Investors are eyeing Optimism, Arbitrum, and Polygon as top Layer‑2 picks for high upside, strong adoption, and sustainable revenue.

Layer‑2 protocols are commanding investor attention as scaling bottlenecks and high gas fees persist on Ethereum and Solana. If you are looking to take advantage of these tokens, here are the top three Layer‑2s drawing fresh capital—each offering distinct risk/reward profiles.

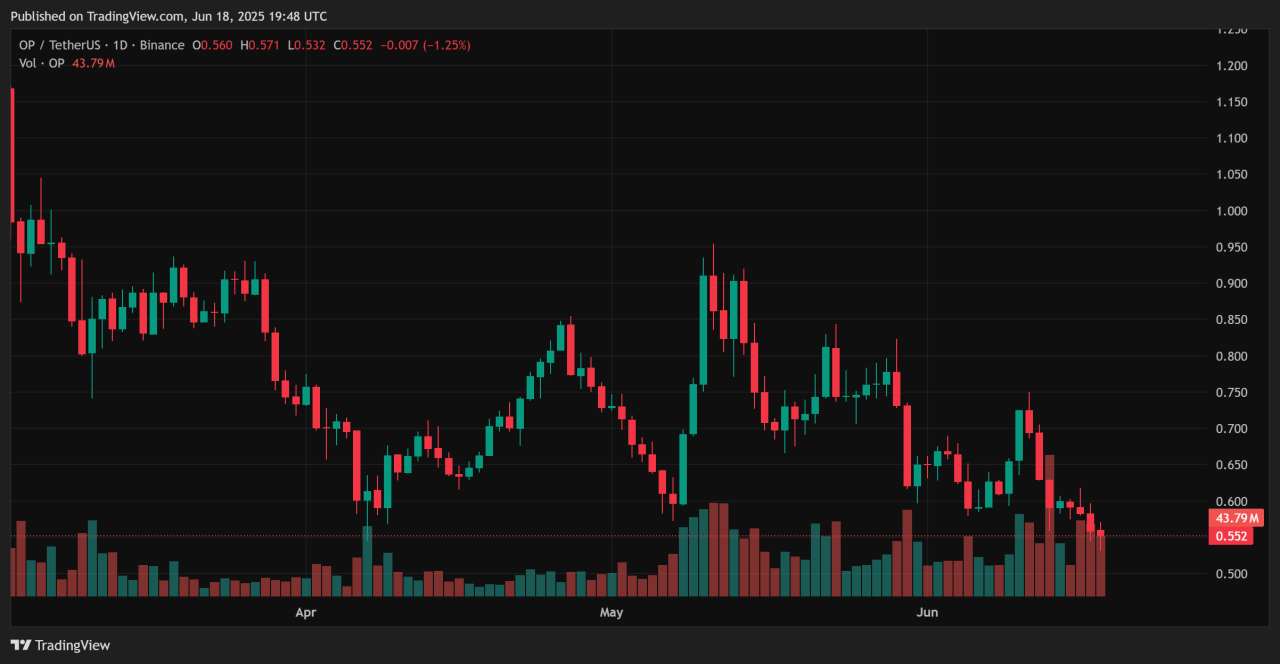

1. Optimism (OP) – Ethereum’s leading Optimistic roll‑up

Optimism supports over 400 dApps on its OP Stack “Superchain,” handling more than 60% of Ethereum Layer‑2 transactions by early 2025, with ~$942 M market cap and 1.71 B circulating OP ≈ $0.55 each.

It generated significant blockspace demand and MEV activity in Q1 2025, with optimistic MEV accounting for over half its transaction gas usage

2. Arbitrum (ARB) – Ethereum’s Optimistic stalwart

Arbitrum remains in the top three L2s by market cap (~$1.7 billion). Its on‑chain metrics show robust activity, and institutions appear to be accumulating steadily.

As Ethereum DeFi continues scaling, ARB is poised to ride that wave—supporting forecasts for adoption growth and token appreciation driven by network effects.

3. Polygon Ecosystem (MATIC) – zk‑Rollup with real value

Polygon’s MATIC stands at roughly $1.8 billion market cap, heavily integrated across enterprise and DeFi ecosystems. A recent academic study pegged MEV extraction on Polygon at $213 million, marking a key revenue stream for validators and signifying deep on‑chain liquidity flow.

With ongoing DeFi traction, Polygon’s revenue and token utility are likely to grow.

Conclusion

Optimism delivers solid growth and high network demand as it powers a large share of Ethereum L2 activity. Arbitrum remains a market leader with strong developer adoption and steady institutional inflows. Polygon combines enterprise partnerships and proven MEV revenue, underlining its deep liquidity and sustainable fee generation. Together, they offer a balanced Layer‑2 portfolio for investors seeking both upside and resilience.

Our latest crypto alerts – instantly accessible

This is how we are guiding our premium members (log in required):

- The Alt Season Charts (June 15th)

- Another Test of 106.1k, Is This THE Big One? (June 8th)

- How Much Longer Do We Have To Wait For Alt Season 2025? (June 1st)

- The Bitcoin vs. Altcoin Divergence (May 24th)

- Is A Massive Breakout Coming? (May 17th)

- Top Altcoin Picks in the Strongest Emerging Narrative (May 9th)