ETF inflows and clearer regulations are creating stronger buying activity for XRP, setting the foundation for potential long-term growth.

The strongest growth signal for XRP this October is growing interest from large investors. Institutional funds are quietly increasing their exposure to XRP through ETFs and other digital asset products.

This steady inflow of money is creating consistent buying pressure that could help XRP move toward higher price levels over time.

XRP ETF And Institutional Inflows: A Strong Demand Boost

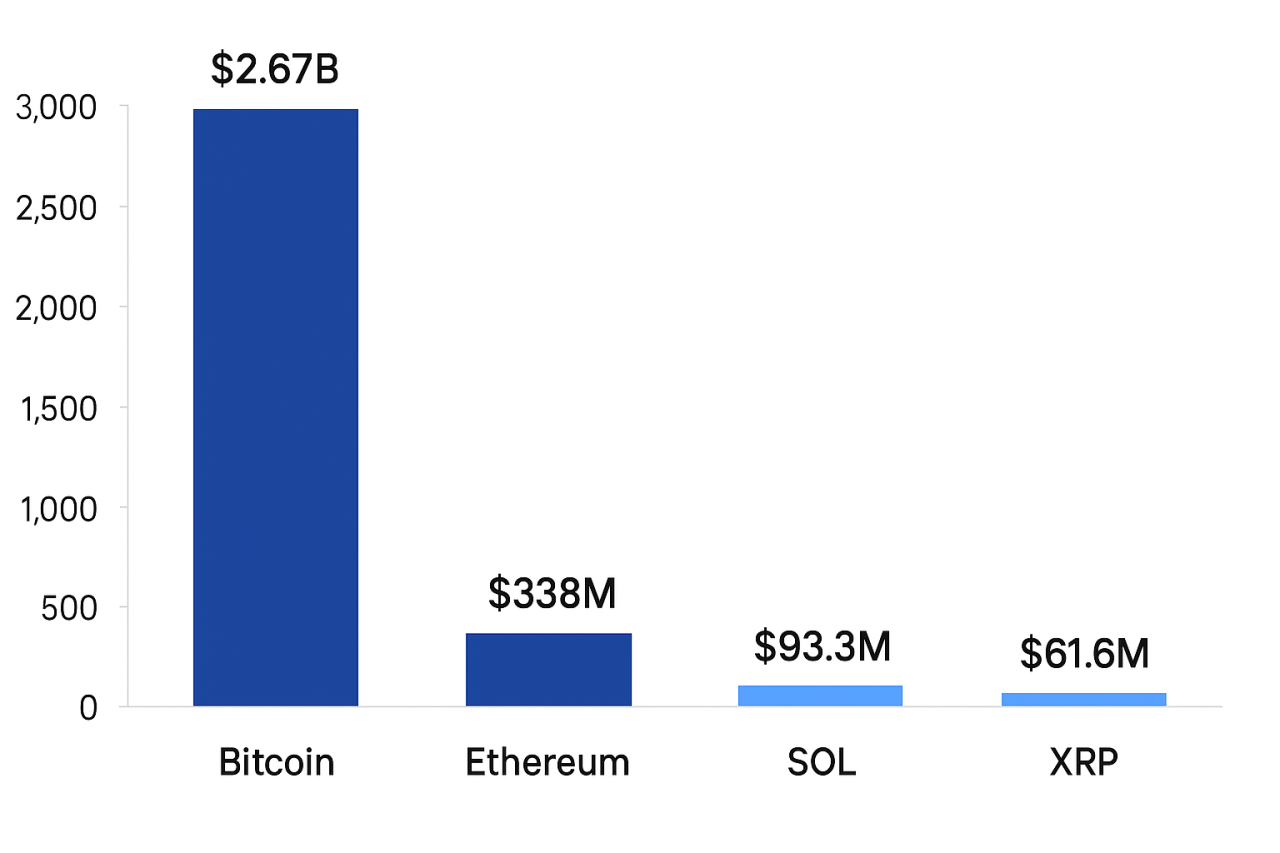

Recent data confirms that big investors are putting real money into XRP. CoinShares reported inflows of about $61.6 million for XRP in mid-October, and earlier reports showed over $200 million entering XRP-related products in the first week of the month.

These are not short-term trades but structured purchases made by funds and financial institutions. Unlike retail traders, these buyers add liquidity gradually and hold assets for longer periods.

This pattern reduces the available supply on exchanges, which supports higher prices when demand keeps building. In short, institutional inflows are giving XRP a solid foundation for steady upward movement.

RECOMMENDED: 5 Major Companies Quietly Acquiring XRP

Legal Clarity And Bank Partnerships Strengthen Confidence

Legal progress this year has also helped attract more serious investors to XRP. Ripple’s legal clarity in the United States removed much of the uncertainty that previously kept institutions on the sidelines.

Reports now show Ripple exploring a U.S. banking license, a move that could open direct partnerships with banks and regulated custodians.

These developments make it easier for investment firms and ETFs to include XRP in their portfolios without legal complications.

With trust returning and banking connections expanding, institutions can invest in XRP with greater confidence, which supports long-term demand and price stability.

RECOMMENDED: XRP Joins S&P Digital Markets 50 – What’s Next for Crypto in 2025

Short-Term Risks And Key Signals To Follow

Some risks remain. Large whale transfers, like the recent $63 million move to Binance, can cause short-term price dips.

However, the main signals to follow this month are ETF inflows, exchange reserves, and on-chain wallet activity.

Continued institutional accumulation would confirm that demand remains stronger than short-term selling.

Conclusion

If institutional inflows continue and regulatory conditions stay clear, XRP has a real chance to climb beyond major resistance levels. Consistent buying from large investors could be the key factor that eventually pushes XRP toward $10.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

-

Proprietary 15-indicator methodology developed over 15+ years of market research.

-

Proven track record of spotting major turning points before markets move.

-

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

👉 Act today and join the original crypto research service — still live and stronger than ever since 2017.

This is how we are guiding our premium members (log in required):

- ATH in BTC = Alt Season 2025 Catalyst? (Oct 5th)

- Crypto Consolidation: When Will Bullish Momentum Return? (Sept 28)

- Is Meme Season Underway? (Sept 19th)

- Alt Season Is Brewing, In Silence. These 3 Charts Tell The Crypto 2025 Story. (Sept 10th)

- Is A Trendless Crypto Market Good or Bad? The Current and Emerging Winners Look Awesome. (Sept 7th)

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)