ETF decisions and clear technical levels could shape XRP’s next big move. Expect volatility and wider price swings this month.

XRP entered November trading around $2.50, showing frequent price swings and rising trading volume on key news days.

With major regulatory updates now settled and new ETF filings awaiting review, the token is in a sensitive phase. XRP’s outlook for November will largely depend on ETF developments, investor sentiment, and how global markets behave through mid-month.

RECOMMENDED: Will XRP Hit $5? Three Scenarios for the 2025 Bull Run

XRP Outlook for November: Market Snapshot And Main Catalysts

XRP has held between $2.45 and $2.60 over the past few sessions. The recent resolution of Ripple’s legal case with the SEC removed much of the uncertainty that had pressured the token earlier this year. This helped attract more market confidence, though short-term volatility remains high.

Attention is now on the updated XRP ETF filings, which have review dates around November 13 and 14. Approval or delay could immediately affect liquidity and investor positioning.

On-chain data also shows more coins moving to exchanges, suggesting some holders may be taking profits. Combined with shifting global market sentiment, these factors could set the tone for XRP’s November performance.

RECOMMENDED: Could Central Banks Quietly Be Testing XRP For Settlement?

Key Technical Levels And XRP Price Prediction in November

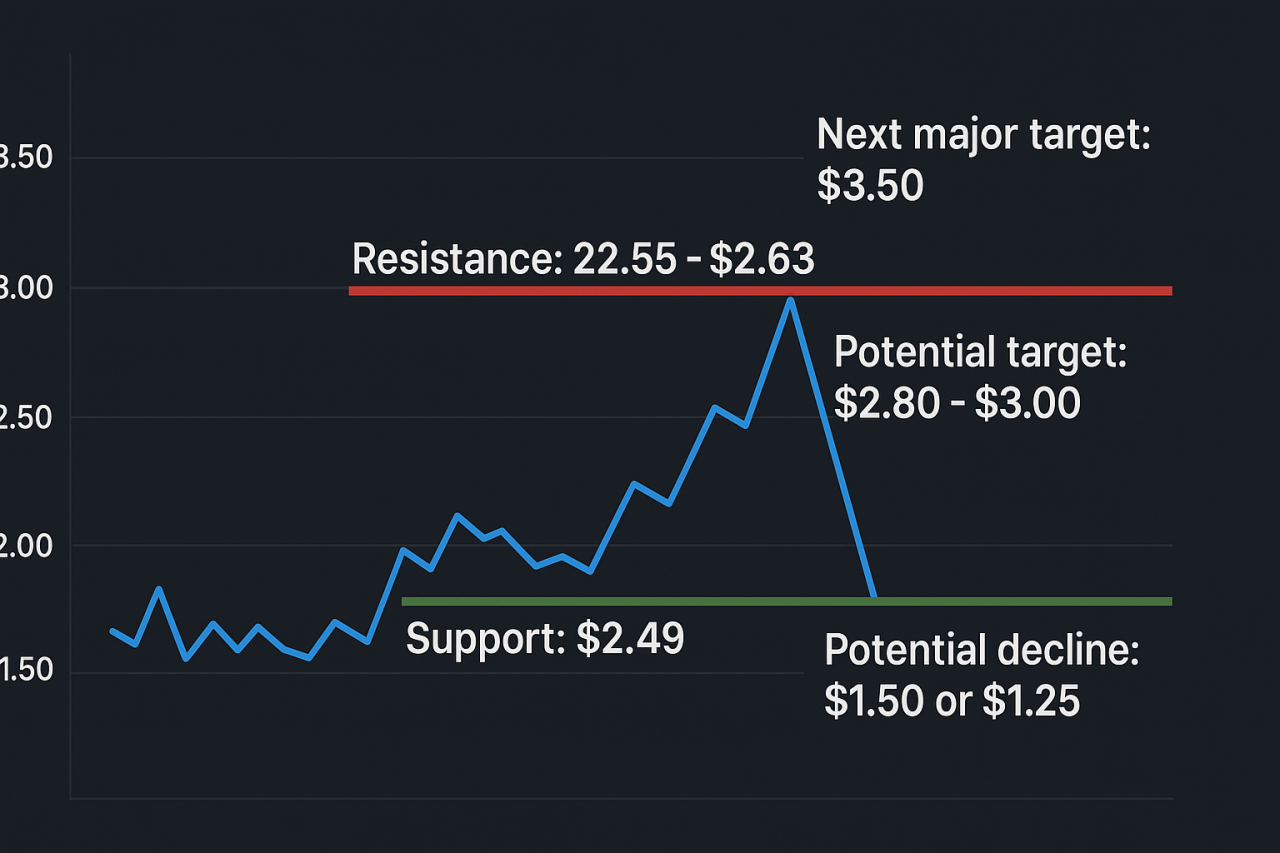

Technically, XRP faces resistance between $2.55 and $2.63. A daily close above this range could open the door to $2.80 or even $3.00 if trading volume strengthens. Beyond that, $3.50 becomes the next major target.

If sellers take control and the price drops below $2.49, XRP could fall toward $1.50 or $1.25. The depth of the pullback will depend on how much volume supports the move. For traders, daily closing prices around these levels matter more than short intraday spikes.

RECOMMENDED: XRP vs SWIFT: How Ripple Cuts Global Transfer Fees

What To Watch This Month

November’s main risks come from macroeconomic data and potential ETF delays.

Quick sentiment changes or concentrated selling on exchanges could trigger fast moves in either direction.

YOU MAY LIKE: XRP Joins S&P Digital Markets 50 – What’s Next for Crypto in 2025

Conclusion

Despite short-term volatility and the potential for sharp swings around key ETF decisions, XRP’s broader setup remains constructive.

The market is consolidating within a well-defined range, setting the stage for a larger directional move once clarity emerges on regulatory and ETF fronts.

Healthy pullbacks are a normal part of any advancing market, and as long as XRP holds above major support, the path toward higher targets including $4 remain valid.

In essence, November may prove to be a pivotal month for XRP, one where patience and disciplined observation around $2.49 and $2.55 could reward those anticipating the next bullish breakout.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here