The SEC dismissed its Gemini Earn case after users recovered assets through bankruptcy.

The decision closes a high-profile dispute without signaling a wider policy shift.

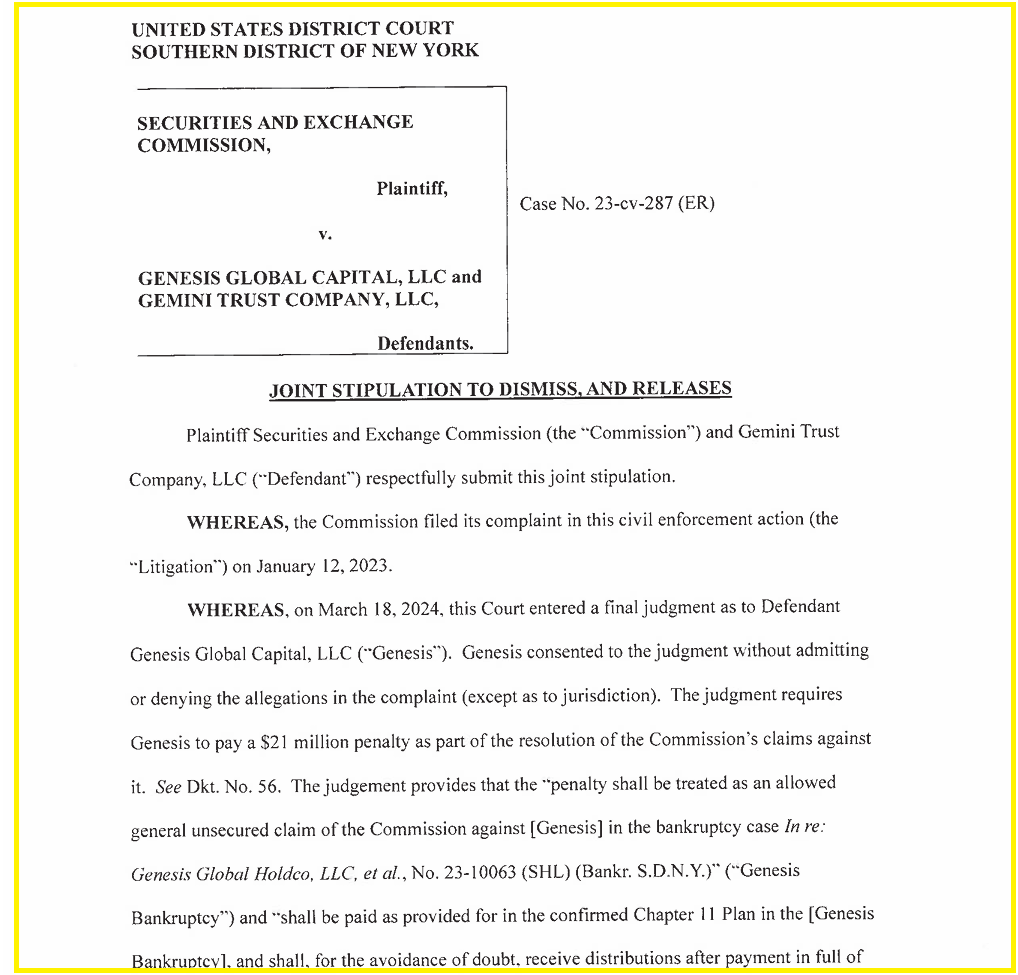

On Jan 24, 2026, regulators and Gemini filed a joint request to dismiss the Gemini Earn lawsuit with prejudice.

The move followed the return of customer assets during the Genesis bankruptcy process in mid-2024 and marked the final procedural step in a case that began three years earlier.

RECOMMEND: Crypto Cases Tied To President Trump Are Dropped

How The Gemini Earn Case Reached Dismissal

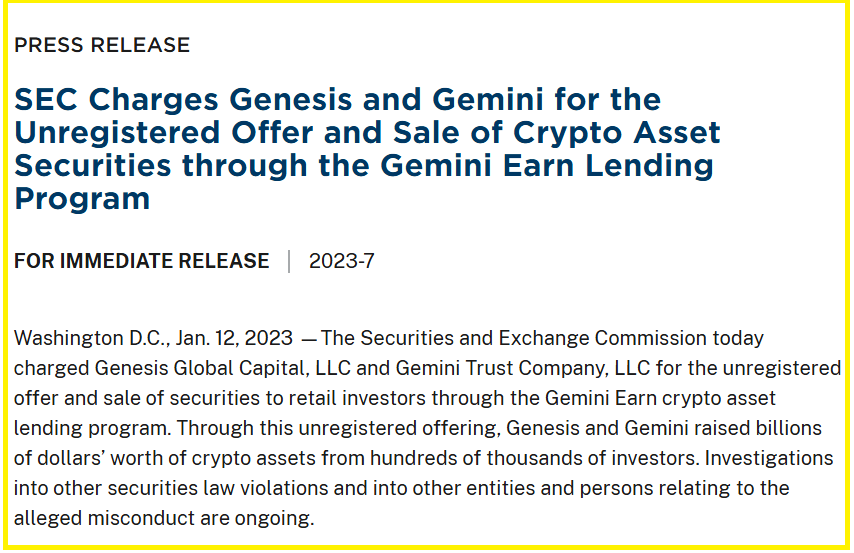

The SEC filed its complaint against Gemini and Genesis in Jan 2023 after Genesis froze withdrawals linked to the Earn program.

At the time, about $900M of customer assets remained locked.

The situation changed during the Genesis bankruptcy process, when administrators returned crypto holdings to users in kind during May and June 2024.

With customers made whole, the legal basis for continued enforcement weakened.

On Jan 24, 2026, both sides submitted a joint stipulation to dismiss the case with prejudice, which prevents it from returning to court.

Reports also noted that Gemini contributed additional funds, cited as up to $40M, to support the repayment process.

RECOMMENDED: Trump Memecoin Collapsed 94% As $1B+ in Profits Spark Public Backlash

What The Decision Means For Crypto Regulation

The SEC made clear that this dismissal reflects the specific facts of the Gemini Earn case.

Regulators did not frame it as a shift in how they view crypto lending or yield products.

Instead, the outcome shows that user recovery plays a central role in resolving disputes.

For crypto firms, the case offers a practical lesson. Legal outcomes depend heavily on how customer losses are handled, especially during insolvency proceedings.

Returning assets reduced pressure on both sides and allowed the case to close without a court ruling on broader legal questions.

Impact On Gemini And The Market

For Gemini, the dismissal removes a long-running legal overhang and clears a major reputational hurdle.

For the wider market, the result brings short-term relief but limited clarity. Each enforcement case will still stand on its own filings, timelines, and recovery outcomes.

ALSO READ: Tether Freezes $182 Million In Suspected Illicit Funds

Conclusion

The Gemini Earn dismissal closes a multi-year dispute after customers recovered assets, while leaving the broader regulatory approach unchanged.