Top altcoins bled by as much as 30% on Monday morning’s intra-day trading.

After the crypto market witnessed its worst single-day crash of 2025, they lost critical support levels, effectively shedding most of the January 2025 gains.

A day after President Trump made good on his campaign promise of imposing heavy tariffs on trading partners, the crypto market suffered its biggest single-day loss of the year.

Top altcoins like Ethereum and Cardano suffered greatly as their prices tanked by double-digit percentages, with liquidations exceeding $650 Million.

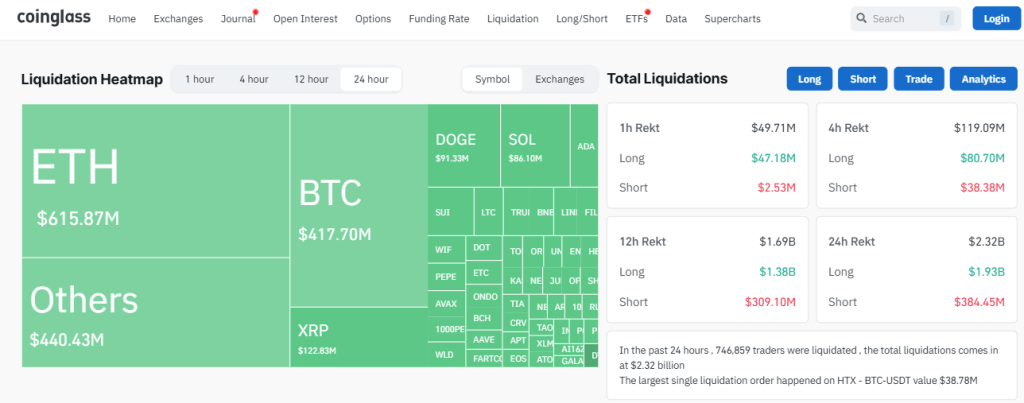

Coinglass: Liquidation heat map

Traders Lose $615 Million as ETH Price Plummets Toward $2100

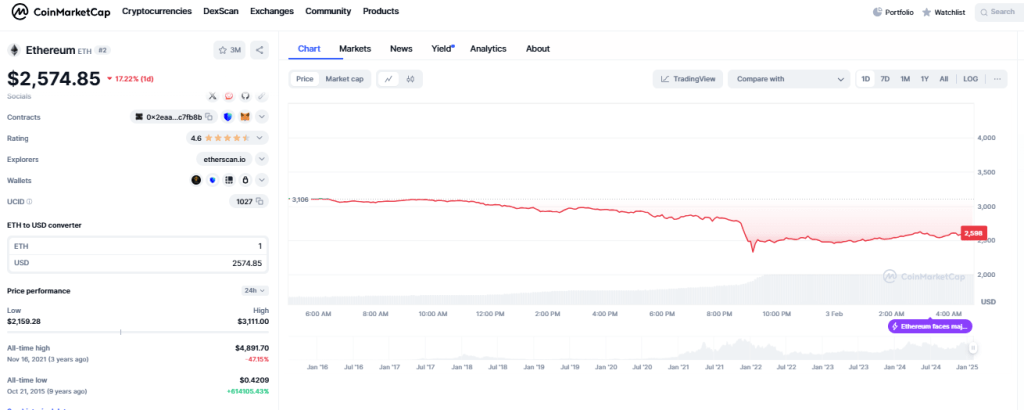

Ethereum bore the brunt of the price crash as its price dipped 30% from a 24-hour high of $3100 to as low as $2150, according to data from CoinMarketCap. This resulted in the liquidation of more than $615 Million in ETH trades, which includes $479M and $136M worth of long and short positions, respectively.

CoinMarketCap: ETH price action after tariffs

At the time of writing, ETH started rebounding and is trading around $2500 – representing a 17% dip in the last 24 hours. This implies that it has wiped out much of the gains made post-Trump election, as it last traded around this price level in late November 2024.

Cardano Crashes by 36% Amidst a $36 Million Liquidation

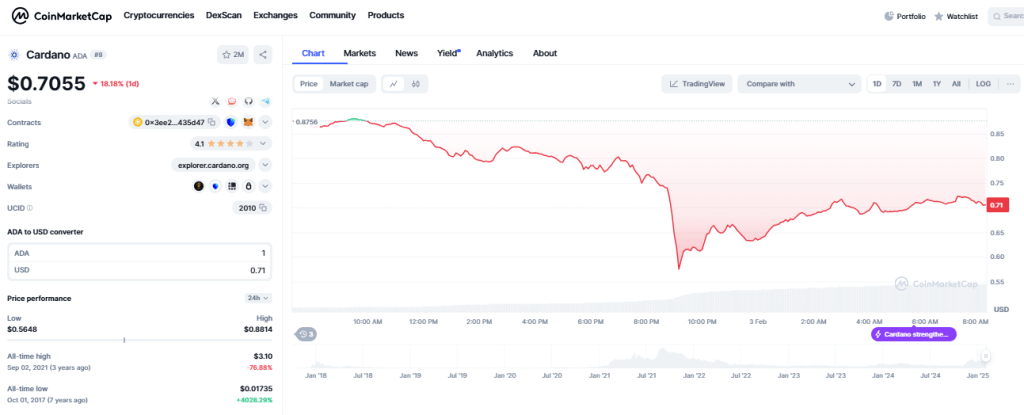

On the other hand, Cardano traders lost $36 Million to forceful liquidations – with as much as $32 Million of these being long positions. The coin’s price also took a major hit and plummeted by more than 36% during intra-day trading – from a high of $0.88 to as low as $0.56.

CoinMarketCap: Cardano price action Monday 3rd Feb

At the time of writing, Cardano has recovered most of the losses to hover around $0.70, representing an 18% dip in the last 24 hours. Like most top altcoins, ADA lost a critical support level – $0.83 – that Cardano bulls have fought hard to defend for the last three months.

Is It Time to Buy ADA and ETH?

Most altcoins today experienced violent losses that were last seen in 2020. This may tempt you to rush to revenge and scoop these coins at the current ‘dip’, assuming that they have dipped and with the hope of riding their recovery phase. However, technical analysis of both coins indicates that the market is still largely bearish with a higher chance of further bleeding.

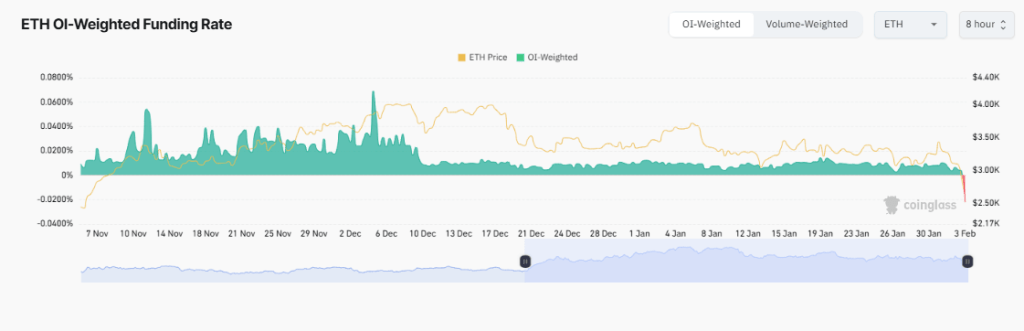

Coinglass: OI-weighted funding rata data for Ethereum

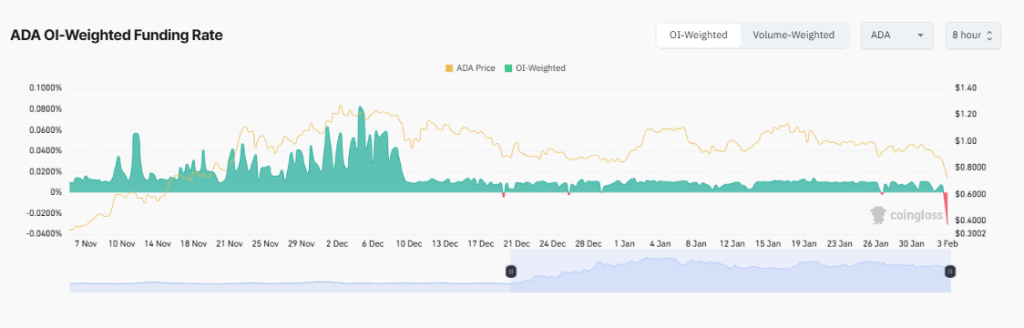

Coinglass: OI-weighted funding rata data for Cardano

For example, the Open Interest (OI) weighted funding rate for Ethereum and Cardano on Coinglass is around -0.0221% and -0.0309%, respectively. A negative OI-Weighted funding rate implies that shorts are paying longs and is a bearish market indicator.

🚀 Stay Ahead of the Crypto Market!

Join our Premium Crypto Newsletter and receive expert market analysis, insights, and early signals for the next big rally. Don’t miss out on profitable opportunities!

Only $14.99