Legal clarity, whale accumulation and fund inflows may prime XRP for a volatile breakout. Exchange supply and volume will determine the next move.

Legal uncertainty over Ripple concluded in August 2025, removing a long-standing market overhang. Institutional funds show mixed activity while large wallets continue to accumulate.

That combination and concentrated exchange supply creates a tight setup that often produces sharp moves in XRP over short to medium horizons with clear entry points.

READ: Is It Too Late to Buy XRP in 2025? What Investors Need to Know

Catalysts And Macro Context

Ripple and the SEC closed their multi-year case in August 2025, with Ripple agreeing to pay a $125 million fine and a court injunction restricting certain institutional XRP sales, a ruling that removes a primary legal overhang and clarifies which XRP transactions the law covers.

Short-term market conditions favor risk assets, with traders pricing multiple rate cuts into futures which raises appetite for crypto.

Banking use cases and clearing partnerships have also increased institutional comfort with XRP, improving its credibility for custody and fund managers considering ETP allocations in recent months.

RECOMMENDED: Is XRP a Good Investment? 7 Factors Every Investor Should Know

On-Chain And Institutional Flow Picture

Since July, institutional liquidation events have removed roughly $1.9 billion of XRP from positions, while large holders added substantial sums, with on-chain data showing hundreds of millions of XRP moved into private wallets, a divergence that concentrates supply and sets up volatile price reactions now.

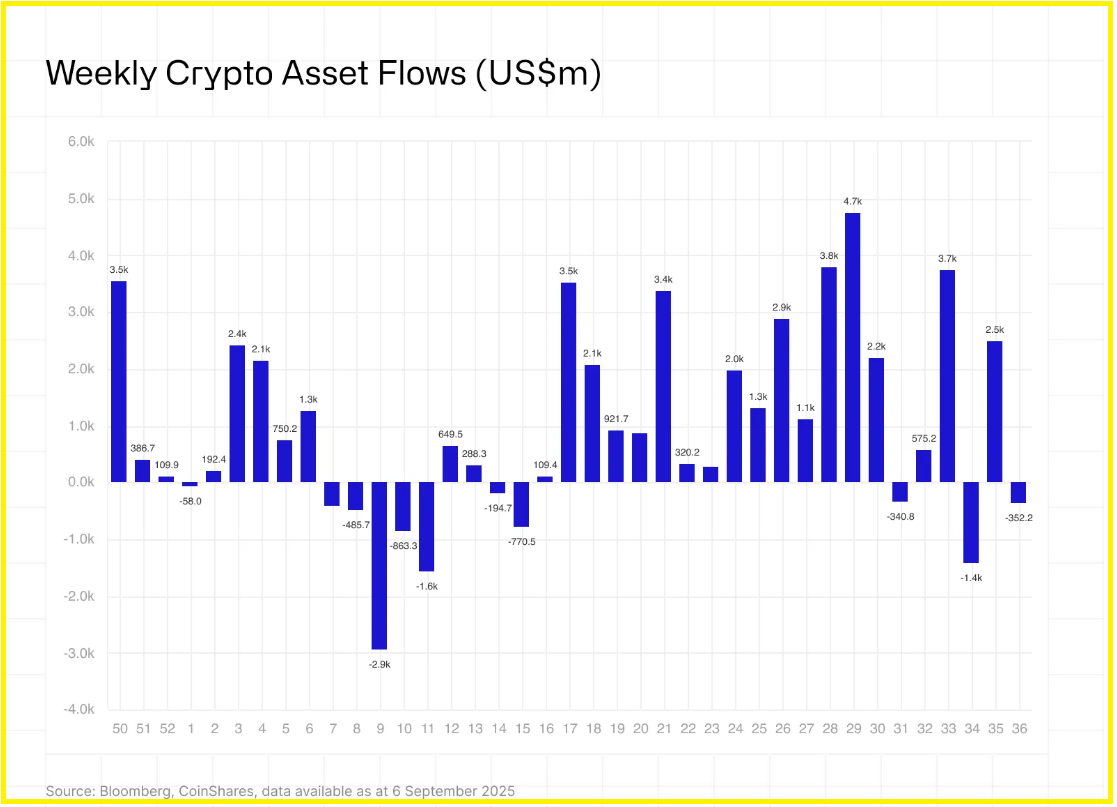

Fund flows support the view that demand persists, with CoinShares reporting about $1.22 billion of inflows for XRP over recent weeks.

At the same time, exchanges hold concentrated balances, Binance storing roughly 2.9 billion XRP, a level that can both supply sellers and limit sudden shortages if outflows accelerate further.

RECOMMENDED: 3 Reasons To Buy Ripple (XRP) Like There’s No Tomorrow

Technical Map And Risk Framework

Based on our XRP technical analysis, we see key levels that define actionable scenarios: support sits at $2.65 to $2.80, and resistance ranges from $3.12 to $3.40, with initial breakout targets at $3.60 and $5.00.

If you are trading as oppose to buying the asset, you may want to trade small size until sustained reclaim or break, watch exchange balances, and keep stop-losses tight to manage sudden liquidity-driven moves and review position sizing.

You can also check our XRP price predictions to understand where XRP might be going.

RECOMMENDED: Is It Worth Buying XRP in 2025?

Conclusion

Conditions favor a high-volatility move, but respect supply metrics and size positions. Have trade plans to protect capital through disciplined exits.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

How To Know When To Buy XRP?

To get key information on potential entry and exit point for XRP, you should consider joining the original blockchain-investing research service — live since 2017.

InvestingHaven alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience. Gain insights from the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- Is A Trendless Crypto Market Good or Bad? The Current and Emerging Winners Look Awesome. (Sept 7th)

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)

- What Happened This Week? Leading Indicator Analysis and 7 Token Charts. (Aug 16th)

- Crypto Shows More Resilience Than Expected. A Bullish Impulse May Be Underway. (Aug 9th)

- Prepare To Buy The Dip In Crypto (Aug 2nd)

- Alt Season 2025 – Progress Update (July 26th)