Will bulls continue to control the price of SUI? We track the metrics in this article to find out whether the price of SUI continues to be supported by bullish foundations.

Sui (SUI) has garnered significant attention in recent months. Its price has soared by over 97% in the past three months outdoing more established cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH).

Despite a temporary pullback in the price of SUI, key market indicators such as open interest, funding rates, Total Value Locked (TVL), and number of active addresses suggest that bullish sentiment remains strong.

Here’s a detailed breakdown of what to expect with SUI based on the above-mentioned market indicators and our recent SUI price prediction.

Sui’s TVL surges beyond $1 billion

One of the most bullish signals for Sui comes from its Total Value Locked (TVL), which recently surpassed the $1 billion mark.

On September 19, Sui’s TVL hit an all-time high of $1.03 billion, reflecting growing liquidity and trust in the network’s decentralized finance (DeFi) ecosystem.

- This represents a dramatic increase from the $802 million TVL recorded shortly before, showcasing rapid capital inflows.

Although the TVL had pulled back to around $949.66 million at press time, it still represents a huge growth from its previous numbers.

Source: DefiLlama

TVL is a critical metric in the DeFi world because it measures the amount of assets locked in smart contracts. Higher TVL generally means higher liquidity, making a protocol more attractive to investors and developers alike.

Sui’s rise in TVL solidifies its standing as one of the top DeFi protocols, and this growing liquidity could entice more participants into its ecosystem, fueling further growth.

Trading volume and derivatives market reflect market confidence

Sui’s trading volume has also been robust. The network saw a trading volume spike to $119 million, the highest in recent months while closing at $63.6 million in the most recent trading session.

These numbers indicate sustained investor interest in the Sui ecosystem, despite short-term price fluctuations.

The derivatives market for Sui tells a similar story. On September 25, derivatives volume climbed to $2.49 billion, marking a 35.57% increase in just 24 hours. Although the numbers have since dropped to around $1.48 billion, it is still a high figure showing investors are still actively trading SUI derivatives.

Source: Coinglass

Such activity highlights increased speculation and participation in the market, further supported by the $805,140 in short liquidations compared to $779,590 in long liquidations recorded at the close of September 27 despite the current price pullback.

The short liquidations suggest that bearish traders are being squeezed out, potentially paving the way for bullish momentum to continue.

Source: Coinglass

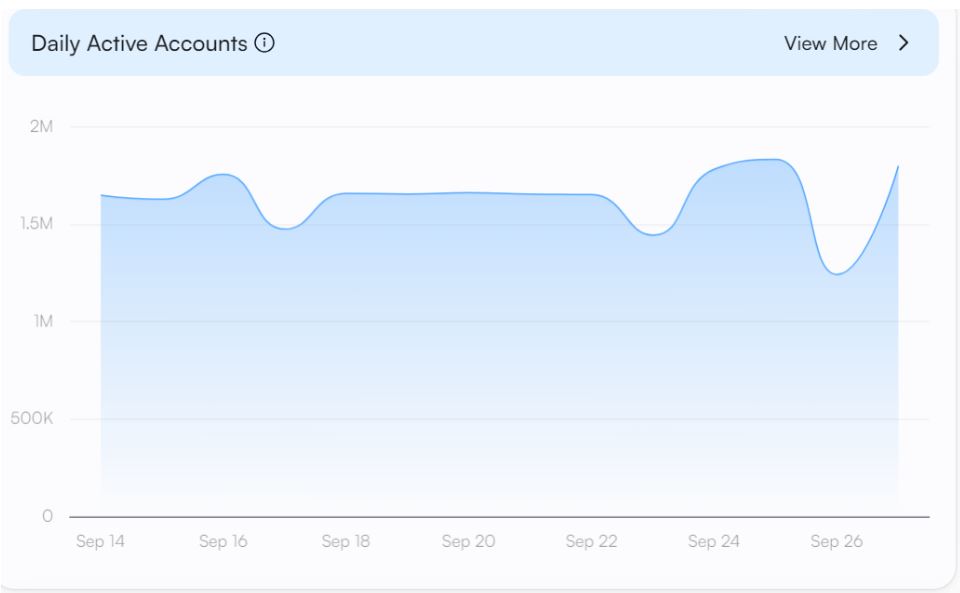

Sui’s user engagement is on the rise

Sui’s bullish outlook isn’t just confined to its financial metrics; user activity on the network has also shown promising growth. Daily active addresses surged from 1.24 million to 1.8 million on September 27 — a 12.93% increase in just one day.

Source: Suivision

This uptick in user participation signals growing interest in Sui’s decentralized applications (dApps) and services.

A larger user base often leads to more assets being locked in smart contracts, which could further push TVL and bolster long-term confidence in the network.

Sui community engagement hits record highs

According to Santiment, Sui’s social interactions have also seen significant growth, peaking at 197 on September 25 before slightly dipping to 121.

Source: Santiment

This surge in social volume reflects rising community interest and market buzz surrounding Sui as evidenced by activity on cash tag $SUI. High social engagement often correlates with higher trading activity, as more investors and traders discuss and explore the project.

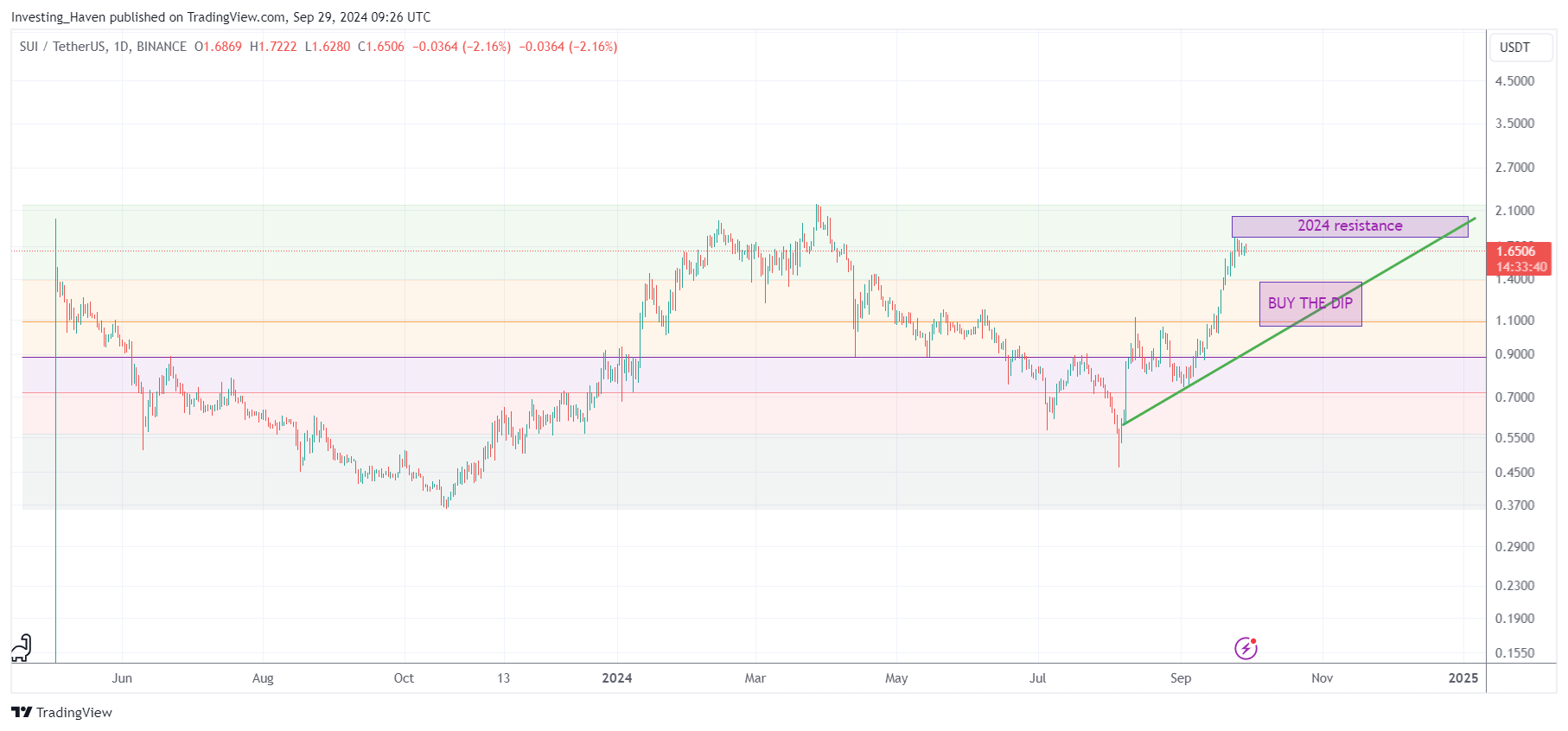

Conclusion: can Sui price break the resistance at $1.76?

As Sui continues to attract liquidity and users, it could very well be on the cusp of resuming its bullish rally, making it a cryptocurrency to watch closely in the coming months. Grayscale has listed it among the high-potential investments for Q4 2024 in its recent research report.

Despite Sui’s price hitting a resistance at $1,76 and pulling back to its current price of around $1.63, Sui Bulls seem firmly in control, with the key metrics pointing towards a bright future for the cryptocurrency.

Buy the dip? For sure, any reading below $1.44 can be considered a ‘SUI buy the dip’ opportunity as long as the green rising trendline will be respected.

FYI – SUI is currently trading above the 10,20,50,100, and 200-day EMAs despite currently being in the overbought region according to the 14-day relative strength index (RSI), showing that it is just a matter of time before it resumes its bullish trend and possibly break above the resistance at $1.76.