Zcash focuses on private transactions, while XRP offers fast settlement and broad liquidity. Each coin serves a different type of investor.

Choosing between Zcash vs XRP comes down to what you want from a digital asset. Zcash gives strong privacy for users who need confidential transfers. XRP provides quick and low-cost settlement for payments and trading.

This article compares both coins using current data, recent legal updates, and real adoption trends to help you decide which one better fits your goals.

ALSO READ: XRP vs SWIFT: How Ripple Cuts Global Transfer Fees

Zcash Vs XRP: Quick Overview

Zcash (ZEC) is built for private transactions using zero-knowledge proofs and the Orchard shielded pool. About 16.3 million ZEC are in circulation, and the project saw renewed attention in late 2025 after roadmap updates and increased discussion around digital privacy. Its market cap sits in the multi-billion range.

XRP, the native token of the XRP Ledger, focuses on payments and rapid settlement. It processes transactions in about 3 to 5 seconds and supports high throughput around 1,500 transactions per second.

XRP also enjoys high liquidity, broad exchange support, and a stronger market cap. A recent U.S. settlement eased a major regulatory obstacle.

RECOMMENDED: Is Zcash (ZEC) a Good Investment in 2025? 5 Reasons It Might Be

Zcash Vs XRP: Utility And Real-World Adoption

Zcash’s main purpose is privacy. Users can send shielded transactions that hide the sender, receiver, and amount when they choose the private option. This helps with confidential payments, sensitive donations, and situations that require discreet transfers.

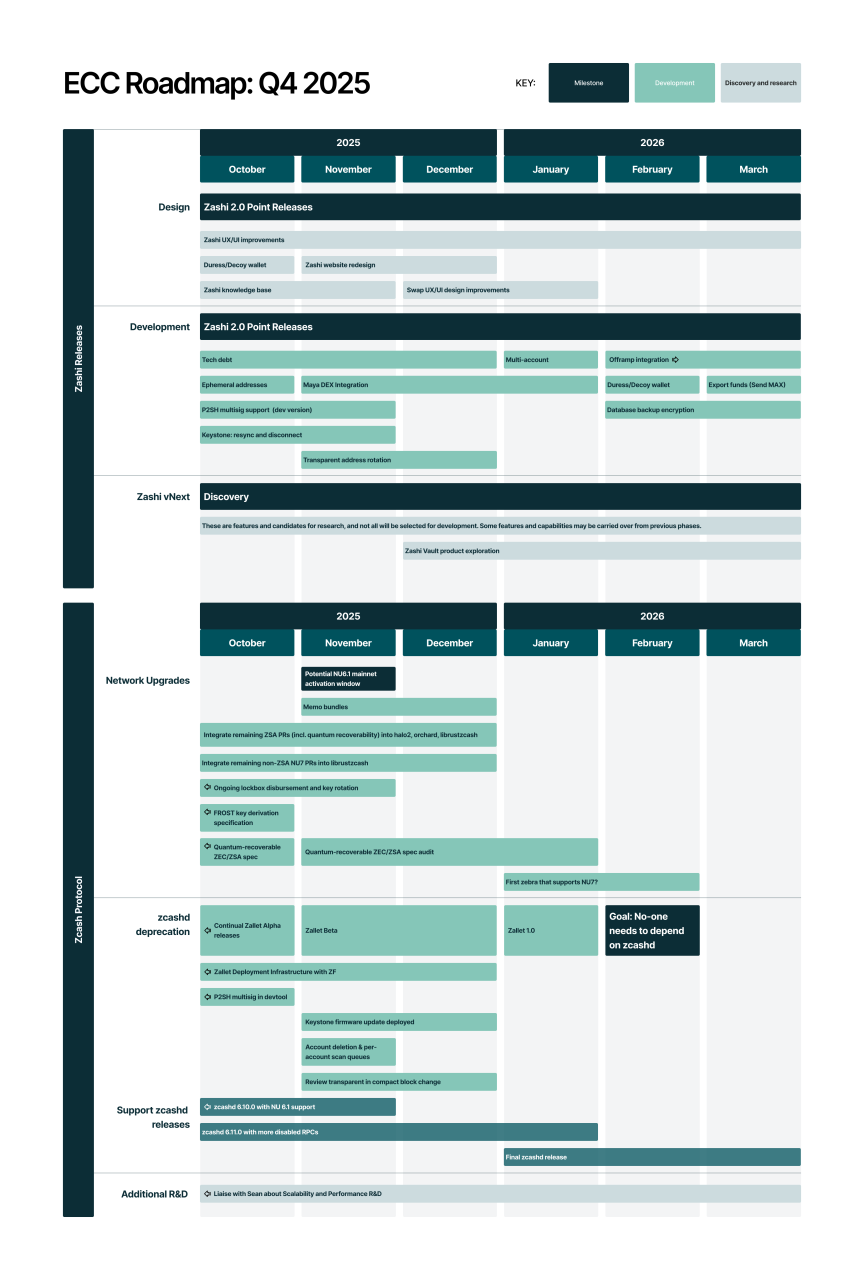

Adoption is steady but limited because some regions restrict privacy coins, and several exchanges lower support due to regulatory concerns. The ECC roadmap for Q4 2025 aims to improve wallet usability and increase shielded adoption.

XRP’s use case is broader. It is designed for payments, remittances, and on-demand liquidity solutions. Companies and payment providers value XRP for its speed and low cost. High liquidity makes it easy to trade and move across platforms.

The recent U.S. settlement removed a major uncertainty, which helped rebuild confidence among institutions looking into payment-focused solutions. XRP’s adoption continues to lean on its settlement speed and exchange presence.

YOU MIGHT LIKE: XRP Tumbles – But Is a Major Upside Shock Coming?

Zcash Vs XRP: Technology And Transaction Speed

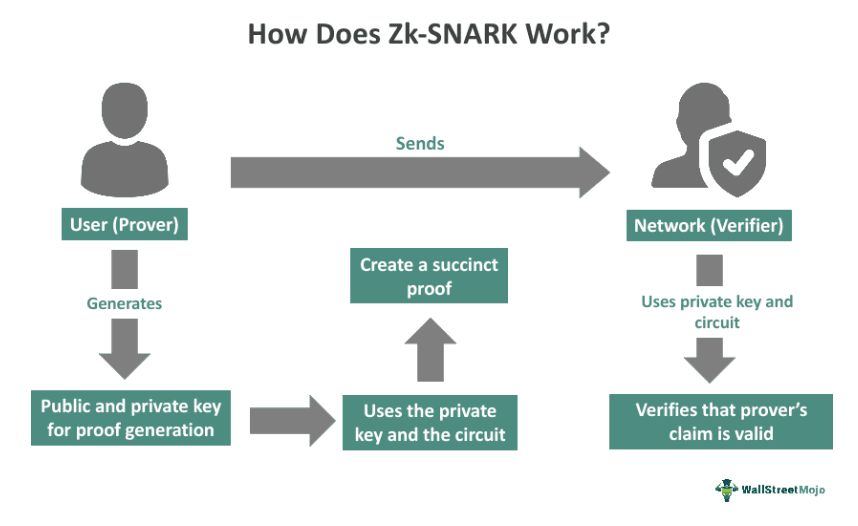

Zcash uses zk-SNARKs to provide strong privacy. Shielded transactions need more computing resources, so they take longer than regular transfers on other chains. Private transactions offer meaningful confidentiality but sacrifice some speed and convenience.

ECC is working on upgrades to make proofs smaller and wallet support smoother, which should give users a simpler experience.

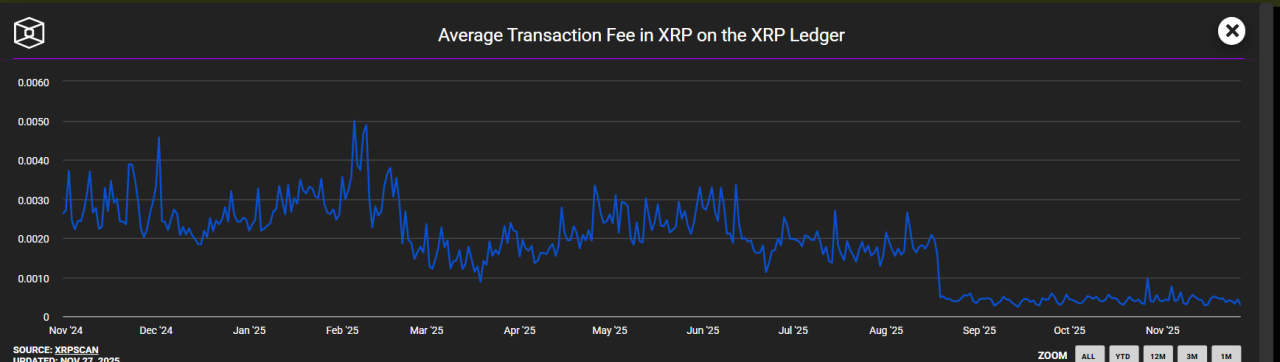

XRP uses a consensus mechanism that gives it fast settlement times of about 3 to 5 seconds. Its transaction capacity sits around 1,500 TPS, which is suitable for frequent payments and high-volume activity.

Fees remain extremely low, so users can move funds without worrying about high transaction costs. The design focuses on speed and reliability for payments rather than privacy.

Zcash Vs XRP: Risk And Investor Profile

Zcash carries higher regulatory risk because some regions restrict privacy coins. Liquidity is lower compared to large-cap assets, which can increase price swings. Investors who buy ZEC usually want privacy exposure or hope shielded adoption grows.

XRP comes with its own risks, including past regulatory issues and concerns about token concentration. The U.S. settlement lowered a major legal concern, but investors should still evaluate distribution and governance. XRP often appeals to those who want liquidity, speed, and easier market access.

RECOMMENDED: Zcash Drops 13%: Is It Time To Buy?

Zcash Vs XRP: Which Is A Better Buy?

Zcash makes sense if you want direct exposure to privacy-focused technology and you accept the risks tied to regulation and lower liquidity. If shielded usage continues to rise and roadmap goals are met, ZEC could benefit.

XRP works better for investors who want fast settlement, deeper liquidity, and clearer legal footing. Many people choose both: a smaller ZEC position for privacy demand and a larger XRP position for payments and trading.

Your final choice should match your risk comfort, access to exchanges, and tax requirements.

ALSO READ: Banks Bet On XRP Again – Which Institutions Are Quietly Accumulating?

Zcash Vs XRP: Key Takeaways For Investors

ZEC focuses on privacy and appeals to users who want confidential transfers, though it faces regulatory resistance and higher volatility. XRP focuses on payments, offering quick settlement, wide liquidity, and improved legal clarity in 2025.

Choose based on whether you value privacy or payment efficiency, and review your custody options and regional rules before investing.

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

-

Proprietary 15-indicator methodology developed over 15+ years of market research.

-

Proven track record of spotting major turning points before markets move.

-

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

Act today and join the original crypto research service — still live and stronger than ever since 2017.

- Why This Bounce Matters (30 Crypto Charts) (Nov 23rd)

- What’s Going On With Bitcoin & Alts?(Nov 16th)

- This Is What We Want To See The Next 72 Hours(Nov 9th)

- The Next 2 To 3 Weeks …(Nov 2nd)

- A Successful Test of Bitcoin’s 200 dma? (Oct 26th)

What Our Readers Say

“I got to tell you, you guys and your charting and your predictions are AMAZING! I don't know how people can even give you a hard time when you make pullback predictions. Markets cannot go up forever!”

“I LOVE how you talk about the ‘buy the dips’ times vs the ‘sell for profit’ times to get more free coins. You have been right sooo many times — it’s actually amazing!”

— Newsletter Subscriber

“Your team puts a huge amount of work into the newsletters and the analyses. You’ve been doing this for so many years already, and the passion is still there. Respect.”

“Because of your research, I’ve become a much more patient investor. And ‘more patient’ basically means ‘better.’ Over the past few years, my capital has often just stayed unused rather than constantly invested — and it has paid off.”

“Now that my perspective is strictly long term, I have far more peace in my life. Nothing is more stressful than constantly wondering what your crypto might do the next day. After seeing firsthand that long-term investing outperforms trading, the difference is night and day.”

— Crypto Research Subscriber

“As a faithful follower, I really miss the commentaries — the wisdom, the thoughts, the analysis. Truly appreciate the knowledge you share.”

— Long-Time Follower