The UK requires crypto firms to register with the Financial Conduct Authority for anti-money-laundering (AML) supervision. Registration does not mean the FCA guarantees crypto investments. It means the firm follows UK AML rules, runs KYC checks, and submits to oversight.

For UK users, choosing a registered platform lowers regulatory uncertainty and makes it easier to verify a firm’s legal status. This article lists 10 FCA-approved crypto exchanges, covering fees, payment methods, pros, cons and more.

Let’s dive right in.

List Of Exchanges That Are FCA-Approved In The UK

| Exchange | FCA Status | Fee Style | Best For | Payment Method |

| eToro | FCA authorised / registered. | Spread + trading fees | Beginners, social trading | Faster Payments, card, e-wallets |

| Coinbase | VASP registered Feb 2025. | Variable trading fees | Retail traders | GBP bank transfer, card, PayPal. |

| Kraken | Registered crypto firm, e-money approval. | Maker/taker fees | Active traders, pro users | Bank transfer, SWIFT, cards. |

| Crypto.com | FCA-registered cryptoasset firm. | Variable fees, spreads | App users, rewards seekers | Card, bank transfer. |

| Gemini | Registered for crypto activities | Spread + fees | Security-focused traders | Bank transfer, card. |

| Bitstamp | UK cryptoasset registration. | Maker/taker fees | Low-fee spot trading | Bank transfer, card. |

| Uphold | Registered for AML purposes. | Spread + fees | Multi-asset users | Bank transfer, cards. |

| CoinJar | FCA-registered UK entity. | Flat fees + spreads | Simple buy/sell | Faster Payments, card. |

| Revolut | UK-regulated group, crypto services available. | Subscription or markups | App-first banking users | Bank transfer, card. |

| Bitpanda | Active UK expansion and registration steps | Variable fees | European users entering UK | Bank transfer, card. |

RELATED: Which Crypto Brokers Are Safe In The USA

1. eToro

eToro (UK) Ltd is a fully regulated UK entity listed on the FCA register. It offers one of the most beginner-friendly trading experiences in the market. The platform combines social trading – where users can copy the moves of experienced investors – with a clean, intuitive app.

eToro focuses on simplicity, making it ideal for first-time crypto buyers. It offers a small selection of major cryptocurrencies and integrates eToro Money, an FCA-regulated e-money service that separates payment processing from trading.

For UK users, eToro’s transparency, FCA oversight, and easy interface make it a trusted choice for basic crypto exposure.

Pros

- FCA-registered and fully compliant in the UK.

- Simple app with social and copy-trading features.

- Integrated e-money arm for seamless fiat deposits.

Cons

- Limited crypto selection.

- Fees included in spreads, which can widen in volatile markets.

Who It Is Best For

Beginners who want straightforward crypto exposure and social features through an app-first experience.

eToro Fees

eToro charges spreads on crypto trades, with possible extra fees for cards or instant payments. Check eToro’s UK fee page for details.

Payment Methods

Supports Faster Payments, debit/credit cards, and e-wallets via eToro Money UK Ltd.

RECOMMENDED: eToro Review 2025: Is It Safe, Legit & Worth It?

2. Coinbase

Coinbase secured VASP registration from the FCA in February 2025, strengthening its compliance and presence in the UK. It serves both new and intermediate traders with a simple, trusted interface and a large catalog of coins.

Coinbase is known for its transparency, public audits of reserves in some markets, and reliable fiat support. VASP registration improves GBP deposits and withdrawals via local bank rails, making Coinbase one of the best crypto exchanges in the UK.

Pros

- FCA-registered VASP status ensures compliance.

- Large token selection and global reputation.

- Excellent user interface and customer experience.

Cons

- Higher fees than some exchanges.

- Some features vary across regions.

Who It Is Best For

Everyday users looking for a safe, easy, and well-known on-ramp with wide crypto coverage.

Coinbase Fees

Coinbase charges variable spreads and transaction fees. GBP bank transfers are usually the most cost-effective method. Check Coinbase’s UK fee schedule for current rates.

Payment Methods

Supports GBP bank transfers, debit/credit cards, and sometimes PayPal. VASP registration covers both fiat and crypto services for UK users.

RECOMMENDED: Coinbase Enters S&P 500 – Is This Wall Street’s Crypto Turning Point?

3. Kraken

Kraken is a UK-registered crypto firm with additional FCA e-money approval for some local operations. Known for its focus on security and reliability, Kraken caters to both retail and professional traders. It offers extensive spot markets, advanced order types, and volume-based fees, along with some derivatives available outside the UK.

Its strong security record, institutional-grade custody, and transparent fee model make Kraken ideal for serious traders. The platform’s recent e-money approval has improved GBP payment processing, enabling smoother deposits and withdrawals for high-volume users.

Pros

- FCA-registered with e-money approval in the UK.

- Competitive maker/taker fees for high-volume traders.

- Advanced order options and secure custody.

Cons

- Complex for beginners.

- Certain features restricted by region.

Who It Is Best For

Active or professional traders who want deep liquidity, low fees, and strong security.

Kraken Fees

Kraken Uses maker/taker tiers that decrease with trading volume. Fiat transfers generally come with low banking costs.

Payment Methods

Supports GBP bank transfers, SWIFT, and cards where available.

4. Crypto.com

Crypto.com is a UK-registered cryptoasset business with the FCA and also holds an electronic money institution (EMI) licence, giving it strong regulatory coverage in the UK. The platform takes an app-first approach, offering a wide selection of tokens, an intuitive interface, and consumer-friendly features such as a prepaid crypto card available in select markets.

The EMI licence allows Crypto.com to handle GBP deposits and withdrawals efficiently, improving its fiat payment rails. Its integrated rewards, staking, and payment options make it appealing to users who want to trade, earn, and spend their crypto in one ecosystem.

Pros

- FCA registration signals strong UK compliance.

- EMI licence improves fiat and payment handling.

- Broad token selection and versatile app features.

Cons

- Fee system can be complex to follow.

- Advanced trading tools lag behind pro exchanges.

Who It Is Best For

App-first retail users who want easy fiat access, spendable crypto, and integrated reward features.

Crypto.com Fees

Crypto.com applies variable fees and spreads based on tier and product. Check the UK fee page for updated rates.

Payment Methods

Supports GBP bank transfers (Faster Payments), debit/credit cards, and in-app options through its EMI framework. Some card methods may include extra charges.

5. Gemini

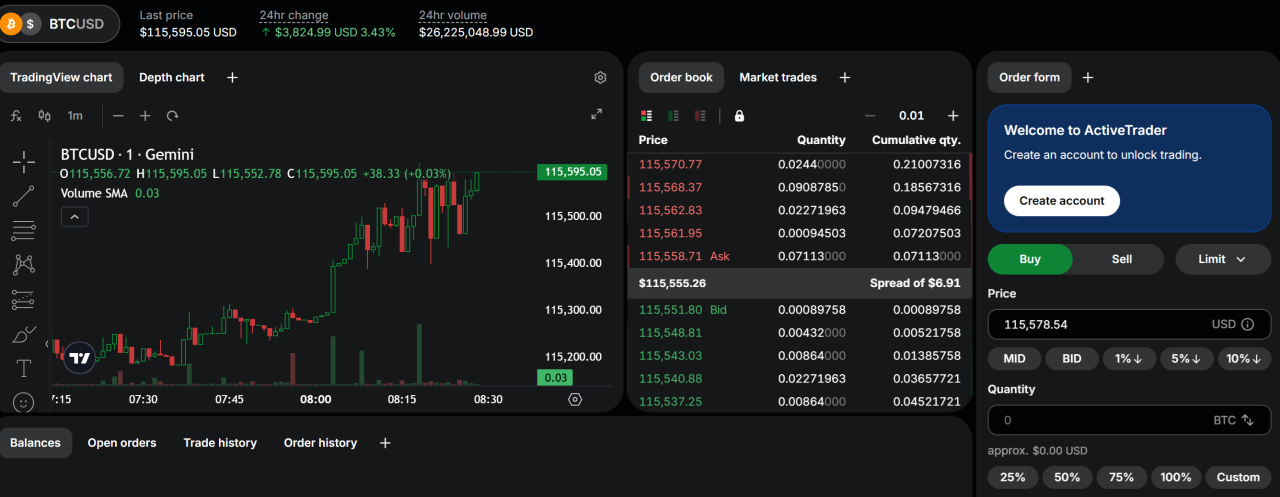

Gemini operates through a UK-registered entity listed on the FCA’s cryptoasset register. The exchange is known for its focus on security, compliance, and transparency. It offers two main interfaces: a simple retail app and a professional-grade ActiveTrader platform.

Gemini’s regulatory clarity and commitment to AML standards make it one of the safest crypto exchanges in the UK. The company also provides insurance coverage and custody protection for certain assets in select markets, appealing to those who prioritise trust and asset safety over low fees.

Pros

- Fully registered with the FCA.

- Strong emphasis on security and regulated custody.

- Choice between basic and advanced trading platforms.

Cons

- Fees can be higher than low-cost exchanges.

- Not ideal for high-frequency traders seeking minimal spreads.

Who It Is Best For

Security-focused retail and intermediate users who value regulatory protection and transparent operations.

Gemini Fees

Gemini uses spreads and tiered fees across its retail and ActiveTrader platforms. Check Gemini’s UK fee section for current pricing.

Payment Methods

Supports GBP bank transfers, debit/credit cards, and other local rails. UK registration ensures smoother fiat processing and AML compliance.

6. Bitstamp

Bitstamp is one of the oldest operating crypto exchanges and holds UK cryptoasset registration under the FCA. It focuses on straightforward spot trading, offering a clear maker/taker fee model and strong liquidity.

Known for its reliability and simplicity, Bitstamp provides an efficient trading environment for users who prefer transparency over complex features. UK clients can access GBP bank transfers via local payment rails, making deposits and withdrawals smooth and low-cost.

Its focus on trust and long-term operation makes it a solid choice for users seeking stability.

Pros

- FCA-registered with transparent UK operations.

- Clear, low maker/taker fee structure.

- Proven track record and strong liquidity.

Cons

- No derivatives or advanced products in the UK.

- Lacks consumer rewards and card-based perks.

Who It Is Best For

Spot traders who prefer a simple, dependable platform with transparent pricing.

Bitstamp Fees

Maker/taker fees drop as trading volume increases. Bank transfers may incur standard banking fees. See Bitstamp’s UK fee page for details.

Payment Methods

Accepts GBP bank transfers via Faster Payments, SWIFT for international users, and card purchases with higher fees.

RELATED: 10 Best Crypto Exchanges Or Apps in 2025

7. Uphold

Uphold Europe Limited appears on the FCA register for AML supervision and cryptoasset operations in the UK. The platform supports multi-asset trading, allowing users to move seamlessly between crypto, fiat, and commodities from a single account. Uphold’s main appeal is its simple conversion tools and the ability to manage different asset types together.

The platform also offers card-linked features in some regions, enabling users to spend crypto directly. Uphold publishes clear risk disclosures, reminding customers that crypto remains unregulated and not covered by FSCS protection. For those seeking a single hub for digital and traditional assets, Uphold offers a convenient, FCA-registered option.

Pros

- FCA registration and transparent risk disclosures.

- Multi-asset support: crypto, fiat, and commodities.

- Fast and easy conversions between assets.

Cons

- Crypto investments not covered by FSCS.

- Conversion spreads can be higher than on exchanges.

Who It Is Best For

Everyday users who want an easy, all-in-one account for crypto, fiat, and other assets.

Uphold Fees

Uses spreads and conversion fees, which vary by asset pair and method. See Uphold’s UK fee disclosures for current rates.

Payment Methods

Accepts GBP bank transfers, debit/credit cards, and supports instant internal transfers between assets.

8. CoinJar

CoinJar UK Limited is listed on the FCA cryptoasset register and serves as a simple, UK-focused exchange. Founded in 2013, it offers an easy-to-use app for retail buyers and a separate professional trading platform for advanced users.

The exchange supports around 60+ cryptocurrencies, with GBP deposits via Faster Payments for quick access.

CoinJar makes crypto buying straightforward but holdings are not FSCS protected. It’s ideal for beginners who want fast, simple trades and a platform that’s both local and reliable.

Pros

- FCA-registered UK entity.

- User-friendly app and professional exchange options.

- Local GBP deposits via Faster Payments.

Cons

- Instant buy fees higher than order-book trades.

- No FSCS protection for crypto holdings.

Who It Is Best For

Beginners and casual traders who want a clean, simple app and quick GBP deposits.

CoinJar Fees

Instant buys include convenience fees, while order-book trading uses maker/taker pricing with lower costs. Check CoinJar’s UK fee page for details.

Payment Methods

Supports Faster Payments, debit/credit cards, and CoinJar-to-CoinJar transfers.

9. Revolut

Revolut Ltd is listed on the FCA register and combines banking and crypto trading within one app. It lets users buy, sell, and hold a wide range of cryptocurrencies alongside their everyday accounts. Revolut is registered for AML supervision and clearly states that crypto remains unregulated and not FSCS protected.

The platform uses tiered plans that affect fees, limits, and perks. For users who already bank with Revolut, adding crypto is seamless and keeps all activity in one familiar app.

Pros

- FCA registration for crypto activities.

- Combines banking and crypto in one app.

- Tiered plans offer fee discounts and perks.

Cons

- Crypto assets are unregulated and lack FSCS cover.

- Uses spreads instead of deep order-book pricing.

Who It Is Best For

Casual users who want to manage both banking and crypto in one place.

Fees

Fees vary by plan level and trade volume. Some plans offer 0% on small trades before applying markups.

Payment Methods

Supports Faster Payments, debit/credit cards, and instant in-app top-ups.

10. Bitpanda

Bitpanda Broker UK Ltd registered with the FCA in early 2025, marking its official UK expansion. Known for its broad product lineup, Bitpanda offers hundreds of tokens, savings plans, staking, and crypto indices. It positions itself as a regulated European exchange that now supports UK users with local GBP rails.

The platform targets investors who prefer hands-off crypto investing, combining traditional brokerage convenience with digital asset exposure. AML registration and EU-wide MiCAR licences add credibility and regulatory strength.

Pros

- FCA-registered for UK crypto activities.

- Wide range of tokens, staking, and savings plans.

- Strong European regulatory presence.

Cons

- Advanced trading tools are less developed.

- Some products differ between UK and EU markets.

Who It Is Best For

Investors who want broad token access and automated savings or staking options.

Fees

Uses spreads, product-specific, and brokerage fees. See Bitpanda’s UK page for exact rates.

Payment Methods

Supports GBP bank transfers, debit/credit cards, and local European rails.

How To Choose The Best Crypto Exchange

Check Regulation and Legal Standing

Always start by confirming that the platform appears on the FCA Cryptoasset Register or the Financial Services Register. Registration means the exchange is supervised for anti-money-laundering (AML) compliance and has verified public contact details.

Visit the FCA’s official register and the exchange’s UK legal page to confirm its reference number, scope of registration, and approval date.

Look at Security and Custody

Choose exchanges that take asset protection seriously. Look for cold storage, two-factor authentication (2FA), independent security audits, and transparency about custodianship. It’s also a good sign if the platform holds insurance coverage for digital assets or partners with a well-known custodian.

Compare Fees and Price Transparency

Check all charges before you trade. Review trading spreads, maker/taker fees, deposit or card surcharges, and withdrawal costs. A good tip is to run a sample £200 trade – both buy and sell – to see your total cost in practice.

Check Payment Methods and Fiat Rails

Ensure the exchange supports Faster Payments or other local GBP transfer methods. Review deposit and withdrawal limits, processing times, and supported payment options such as bank transfers and debit cards. This affects how quickly you can move money in or out.

Assess Liquidity, Product Fit, and Support

Check that the exchange offers deep order books for your preferred trading pairs to avoid slippage. Match the product range to your needs; whether it’s spot trading, staking, or savings products. Finally, test how fast the platform completes KYC verification and how responsive its customer support is before you deposit funds.

FAQ

How Do You Know If an Exchange Is FCA Regulated?

Search the FCA Financial Services Register or the FCA Cryptoasset Register using the firm’s name or FRN (Firm Reference Number). The entry will show its permissions, registration status, and contact details. Most exchanges also display their FCA reference number on their UK legal page. Always use the official register for confirmation.

Is eToro Under FCA?

Yes. eToro (UK) Ltd appears on the FCA Register with full permissions, and eToro Money UK Ltd is also authorised for e-money services. Together, these registrations confirm eToro’s regulated status for both crypto and payment services in the UK.

What Does It Mean If an Exchange Is Regulated by the FCA?

FCA regulation or registration means the company follows UK laws for the financial activities it provides. For crypto businesses, this mainly covers AML and KYC compliance. It adds oversight and accountability but doesn’t automatically mean your crypto assets are covered by the Financial Services Compensation Scheme (FSCS).

What’s the Difference Between FCA-Approved and FCA-Regulated Crypto Exchanges?

The term “FCA-approved” often refers to firms fully authorised for specific regulated products, like e-money or investments. Many crypto platforms, however, are registered under anti-money-laundering rules rather than fully authorised. Always check the FCA register to see whether a firm is authorised, registered, or has limited permissions.