It is a while ago that we covered an individual stock, certainly a blockchain and crypto oriented stock. In this article we look at one of the few blockchain stocks that survived all major boom and busts in recent years. The fact that it has not only survived but also thrived, as one of the few blockchain and crypto stocks, is telling. Our best forecast is that whenever crypto resumes its bull market, at whatever point in time in the future, Galaxy Digital Holdings should be in a pole position given the impressive growth that this company has achieved over the years.

Galaxy Digital Holdings, $GLXY on the TSX and $BRPHF on the OTC market (for now), was founded by Wall street veteran Mike Novogratz. The company first started trading on the TSXV in January 2018, in the midst of the bear market. Not the best time for a Crypto merchant bank to IPO but fast forward to today and it’s a success story. The fact that Galaxy digital survived and thrived after such a difficult start is a testament to how strong both the vision and the people behind the wheel are.

You can probably tell by now that I am a $GLXY bull, however, this article is meant to be an objective assessment of Galaxy digital holdings. As discussed with other $GLXY investors on twitter, we want to cover both the Bullish and the Bearish scenarios (risks) that could arise. I also want to cover Galaxy digital’s impressive journey to date, a success story.

Galaxy Digital Holdings: What exactly do they do? Which problem are they solving?

This technology-driven financial services and investment firm focuses on Cryptocurrency, Blockchain Technology and digital assets. The company has 5 business lines:

- Asset management

- Trading: OTC Spot, On exchange, OTC options & derivatives and bespoke SMAs.

- Investment banking: Financial and strategic advisory for the Cryptoeconomy.

- Mining

- Principal investments

The problem they are solving is one that most financial institutions have been facing especially since 2017. Clients are looking for extraordinary returns of their portfolios to complement the “traditional asset classes”, comparing them to the average Crypto investor and asking their advisors: “How can I buy Bitcoin? I need to invest or trade Cryptocurrencies?”

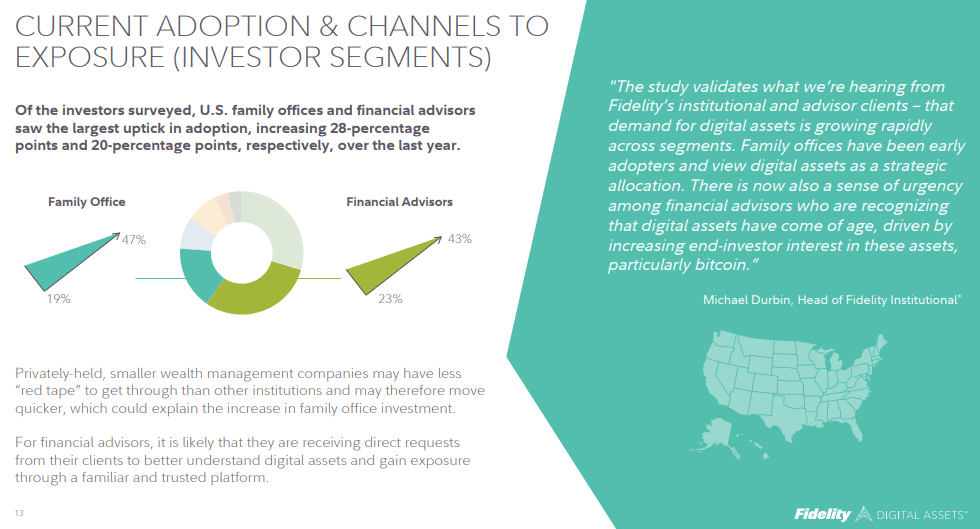

This study published by Fidelity in September 2021 shows how strong the appetite for digital assets is amongst institutional investors. 70% of the respondents were interested in investing in digital assets. I highly recommend reading the study to get the full picture.

This slide below shows the strong uptick in interest from family offices and financial institutions. This is exactly who Galaxy digital is targeting through their financial advisory services.

Galaxy Digital is the bridge between traditional financial institutions and Crypto markets

As more financial institutions and private clients are looking for exposure to this new market, Galaxy is offering specialized knowledge and infrastructure about the Cryptocurrency market, digital assets and the blockchain technology sector. So in this gold rush, $GLXY is selling the shovels, tents and pickaxes to both financial institutions and high net worth investors looking to gain exposure to the Cryptocurrency market.

The company is also very innovative in the way they offer that access. A good example is when $GLXY facilitated its first OTC crypto transaction with Goldman Sachs as a bitcoin non-deliverable option. Huge step towards bringing Crypto assets towards institutional investors in a format they are familiar with. This however, is just one facet of what they offer and their operations. The vision is to become a one-stop shop for crypto infrastructure.

Galaxy Digital Holdings: A story of Growth and Resilience

Resilience since Galaxy Digital is one of the very few companies that IPO’ed during a Crypto bear market and even fewer to survive. They also managed to identify and invest during the bear market in what would be strong players in the upcoming Crypto bull market. Between 2018 and 2019, they had already invested in Bitfury , Bakkt, BitGo to name a few.

As for growth, its story is best told through numbers. But numbers could be very subjective when taken out of contest, something financial media excels at when they come up with sensational headlines like “Galaxy digital, $300M losses this quarter” while ignoring the overall performance to date.

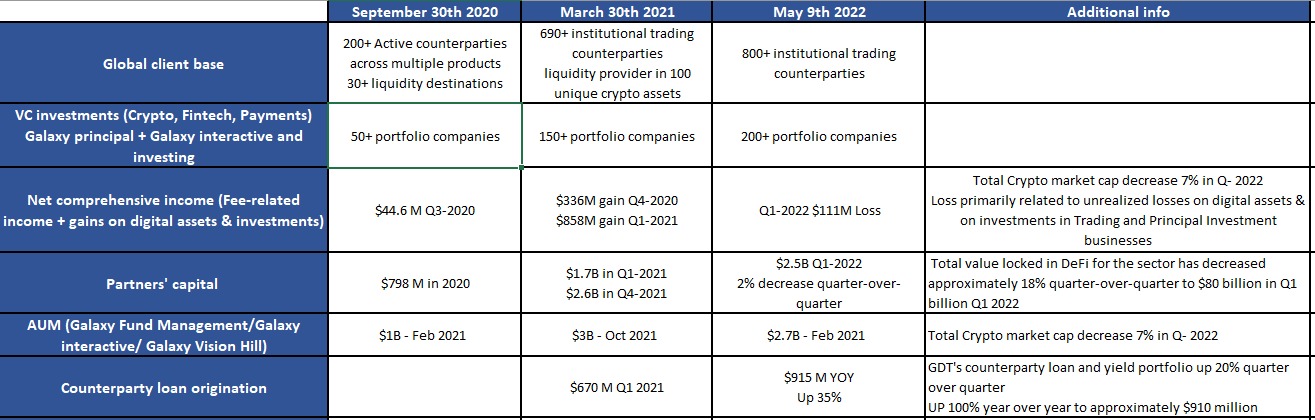

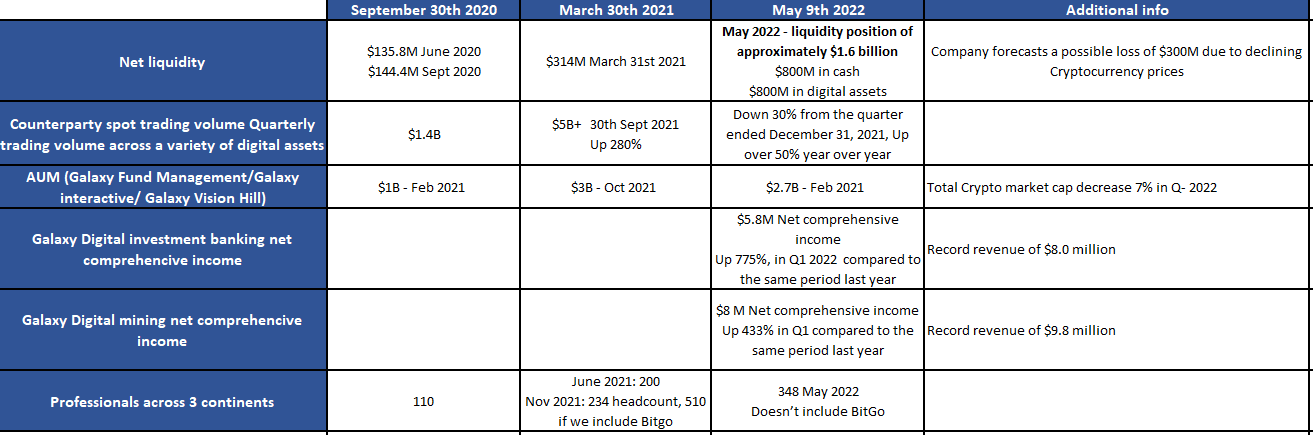

Hence why we compiled the document below. It includes figures compiled from all 3 investors presentations, PRs and filings. Hopefully, it provides investors with a decent view of Galaxy Digital’s impressive growth story.

Let’s look at the net liquidity for instance:

You probably saw the headlines and how Galaxy is bracing for a $300M loss. Sounds like a substantial amount, but here is another way to look at it:

- GLXY’s net liquidity in March 2021 was $300M

- GLXY’s net liquidity in May 2022 was of $1.6B ($800M in cash, $800M in digital assets).

The $300M decline that the company is bracing for in the equivalent of their net liquidity in March 2021. Yet, by the end of March 2021, $GLXY was trading around $30 CAD. Now $GLXY is sitting on $1.6B (50% of it in cash) and trading at $7.4 CAD at the time of writing.

May 2021, Galaxy announced the acquisition of Vision Hill Group, an asset manager and data shop. They develop market intelligence products (hedge fund indices and Vision-track, a buy-side database for institutional clientele). I believe this is an acquisition that investors want to keep an eye on as it is making tremendous progress and seem to have a very innovative way in operating.

Their AUM more than doubled between the 31st of October 2021 and the 31st of May 2022. The value initially at $59M reached $129M in 7 months. The strong demand in the sector for how to optimally allocate capital in the new digital asset class, Galaxy’s strong ties to wall street and Vision Hills’ potential for innovation leads us to think that the future revenue generation will be substantial. Read more about what vision-track is here.

Galaxy Digital Holdings: The bearish cases & risks

Let’s start with the elephant in the room, the impact of the very unfortunate situation with Luna. And the tattoo… For some reason, financial media was so focused on the Tattoo! By the way, Novo also has a Bitcoin tattoo but nobody is talking about that one! $GLXY’s first invested in Cryptocurrency / Blockchain in 2013. Since then the price skyrocketed, which probably led to this celebratory Tattoo. Same for Luna. $GLXY was an early investor, the price went up multifold and we know Novo likes Tattoos. End of story.

Why should investors care about how a CEO is celebrating his success? This is a company that is literally shaping the future of investing for financial institutions. They are busy building a comprehensive platform offering institutional investors and their clients access and advisory to gain exposure to this booming digital economy. Why are so many stuck on a Tattoo? As investors, we absolutely need to remain factual. Making decisions based on sensational media stories, drama or click baits is never a winning strategy.

This is my take on the unfortunate situation: The way $GLXY handled the investment in Luna, if anything, shows how seasoned the team is. They bought in early, let the trade ride, took profits and managed risk. If you look into the company’s filings, they mention that by March 31st 2022, sales of Luna were the largest contributor to the net realized gain on digital assets of $335M, “MD&A March 31st P -18”. You can find more details in this tweet here.

The next points that came up were the declining AUM in 2022 and that the company is “trading and VC heavy, and a lack of steady cash flow.”

The declining AUM is a major part of being invested in a volatile asset class. There is no avoiding that. However, we need to consider the focus of the company on revenue generation from the mining and investment banking divisions. Both have shown solid increases in Q1 2022 and compensated for some of the losses from segments that were hit by the decline in the cryptocurrency market cap.

Galaxy Digital Mining net comprehensive income was up 433% by Q1 2022. This segment of Galaxy digital holdings carries mining operations focused on BTC in addition to providing north American miners with proprietary financial tools, mining operations and resale. The goal is to be (again) the 1 stop shop for mining financial services and a hub for Crypto mining in North America. This approach is another way for $GLXY to diversify income streams and reduce the impact of a Bear market in crypto. A bear market is another major risk for Crypto related operations but the company is well capitalized and has survived a previous one during its early days.

Quick facts about GDM mining operations:

- Based on forward purchase commitments, GDM expects to achieve just under 2000 petahash per second (PH/s) of mining capacity and monthly deliveries till end of 2022.

- Glxy mines $BTC at >80% discount to fait value when BTC trades above $57k.

- Hash rate expected to reach 1% of today’s Bitcoin mining network (expected by year end 2022 based on existing hash rate and outstanding orders.

- $10k cost to mine 1 Bitcoin.

As for the trading and VC heavy, and a lack of steady cash flow

The increase in income mining and investment banking should help with the steady cash flow especially considering the cash at hand. The company seems to be evolving from being dependent on trading and crypto appreciation to increasing revenue generation from the other segments. The trading part is a plus in my opinion as you have veterans from major financial institutions managing the portfolio and the numbers speak for themselves here.

Concerning the risk involved in trading this new asset class and VC investing, the company has a strong focus on both parts of the due diligence and their 2 folds approach: Investment due diligence and operational due diligence and how they tailored it to digital assets. You can find more details in Scott Army’s interview. He is the managing director & CIO Galaxy Vision Hill.

Galaxy digital has a solid balance sheet and expertise that should help weather a potential bear market in Crypto.

However, the major risks Galaxy could face and that investors should keep an eye on are the following:

- An unfavorable regulatory environment.

- Delays in the domestication process that could further delay the BitGo closing (Current ETA between Q2 and Q4 2022).

- A reverse termination fee of $100 million payable to BitGo if the transaction has not been completed by December 31, 2022.

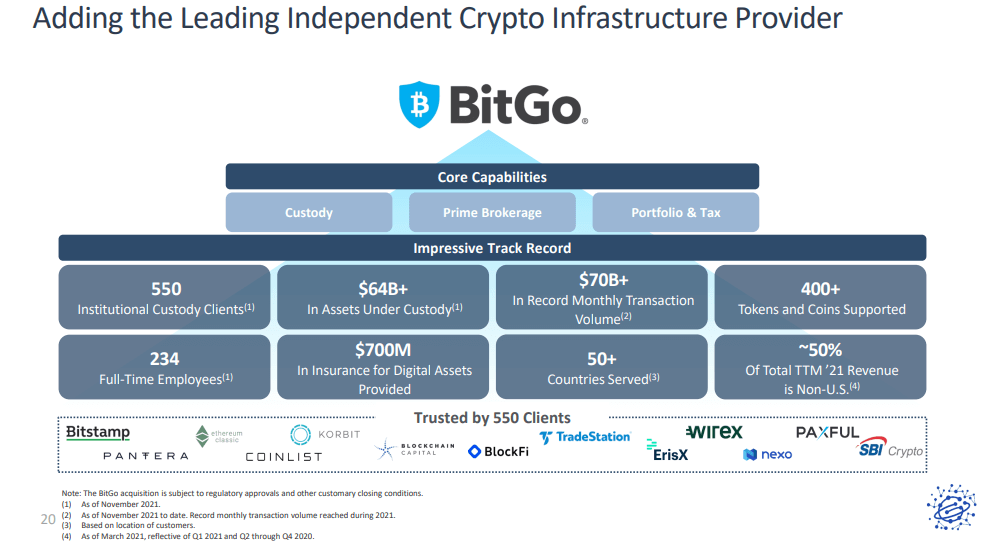

What Does Galaxy digital Gain From the Bitgo acquisition?

During my conversations with GLXY stock holders, I heard multiple times concerns regarding the dilution from the new stocks issued to acquire BitGo. To assess this risk, let’s look at the structure of the deal and also how the BitGo acquisition adds value to $GLXY shareholders.

- May 2021 Initial deal to acquire BitGo: 33.8 million in newly issued Galaxy shares + an additional $265 million in cash.

- April 2022 Amended acquisition deal: 44.8 million newly issued shares + $265 million in cash. An increase of 2% in the share count for a total of 12% increase of combined company shares Versus the initial 10%.

⇒ 11M additional newly issued shares in the new deal

- May 2022 Galaxy digital announces a 10% share buyback approval of up to 10% of its public float starting May 18th 2022. The company already started buying back at time of writing.

- GLXY current public float: 109.45M share

10% buy back = 10,945,000 shares

⇒11M share buyback if we round the number

Next, we assess the value BitGo’s acquisitions adds to Galaxy Digital Holdings

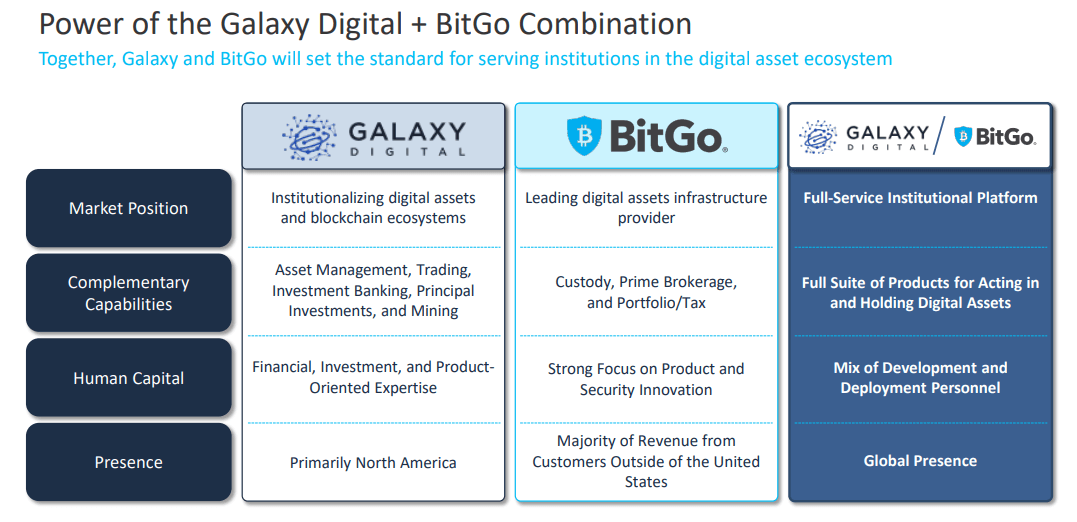

This is what BitGo brings to the table

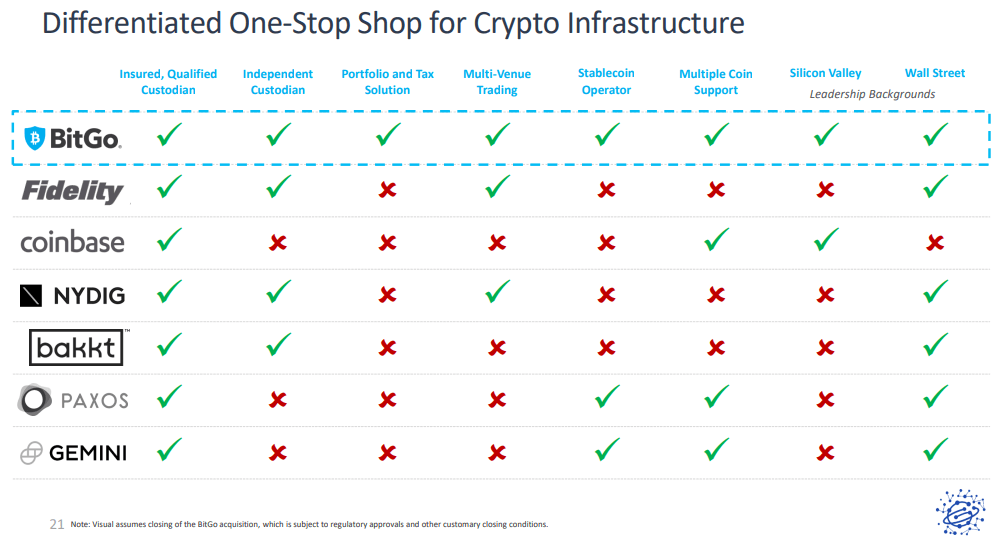

This is how it compares to competition

And this is what the integration of BitGo into Galaxy Digital will look like

There is no doubt that the BitGo merger will strengthen Galaxy’s position as the first full-service digital asset financial platform for institutions and provide a huge competitive edge. It takes a long time to build such specialised niche teams, develop and retain all that talent through compensation and interesting projects to contribute to. BitGo was behind Wrapped Bitcoin, Wrapped Ether and continues to be an innovator and a leader in the institutional digital asset custody, trading, and finance. I can’t wait to see what’s next when these two form one solid Tech and innovation driven financial services platform.

Galaxy Digital Holdings: The bullish case

The Bullish case for Galaxy is pretty clear. We have an innovative, well connected, well capitalized, well managed company in a booming sector. Galaxy provides the tools, expertise and solutions so financial institutions can have access to this new asset class.

They are well positioned to capture new business in North America and have offices in Europe and Asia.

Their VC portfolio is impressive and the company is still expanding it while maintaining a strong focus on due diligence.

The closing and merging with BitGo will make Galaxy Digital Holdings a true one-stop shop for Crypto infrastructure. As we saw above, even Coinbase and fidelity do not come close. That’s a significant competitive edge. The uplisting to Nasdaq should bring the trading volume $GLXY needs for the next leg higher.

For those who believe that the Cryptoeconomy and digital assets are here to stay, GLXY seems to be a top bet on the future of this asset class. The stock price is currently trading at 2020 levels while the company is miles ahead of what it was back then.

Disclosure: hdcharting holds shares of GLXY.