Crypto markets are indecisive. That’s frustrating. Add to this the ultra volatile nature of this asset class and you get a very dangerous mix of characteristics for investors. A volatile asset that is indecisive is probably the worst possible combination for an investor’s psyche. How to handle this, and how not to handle this type of situation?

Here are a few tips of what (not) to do in this type of situation.

First, zoom out.

What we saw happening this week is most people trying to zoom in into low timeframes. It seems that volatility is inviting to look trends on a very short timeframe. While there is nothing wrong per se with low timeframes it certainly is not the only thing to do, on the contrary.

The more volatile a market the higher the need to combine high timeframes with low timeframes. Both are equally important.

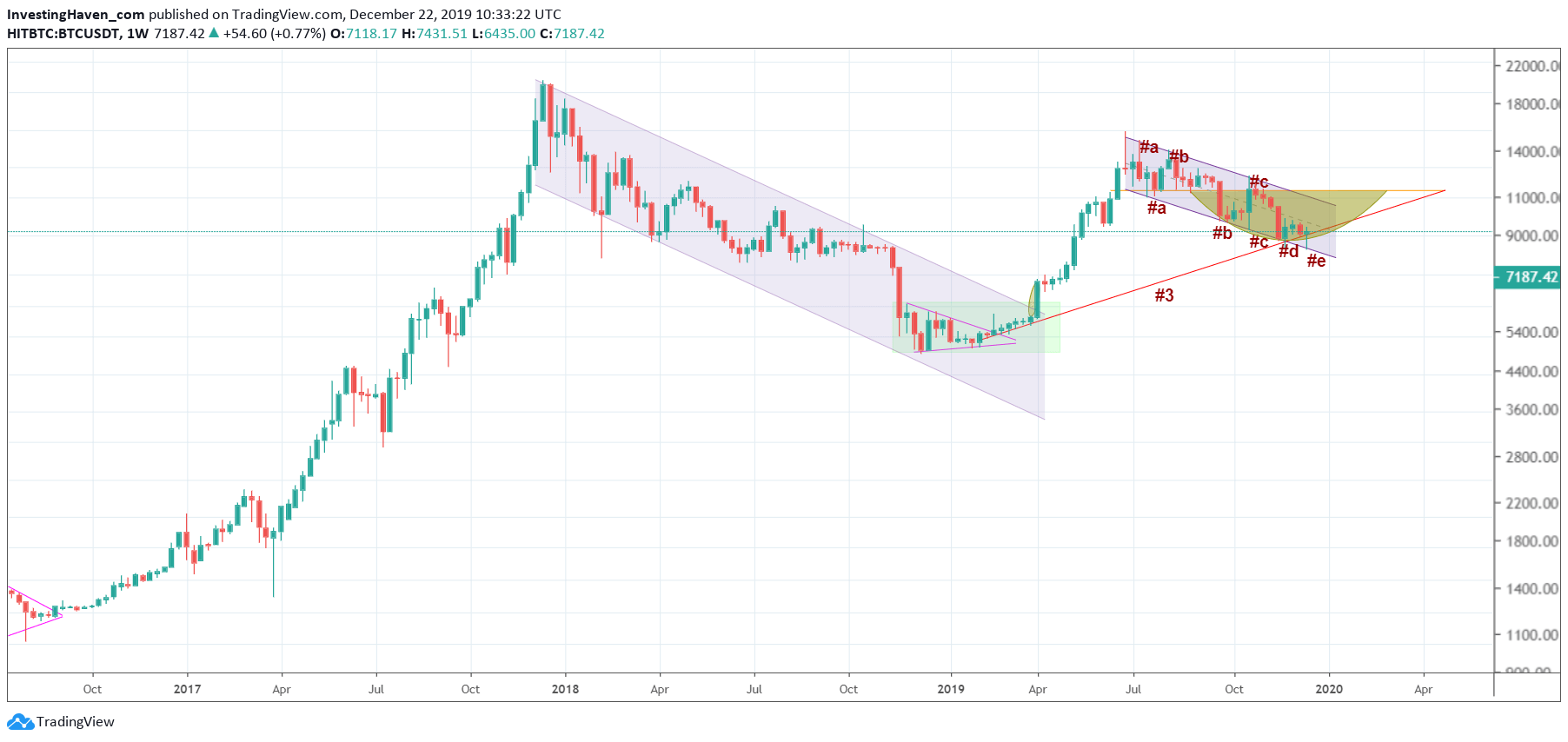

We see that most forgot to zoom out. What happens if we zoom out as shown on the weekly chart below we see that Bitcoi, the leader of the crypo market, is rather indecisive. Its price behavior is very volatile, but range stuck in the $6.6k to $10k area for almost half a year now.

What to do in this type of situation? Give the market the time it needs. Let it sort out what it wants to do. And this brings up the second tip.

Second, listen to the market, don’t talk.

Everyone knows that listening is much more important than talking. Yet, when it comes to making investing decisions, there is a clear desire to talk to markets as opposed to listening very carefully. With talking we mean this: “This market is not doing what I want it to do, so I am going to decide x, y, z.” As if the market cares.

As in every relationship and as in every engagement between parties it all starts with listening very, very carefully. It is wise to prepare a reply (action) based on a thorough understanding. Listening implies looking at multiple chart timeframes, analyzing what other markets are doing, trying to spot trend changes, etc.

Third, don’t look at the wrong sources.

It is so tempting to look up the gurus on social and financial media, especially when a market goes against your position. There is zero point zero value in doing so. Yet, we continuously see this behavior coming back because we want to understand why something is happening. As if there is any valid answer that anyone can formulate. There isn’t. It seems to be natural hum behavior to look up the gurus and social answers … pretty irrelevant when investing in financial markets, especially in crypto markets.

Fourth, don’t forget that news is a lagging indicator.

Somehow related to the previous point but still a point on itself: news is a lagging indicator. In case you find something in the news it is already too late, the market has already acted on it. You want to be faster than the news when investing.

What we do so pot on the charts is a potentially a new reality in crypto markets. One that has not existed in 10 years: an indecisive market. We may see some moves up and down in 2020 without a clear direction. If crypto markets will be range bound between say $6k and $10k it will be THE ultimate test for all investors. Nerves will be wracked, many will sell out of frustration … and once all this frustration has left the market we might see the next upleg.

We continuously cover these topics in our crypto alerts. Never before did we write as much as in the last week. Our premium crypto members clearly appreciated the guidance from our writings and analysis. We will continue to offer this in 2020, and the points in this short article are handled extensively and in-depth in our crypto service.

In the meantime for investors that want to feel the excitement of short to mid term trades we launched Trade Alerts, a premium trading service that delivered 393% in the ‘highly volatile with fast rewards’ category, and 201% in the ‘hardly volatile with steady rewards’ category. It just takes 5 minutes per day to follow our algorithm, and the profits are astonishing. Ultimately these profits can be used to rotate them into crypto once the big bull market continues (after this potentially indecisive period).