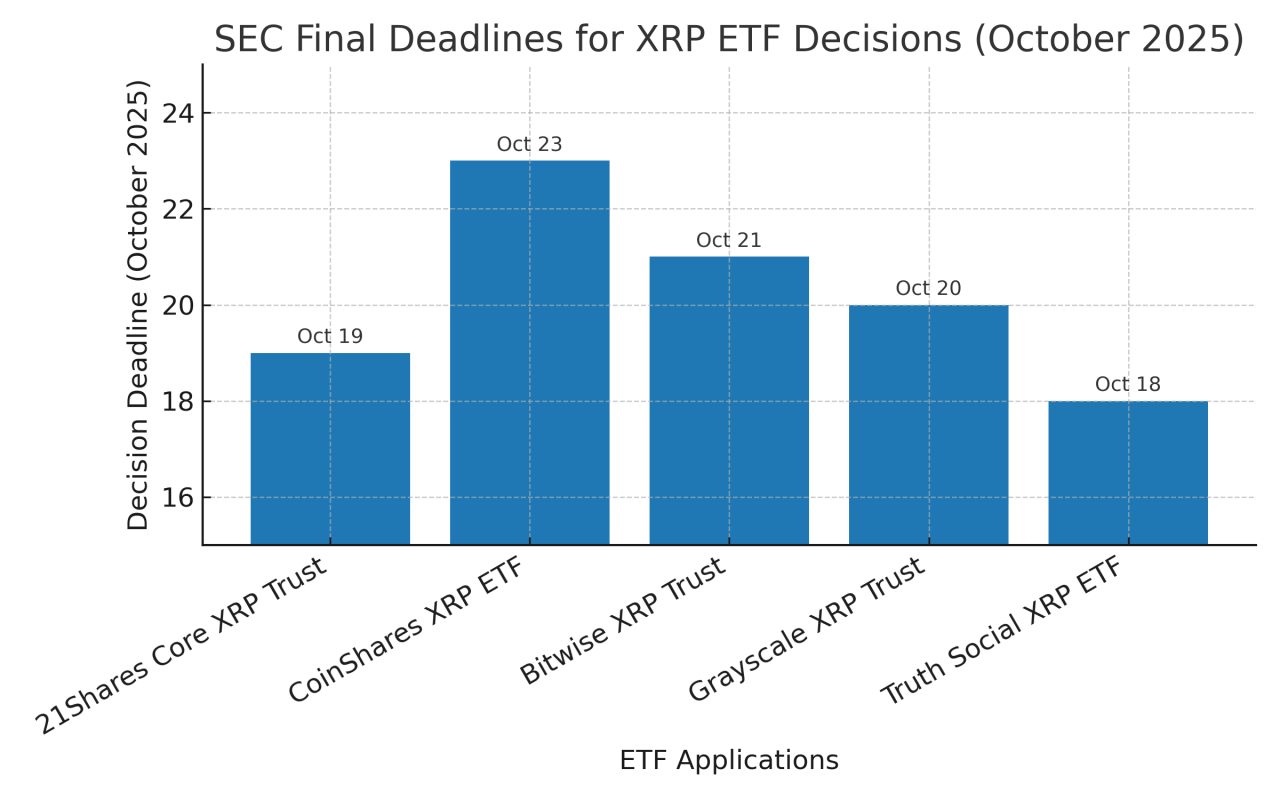

SEC delayed decisions on five spot XRP ETF applications to mid-to-late October. Ripple’s pending national banking license decision may land in the same window.

The U.S. Securities and Exchange Commission pushed decisions on five spot XRP ETF proposals into October, setting final deadlines between October 18 and 23 for firms such as Grayscale, 21Shares, CoinShares, Bitwise and others.

Meanwhile, Ripple awaits a ruling from the Office of the Comptroller of the Currency on its U.S. national banking charter, which analysts expect no later than late October. These concurrent deadlines make October 2025 a defining moment for XRP’s institutional integration.

RECOMMENDED: Is It Worth Buying XRP in 2025?

SEC’s ETF Delay — A Catalyst in Disguise

The SEC granted itself up to 60 extra days to assess XRP ETF filings, extending decisions into mid- to late-October. The 21Shares Core XRP Trust now faces a decision deadline of October 19, while CoinShares’ ETF is set for October 23.

The SEC typically uses the full 180-day review window, and asset managers consider October as the “norm” for such decisions. These delays give institutional players time to prepare for market entry via regulated channels.

RECOMMENDED: Want to Make $1M with XRP? Here’s How in 10 Years or Less

October’s Dual Regulatory Moment — ETFs and Banking License

October now represents a critical regulatory window. The OCC generally resolves national bank charter applications within 120 days, placing Ripple’s expected decision in late October.

If approved, the charter could elevate Ripple to a federally regulated trust bank, granting access to a Federal Reserve master account and solidifying its legitimacy in traditional finance.

Approval of both the ETF and bank charter would offer XRP regulated liquidity and a stronger institutional foothold. A rejection in either case would delay broader adoption.

RECOMMENDED: An In‑Depth Review of Buying XRP on eToro

Conclusion

October 2025 now holds outsized significance for XRP. SEC rulings on spot ETF approvals and the OCC’s decision on Ripple’s bank charter will together shape institutional access and regulatory credibility.

Market participants should closely monitor outcomes in mid- to-late October as these decisions will chart XRP’s next growth phase.

Don’t Miss the Next Big Move – Access Alerts Instantly

Join the original blockchain-investing research service — live since 2017. Our alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience. You’re following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- Crypto Shows More Resilience Than Expected. A Bullish Impulse May Be Underway. (Aug 9th)

- Prepare To Buy The Dip In Crypto (Aug 2nd)

- Alt Season 2025 – Progress Update (July 26th)

- This Is What Bullish Basing Patterns Look Like (Hint: Alt Season Starting) (July 20th)

- Is Alt Season 2025 Here? (July 15th)

- Alts Breakout Happening Now. These Are Price Time Combinations To Watch. (July 11th)