Ethereum has seen over $1 billion in ETF inflows in a single day, lifting the price toward the $4,800 mark, while Standard Chartered now expects ETH to reach $7,500 by year-end.

Ethereum nears its November 2021 all-time high of $4,891 as spot ETFs deliver massive inflows and institutional appetite accelerates. Can this wave of demand and capital push ETH past that threshold and sustain further gains before year’s end?

Current Momentum & Short-Term Outlook

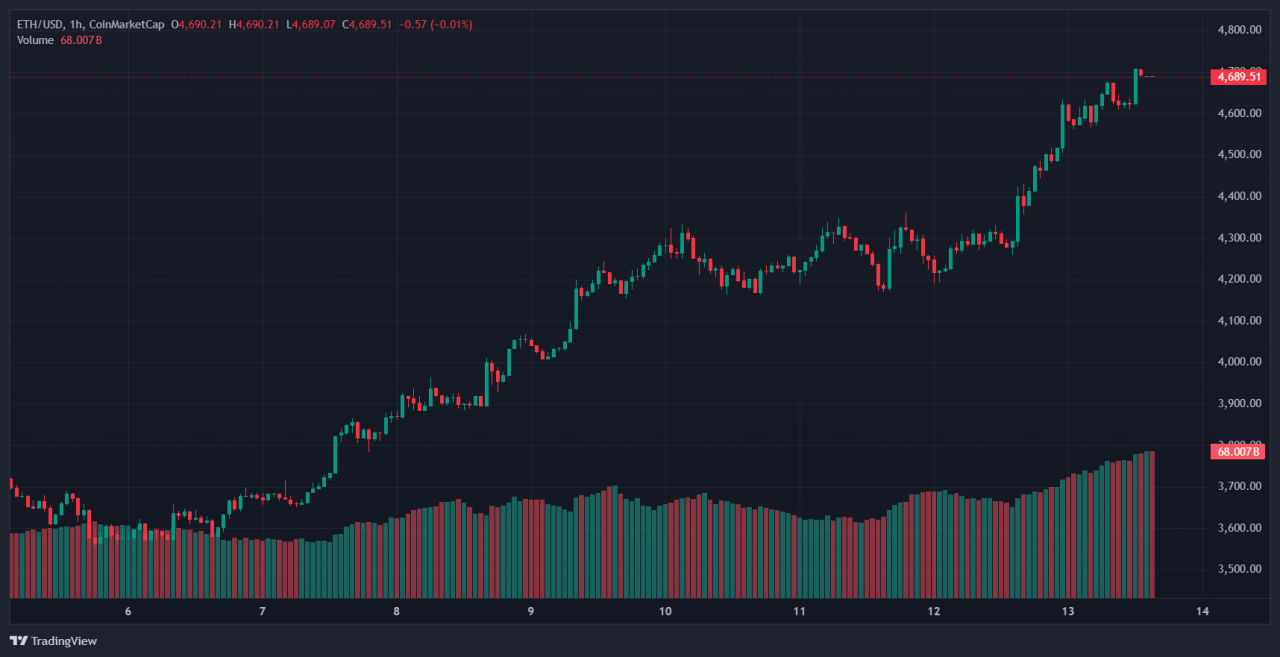

Ethereum’s price climbed above $4,700 on 13th August 2025, sustained by a record-setting $1 billion in daily ETF inflows led by BlackRock ($640 million), Fidelity ($270 million), and Grayscale ($80 million).

At the same time, large-scale players such as BitMine and SharpLink Gaming have ramped up their ETH holdings, strengthening demand . Technical analysis shows ETH broke multi-year resistance near $4,000 and now tests the $4,800 ceiling. If buyers hold these levels, the asset could rally toward $5,000 or more in the near term.

RECOMMENDED: Best Crypto To Buy For Short Term: Ethereum Shows Clear Upside Potential

Medium-Term Growth Catalysts & ETH Price Predictions

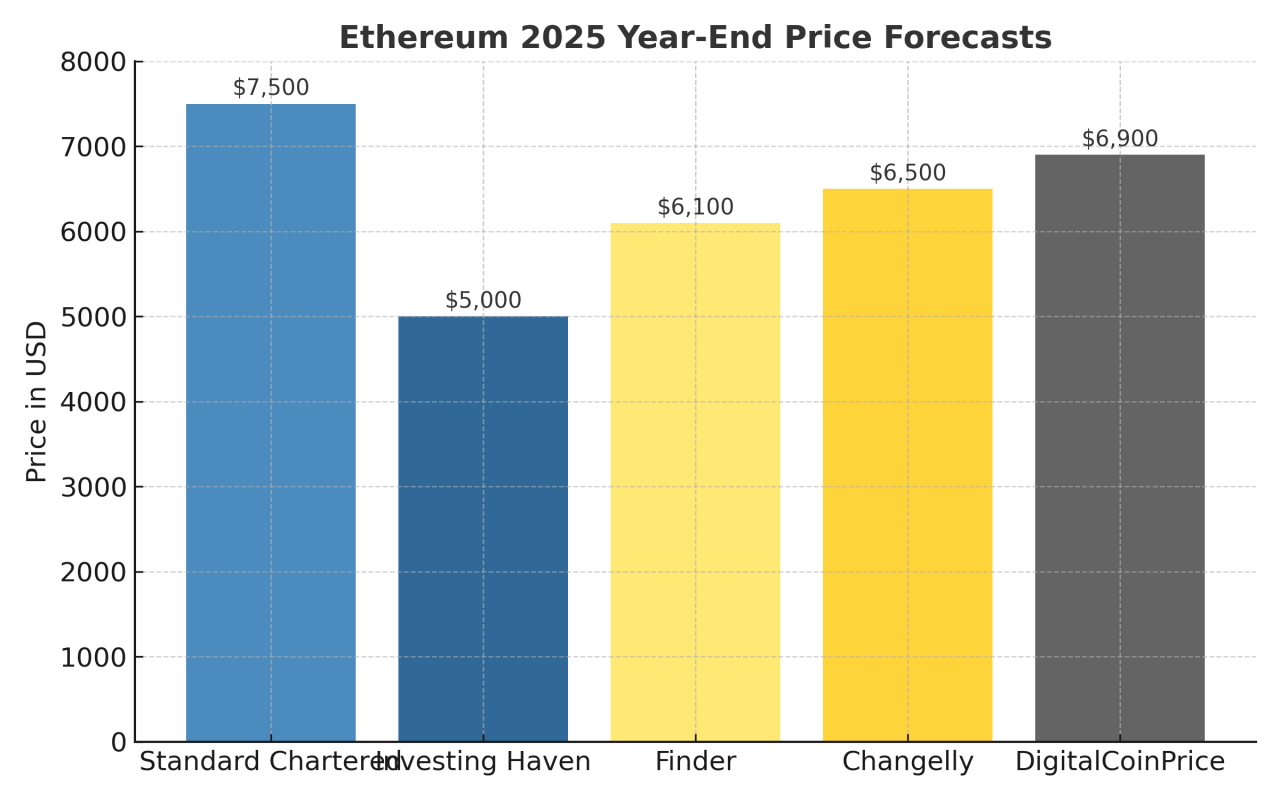

Standard Chartered raised its 2025 year-end forecast to $7,500, citing regulatory progress, ETF approval momentum, and surging demand for applications tied to stablecoins and Layer 1 usage.

Investing Haven’s Ethereum price predictions see ETH reaching $5,000 or more by the end of 2025 amid improving macro signals and institutional adoption.

Alternative projections include Finder expecting over $6,100 in 2025, Changelly suggesting potential highs of $6,500 or more, and DigitalCoinPrice forecasting peaks near $6,900.

These forecasts hinge on continued capital flows, demand from DeFi and staking, and favorable regulation.

RECOMMENDED: How to Buy Ethereum (ETH) in 2025: A Step-by-Step Guide for Beginners

Bullish Scenarios & Risks

If Ethereum ETF inflows remain strong and institutional activity continues to ramp, ETH may breach $4,800 and extend to $5,000–$6,000. Momentum could even support a run toward Standard Chartered’s $7,500 forecast.

However, elevated technical indicators risk short-term pullbacks, and any macroeconomic shocks or regulatory uncertainties could halt the rally.

Conclusion

Ethereum stands within reach of its all-time high. With ETF inflows and institutional demand powering it, ETH may clear $4,800 and target new highs—but it must navigate volatility and macro risks first.

Don’t Miss the Next Big Move – Access Alerts Instantly

Join the original blockchain-investing research service — live since 2017. Our alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience. You’re following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

Read more about our premium blockchain investing service here

This is how we are guiding our premium members (log in required):

- Crypto Shows More Resilience Than Expected. A Bullish Impulse May Be Underway. (Aug 9th)

- Prepare To Buy The Dip In Crypto (Aug 2nd)

- Alt Season 2025 – Progress Update (July 26th)

- This Is What Bullish Basing Patterns Look Like (Hint: Alt Season Starting) (July 20th)

- Is Alt Season 2025 Here? (July 15th)

- Alts Breakout Happening Now. These Are Price Time Combinations To Watch. (July 11th)