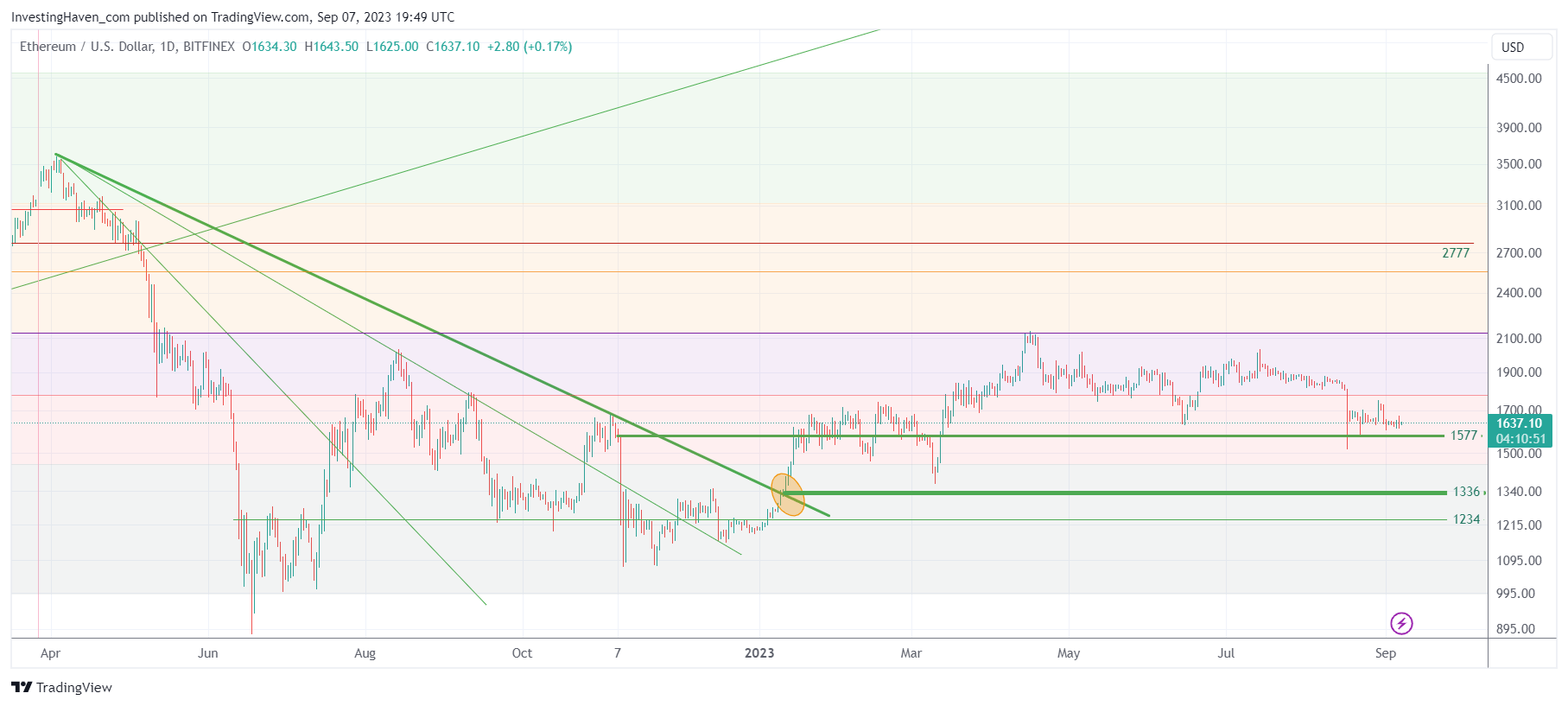

Ethereum (ETH) has captured our attention when we noticed that it was flat: Ethereum longest trendless period in its history. Its price movements (or lack thereof) often reflect broader market sentiments and trends. As of late, Ethereum finds itself in a 6-month consolidation, in the last 4 weeks trading just below a critical 68.2% retracement level. This chart analysis delves into the implications of Ethereum’s current state, considering the overarching macro environment characterized by consolidating broader markets, uncertainty surrounding interest rates, and evolving regulatory landscapes.

Ethereum’s Consolidation Reflects Broader Market Uncertainty

Ethereum’s chart paints a vivid picture of its recent price action. After experiencing significant volatility and price surges, Ethereum now appears to be taking a breather. This period of consolidation is not unique to Ethereum; it mirrors a broader trend observed across various asset classes.

Global financial markets are undergoing a phase of hesitation. Investors are navigating uncertain waters, marked by concerns about inflation, economic recovery, and the ongoing pandemic. In such an environment, assets often consolidate as market participants await clearer signals about future directions. This cautious approach is also evident in the crypto market.

Interest Rates and Cryptocurrency Correlations

One critical factor influencing Ethereum’s current state is the uncertainty surrounding interest rates. Historically, cryptocurrencies like Ethereum have exhibited an inverse correlation with interest rates. When interest rates rise, the appeal of interest-bearing assets grows, often drawing capital away from non-interest-bearing assets like cryptocurrencies.

The recent fluctuations in Ethereum’s price coincide with discussions of rising interest rates by central banks worldwide. The uncertainty surrounding the timing and pace of these rate hikes has introduced an element of caution among crypto investors. Ethereum’s consolidation can be interpreted as a pause while market participants assess the evolving interest rate landscape.

Navigating the Regulatory Landscape

Another dimension of Ethereum’s hesitant consolidation is the evolving regulatory environment. Cryptocurrencies operate in a legal gray area in many jurisdictions. Governments and regulators are increasingly focusing on the need to establish clear frameworks for crypto assets, including Ethereum.

This regulatory scrutiny can create uncertainty and volatility in the crypto market. Ethereum’s consolidation may reflect the market’s response to regulatory developments and its anticipation of potential changes in how cryptocurrencies are treated.

Ethereum’s Chart Analysis

Turning our attention back to Ethereum’s chart, the 68.2% retracement level (fine red line on below chart) serves as a key focal point. While consolidation can sometimes be interpreted as a precursor to a bullish breakout, the hesitant nature of Ethereum’s current positioning warrants a cautious outlook. The crypto market appears to be in a “wait-and-see” mode, with traders and investors monitoring external factors like interest rates and regulatory changes.

In such circumstances, chart patterns can provide valuable insights. Ethereum’s consolidation below the 68.2% retracement level suggests that the market is undecided about its next move. It’s important to recognize that while Ethereum remains in this phase, it is also gathering strength and support at this level. The consolidation could serve as a solid foundation for a potential upward push, should external factors align favorably.

Conclusion

Ethereum’s current consolidation below the 68.2% retracement level is indicative of the broader market’s uncertainty amidst consolidating global markets, interest rate fluctuations, and evolving regulatory landscapes. While this setup may appear hesitant, it also signifies a period of gathering strength and preparation.

Investors in Ethereum and other cryptocurrencies should remain vigilant and adaptable, ready to respond to changing market dynamics. As the macro environment clarifies and Ethereum’s chart develops further, opportunities may arise for those who can decipher the signals amidst the hesitancy. The crypto world, as always, promises both challenges and rewards for those who navigate it wisely.

In tomorrow’s crypto alert, we will explain why September 9th, 2023, is an important date for the crypto market, based on an invisible sign on Bitcoin’s chart. Premium crypto members will receive this alert early in the morning, we don’t publish any of these deeper insights in the public domain in order to respect the value of our premium membership.