The recent crypto market crash has left investors questioning its future, but history suggests that downturns often pave the way for strong recoveries—making this a potentially great time to invest before the next bullish cycle kicks in.

After a relentless three-year bear market, the crypto industry staged a historic comeback in the last half of 2024.

The euphoric recovery pushed the industry’s market cap past $3.6 Trillion and helped Bitcoin smashed through the $100k barrier to set a new ATH above $109,000.

The correction coincided with Trump’s win and came in a few months after the all-important Bitcoin halving event. All these sparked mass speculation that we would witness a bull run this year.

However, the first quarter of 2025 has been mired with negative macros – from Trump tariffs and Fed’s inaction, to mounting fears of inflation. These have spooked investors and cast a huge shadow of doubt on the market’s immediate future.

At the time of writing, a brutal sell pressure has engulfed the market. It threatens to drag Bitcoin prices below $80k, having already pushed the likes of Ethereum and Solana to multi-month lows.

Following The Crypto Market Crash When Will The Market Start To Recover?

To know when the crypto market will recover we must first look at the reasons why the market crashed.

Everyone is wondering when will crypto go up and or if we are staring at a deeper crypto market crash. In this article, we’ll help you understand the crash and discuss the market’s next move.

More importantly, we will tell you if we think now is the right time to invest.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

GET STARTED

Crypto investments are risky and may not suit retail investors; you could lose your entire investment.Understand the risks here

Reasons for the Early 2025 Crypto Market Crash

Until January 20, the market was upbeat and investors looked forward to the best year for the industry yet.

Everyone was convinced that it is a good time to invest in crypto. In fact, top altcoins like Ripple, Litecoin, and Cardano were also already hitting multi-year highs.

It had become apparent that the crypto-friendlier SEC would approve their respective ETFs.

Unbeknownst to many, a perfect storm of negative macro headwinds that would turn the industry on its head was forming. Here is the sequence of key events that have contributed to the unexpected industry downturn.

The compounded impact of these factors has been crushing investor confidence in the market. This has, in turn, triggered a massive selloff that has crashed the price of top coins.

Chronological order of events that led to the early 2025 crypto market downturn

It started with the consumer price index for January coming in higher than expected.

This raised inflation concerns and sparked fears that FED would delay interest rate cuts.

In reaction to this, investors started selling Bitcoin and top cryptos to book profits ahead of the January FOMC meeting.

In mid-January, a Chinese tech company launched the Deepseek R1, an AI chatbot.

They said it outperformed its US counterpart, ChatGPT on all the key metrics even though it had been developed at a fraction of GPT’s cost.

It sucked liquidity off the crypto markets and exacerbated the sell off for Bitcoin as investors diverted their cash to AI-related stocks and projects.

In the last week of January, the FOMC meeting took place and the FED confirms everyone’s fears when it failed to lower interest rates.

Tariffs have contributed towards the crypto market crash

Less than three days later, Trump made good on his campaign promise of imposing harsh tariffs on US trading partners. In this first wave, he targeted, Colombia, Chinese, Canadian, and Mexican imports.

Even though he would later on pause Canadian and Mexican tariffs, the damage had been done.

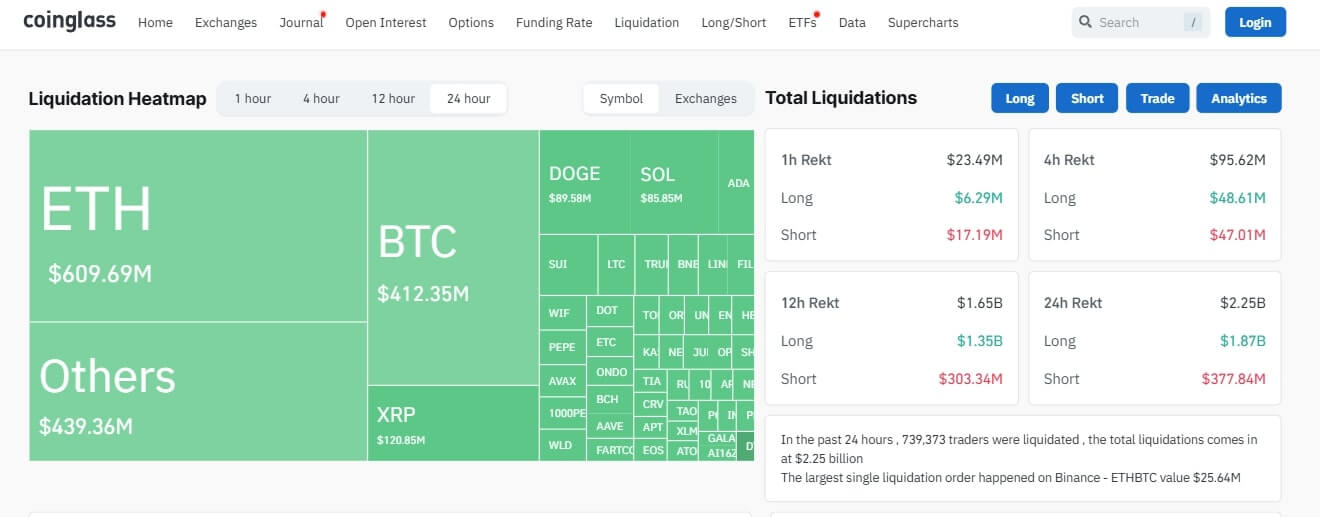

BTC had already dipped below $100k and the market cap below $3 Trillion. On-chain analysis platform – Coinglass noted that more than $2 Billion worth of leveraged trades (mostly longs) were wiped out in the ensuing chaos.

Though some equally reputable sources – like ByBit CEO argue that liquidations exceeded $10 Billion.

A week later, FED chair testified before the senate and doubled down on their cautious stance and non-commitment to lower interest rates.

Before the market decided what to do with this information, China imposed retaliatory tariffs on the USA, forcing the Trump administration to double down with the second wave of tariffs on china and reactivated of suspended tariffs on Canada and Mexico.

In addition to the many negative macros affecting the crypto industry, there were several other coin-specific factors.

The most impactful has to be the $4.5 Billion Libra scandal that accelerated Solana’s crash from $200 to below $125. The postponement of Ethereum’s PECTRA upgrade after hacker infiltration of the rollout also helped drag it below $1800.

The Overall Impact of These Factors on Market Performance

- Bitcoin ETFs had their largest weekly net outflow of $2.61 Billion in the last week of February

- Bitcoin ETFs had posted net outflow for four straight weeks – totaling more than $4.5 Billion

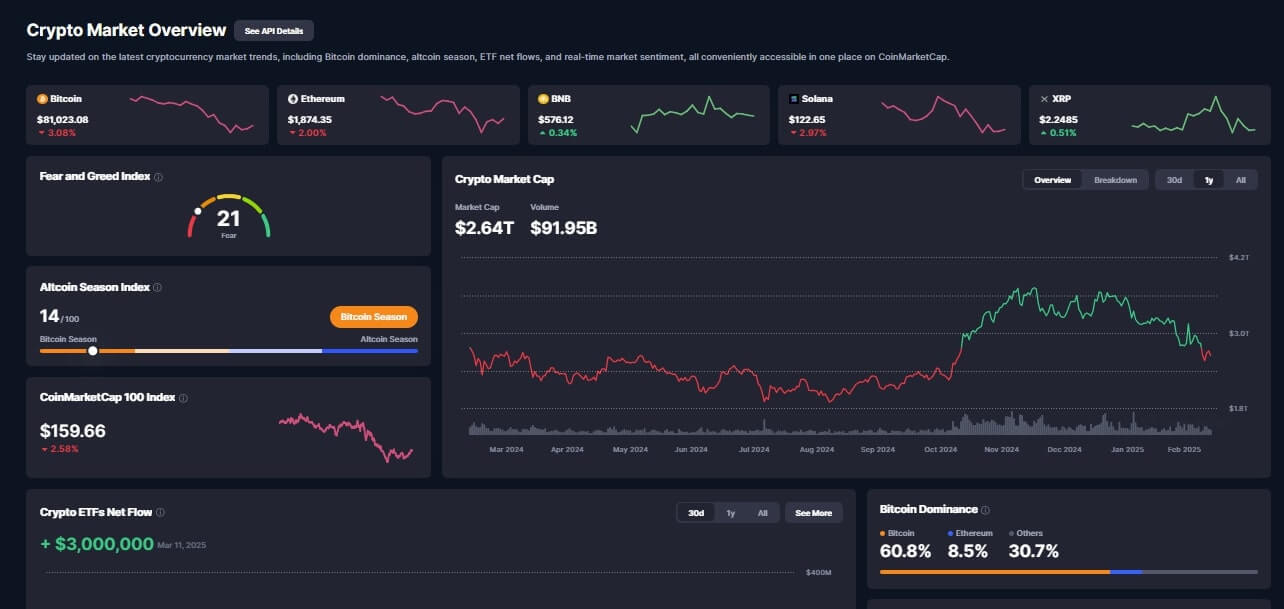

- The Fear and Greed index fell to a multi-year low – around 17

- The crypt market cap lost the $3 Trillion valuation to sit around $2.6 Trillion today

Can the Crypto market Recover after the crash and Will a Bull Run Start in 2025

The short answer is yes, the crypto market industry will rebound. This implies that the crypto market will go up and a bull run is still possible in 2025, the negative macros and crypto specific factors, however, make its timing uncertain.

Here are a number of factors that have the majority of investors and analysts convinced that the crypto industry will rebound:

Historical cycles suggest crypto will bounce back

The strongest argument in support a crypto market recovery for 2025 is Bitcoins documented four-year cycle.

If you zoom out the legacy coin’s price chart, you will notice that it has followed a consistent pattern of peak-crash-recovery every four years. And it is mainly driven by halving events and investor psychology.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

GET STARTED

Crypto investments are risky and may not suit retail investors; you could lose your entire investment.Understand the risks here

Typically, it starts with the halving event, followed by investor hype and speculation which sends Bitcoin and top altcoins to their first season high. Macroeconomic factors then come to play, disrupting what seems like a perfect rally before the eventual explosion pushes it to a new ATH.

This cycle started with halving in 2024, followed by the speculation and hype that led to January 2025 highs. Going by this pattern we currently are at the temporal setback, which will set the foundation for the upcoming explosion.

This happened in 2017 when BTC’s race to $5000 in September, preceded a 35% correction, that set base for the surge to $20k in December.

In 2021, BTC raced to $64k in April preceded 55% correction that paved way for the November rally to $69K.

At the time of writing, BTC is down 29% from January highs.

A growing number of analysts expect the mid-bull-cycle correction to push it to around $70 (36%) before the eventual recovery pushes it above $200k by December.

Key Technical Analysis Supports a Temporary Pullback – Not a Full Bear Market

Despite the recent crypto market crash, many technical indicators suggest that this could be just a temporary correction and not the start of a long-term bear market.

For starters, zooming out the charts shows that Bitcoin all top altcoins suffered correction even in the strongest bull runs.

In 2017 and 2021, for example, Bitcoin and top altcoins faced multiple retracements of between 20% and 60% before the final Bull Run leg up. We have mentioned above that BTC corrected by 35% and 55% in the last two cycles. Currently, BTRC is less than 30% down – which suggest it is still within the normal retracement range.

Further reasons why we think Bitcoin and crypto will recover after the crash

Secondly, after the crypto crash, Bitcoin’s key support levels are still holding. The first is the $78k – $80k major support from January’s peaks.

The second has to be the $72k – $75k, as indicated by Fibonacci 0.618 retracement that most analysts believe will form Bitcoin cycle bottom. And the last is the key psychological level of $69k – last cycle’s all-time high.

Thirdly, Bitcoin’s RSI recently dipped below 40, suggesting the legacy digital asset is oversold and due for a relief bounce back.

Historically, a drop below 40 during a market cycle has paved way for significant rebound.

This already happened in 2021 when it rallied below 40 in line with Bitcoin’s -25% correction before the monster rally in the fourth quarter.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

GET STARTED

Crypto investments are risky and may not suit retail investors; you could lose your entire investment.Understand the risks here

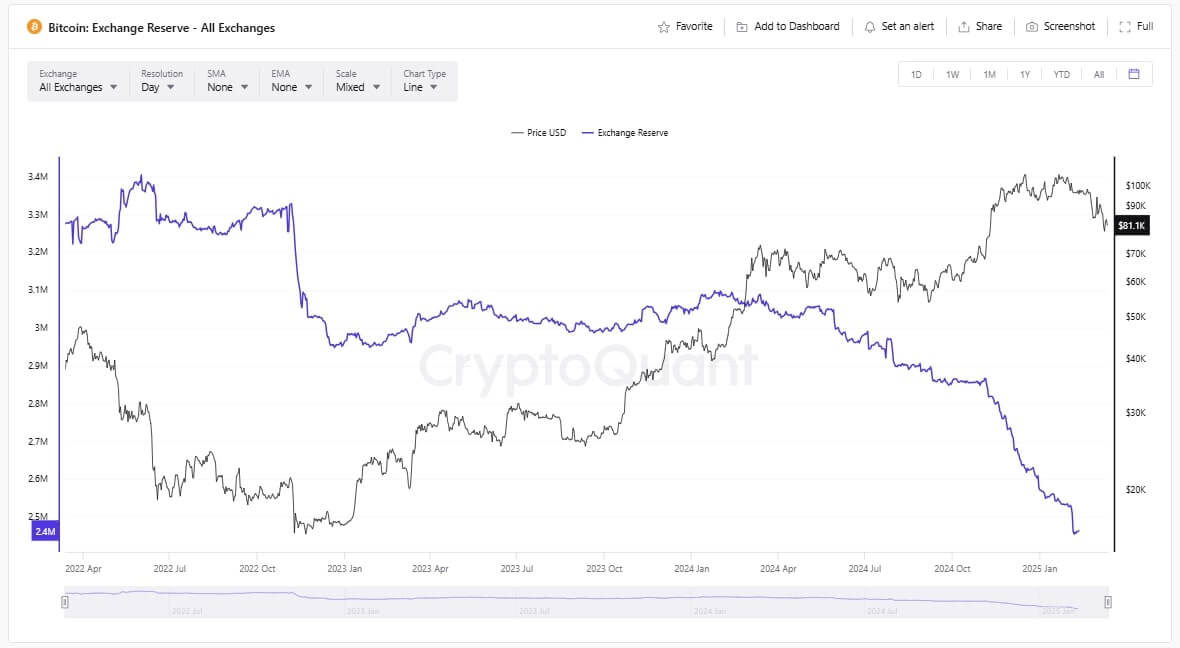

Additionally, on-chain analysis reveals great long-term holder confidence the market.

This is evidenced by the fact that BTC on-chain reserves have fallen to record lows of 2.4 million. Further, whale accumulation has been on the rise with as large holders buy the dip.

The likes of Strategy in the US and Metaplanet in Asia have been at the forefront of whale accumulation.

Lastly, the crypto fear and greed index has also sent out a bullish signal.

It has fallen from extreme greed to (80+) to extreme fear (17) in a matter of weeks. Zooming out again, you will notice that extreme fear has been traditionally been a strong buy signal.

During the mid-bull-cycle correction of June 2021, for example, the index fell to 20 right before Bitcoin’s rally from $30k to 69k. Similarly, it fell to 10 in November 2022 after FTYX collapse, signaling BTC’s bottom – around $15k and sparking a massive rally.

Top Altcoins, Memecoins, and Speculation: How are the Speculative Assets Performing during this crypto market crash?

Unlike Bitcoin and Ethereum, speculative digital assets often experience more extreme volatility during both bull and bear cycles.

They almost always outperform Bitcoin and Ethereum in the race to the top. Similarly, they crash harder than the two top coins during bear markets as well as during the mid-bull-cycle-retraction.

In the current cycle, the macro headwinds and negative on-chain factors have had a massive impact on the prices of these coins. Let us look at how top coins like Ripple, Cardano, Solana, Litecoin, and Dogecoin are reacting to the larger crypto market crash.

Ripple (XRP) – Struggling under regulatory uncertainty (currently crashed down 36%)

Ripple has had both the macro headwinds and regulatory uncertainty to deal with this cycle. Before the crypto market crash, it had rallied to a multi-year high of $3.40. A crypto friendly SEC and the acknowledgement of a Ripple ETF then promised to help fuel its next phase of bull run.

But SEC’s failure to drop the case, declining on-chain activity and the bearish-inclining market have dampened any bullish momentum these would have caused.

Solana (SOL) – One of the Most Promising Coins Faces Brutal Sell Off (Currently down 60%)

Before Solana fell under the spell of brutal sell off, it was the breakout star of the 2024-2025 cycle. It had rallied from $20 to set a new all-time high of $294. Its memecoin printing factory – Pump.Fun – took the industry by storm, sucking liquidity from every other top altcoin.

The altcoin’s fortunes started turning when $4.5 Libra meme coin scandal involving Argentinian President Javier Mile came to light. Since then, further criticism of the project – including a class action lawsuit filed against Pump.Fun in a New York court have only served to drag SOL prices further down.

Cardano (ADA) – One of the Most Resilient Altcoins (Currently crashed down 55%)

Network developments throughout the bear market helped Cardano keep pace with the rest of the industry in the first phase of the crypto market bull run. The rally was given a boost after the SEC acknowledged a Cardano ETF filing. But as the market downturn exacerbated, the ETF buzz fizzled, and ADA started tanking.

Litecoin (LTC) – Fizzling Litecoin ETF Buzz Pushes LTC Below $100 (Currently down 40%)

Litecoin had also promised to be yet another breakout star of the bull market when it rallied from $55 to a cycle top of $134. Much of the uptrend may be attributed to its positive correlation to Bitcoin’s price action. But the acknowledgement of Litecoin ETF filing with the SEC also gave it a boost.

Analysts have particularly opined that it may be the first speculative asset to have its ETF approved due to its structural similarities with Bitcoin. But as the RETF buzz fizzled and macro headwinds fed the bears, LTC was dragged well below $100.

Dogecoin (DOGE) – Top Memecoin Expected to Break Above $1 (Currently down 75%)

Coming into the 2024-2025 bull market most analysts were convinced that Dogecoin would break above $1. It started with a 400%+ price jump that sent it to the cycle top of $0.48 in the first week of December 2024. But as the Solana meme coins took a beating, they took with them investor confidence in the likes of DOGE and SHIB.

Note: Virtually all the speculative coins are still trading within the allowable retracement level of between 20% and 60%.

Does The Crypto Market Crash Mean Now is a Good Time to Invest in Cryptos?

When there is a crypto market crash it raises such serious questions as when will crypto go up. In the short term, inflation fears and potential Bitcoin price drops will likely continue fueling the volatility of most coins.

Over the longer term, however, historical cycles show us that the market will almost always rebound. The theory is reinforced by the growing crypto adoption, potential ETF approvals, Fed rate cuts, and the crypto friendly Trump administration.

Today, therefore, presents a buying opportunity for long term buyers looking to capitalize on the dip.

Our latest crypto alerts – instantly accessible

This is how we are guiding our premium members (log in required):

- The Time Window as of March 14 Should Bring Relief (March 11th)

- Buy The Dip Is Here (March 1st)

- BTC Very Close To Its 200 dma – Chart Looks Constructive (Feb 26th)

- How To Know Whether BTC Will Set A Bottom This Week? (Feb 25th)

- Crypto Markets Showing Strong Signs Of Selling Exhaustion. Buy The Dip?! (Feb 23d)