In crypto markets, where market conditions are notoriously volatile, the recent behavior of Solana’s price has captured the attention of investors and analysts.

Related – SOL predictions for 2024, 2025 & beyond

As we experience a period marked by sharp market swings and an uncertain economic backdrop, Solana has emerged at the forefront of discussions, particularly due to its performance against a key rising trendline.

The Significance of Solana’s Rising Trendline

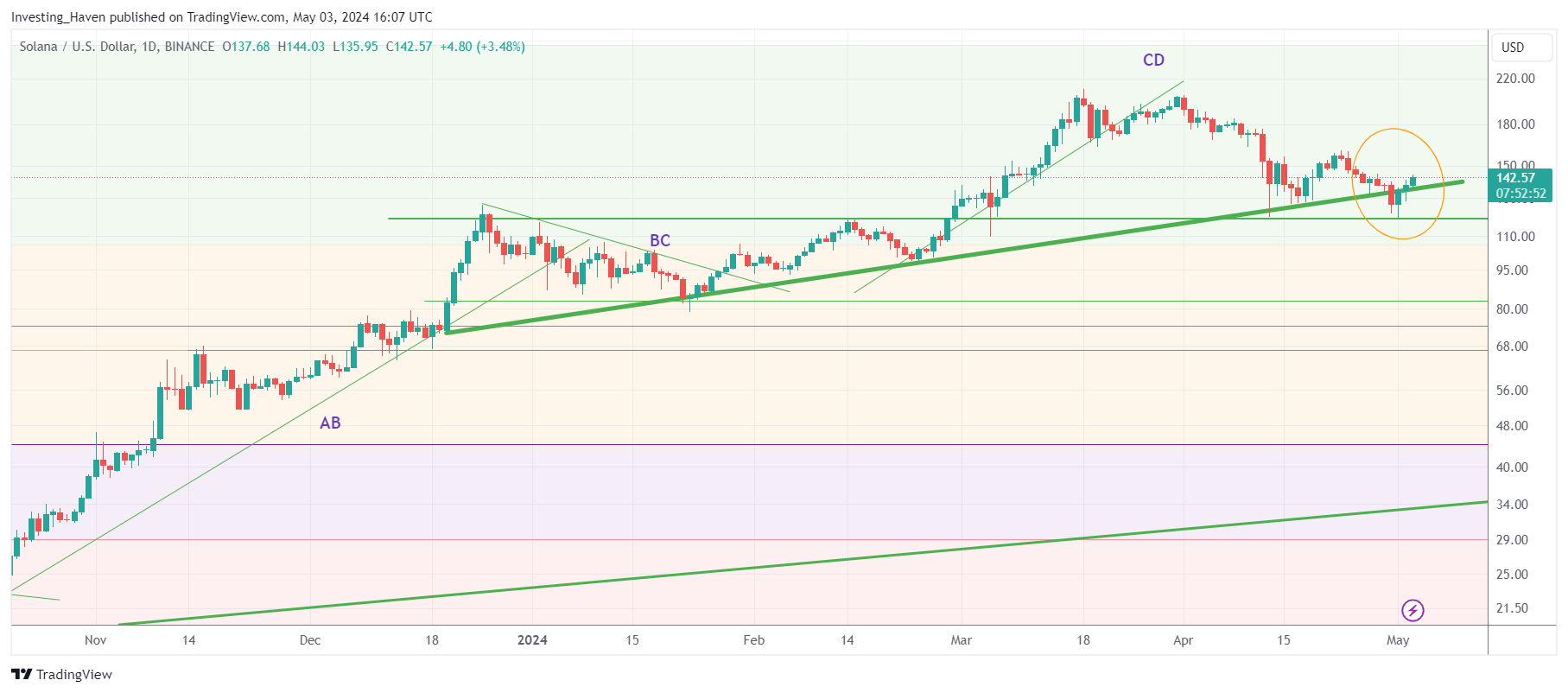

Solana’s price evolution has been closely monitored throughout 2024, primarily due to its adherence to a rising trendline that has acted as a critical indicator of its market sentiment and investor confidence.

This trendline, formed by connecting the lows of Solana’s price movements over the year, has served as a foundation for the asset’s valuation and an indicator of potential future movements.

However, this week’s trading brought a significant scare to those closely watching this indicator. Solana’s price briefly broke below this rising trendline, causing speculation about a potential major downturn. This breakdown, although brief, was significant enough to raise doubts about the future stability of Solana.

Solana’s Quick Recovery

Remarkably, the breakdown of the trendline did not persist.

Within just three days, Solana managed to climb back above this pivotal line, reinstating the trendline’s role as a key support level. This swift recovery is not just a testament to the asset’s resilience but also highlights the dynamic and rapidly changing nature of the crypto markets.

Why Solana’s 2024 Trendline Test is Crucial

The recent test of the rising trendline is possibly the most critical event for Solana in 2024. Trendlines are not merely lines on a chart; they represent psychological barriers and points of mass consensus among investors.

A confirmed breakdown would suggest a loss of faith among investors, potentially leading to a significant sell-off.

Conversely, a strong bounce back above the trendline reassures the market of Solana’s underlying strength and can attract fresh buying interest.

Market Implications

The implications of this trendline test are broad and significant:

- First, it serves as a clear signal that despite the market’s broader volatility, there is substantial investor interest in maintaining Solana’s upward trajectory. This interest could be driven by fundamental beliefs in Solana’s long-term value or its technological propositions that continue to attract developer and user interest.

- Secondly, the rapid recovery reinforces the perception of Solana as a resilient asset in a landscape that is frequently shaken by external shocks and internal developments.

For new investors, the ability of Solana to withstand such pressures and quickly recover can be seen as a green flag for potential engagement.

Solana – Looking Ahead

As Solana continues to trade above this critical trendline, all eyes will be on its ability to maintain this position. The outcome of this ongoing test could very well set the tone for Solana’s market behavior for the remainder of the year. If the trendline continues to hold, it could pave the way for renewed confidence and potentially higher price levels as the year progresses.

In conclusion, while crypto markets remain filled with uncertainties, Solana’s recent performance against its rising trendline is a key development that could have significant implications for its future. This scenario underscores the importance of trendlines as tools for gauging market sentiment and decision-making in cryptocurrency investments.

As we move forward, maintaining a close watch on Solana’s adherence to this trendline will be crucial for both short-term traders and long-term investors.