This week, the ISM manufacturing PMI came in below expectations. We will tell you what this means for the crypto industry and look at the reaction of different coins.

The ISM Manufacturing PMI is a monthly economic indicator that measures the performance of the US manufacturing sector.

Typically, a reading above 50 indicates an expansion of manufacturing activity in the country. A reading below 50, on the other hand, implies a contracting sector.

For the month of April, the PMI reading was 48.7%, which is 0.3 percentage points below March reading. It also represents the second consecutive month of contraction and the lowest reading in 5 months, implying growing negative sentiment towards the business environment in the country.

This, in turn, triggers a risk off sentiment and liquidity flee from risk assets like cryptos toward safe haven assets like gold.

How Did the Crypto Market React to April PMI Readings?

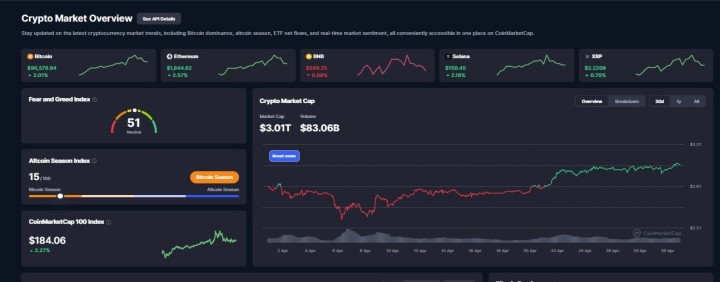

Though negative, the PMI reading didn’t have any tangible impact in the large crypto industry. In fact, the larger crypto market cap rallied by about 2%, adding $60 Billion to help it climb back above $3 Trillion. The fear and grid index also remained neutral at 51.

Top coins have also rallied unbothered by the PMI readings. Bitcoin, for example, jumped by 3.6% to hit an intraday high of $97,437. Ethereum followed suit and rallied by more than 10% in the day – jumping from an intraday low of $1700 to peak around $1872.

How Did Gold React to Contracting ISM Manufacturing PMI Reading?

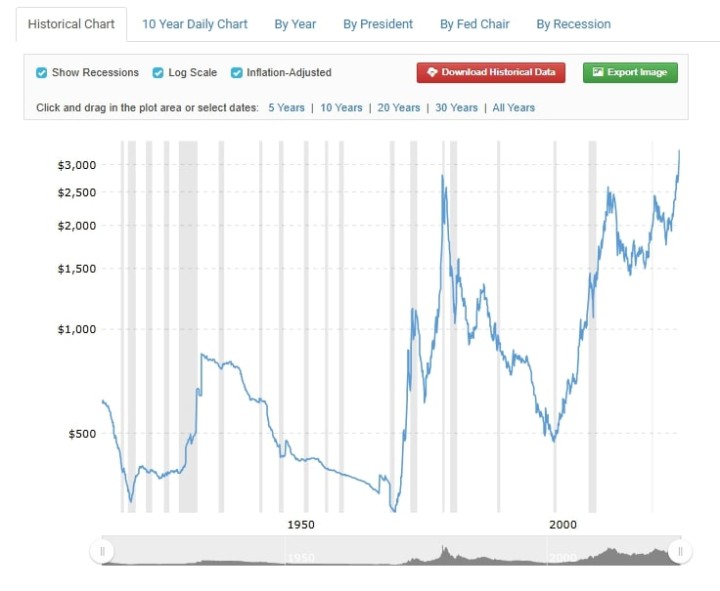

Unlike cryptos that have been surging, gold continued consolidating with drop in value. At the time of writing, the precious metal is trading around $3,337, which is a 4.6% drop from the all-time high of $3,500 set earlier in the month.

However, we cannot wholly attribute gold’s disappointing price performance to the contracting PMI readings. In fact, we would have expected the safe haven asset to hint at a rebound on the news of a contracting manufacturing industry.

The most likely explanation for gold’s diminishing value is that it has entered a consolidation phase after months of sustained bullishness.

Bottom line

A declining ISM Manufacturing PMI typically signals weakening economic conditions, which can trigger risk-off sentiment and pressure risk assets like crypto.

However, the April data had little negative impact—crypto prices rallied, showing growing market resilience and decoupling from traditional macro fears.

Join Our Premium Research on S&P 500, Gold & Silver — Trusted Insights Backed by 15 Years of Proven Market Forecasting

Unlock exclusive access to InvestingHaven’s leading market analysis, powered by our proprietary 15-indicator methodology. Whether it’s spotting trend reversals in the S&P 500 or forecasting gold and silver price breakouts, our premium service helps serious investors cut through the noise and stay ahead of major moves.

- Gold Retracing, Silver and Miners at a Critical Level (May 4th)

- The Precious Metals Charts That Bring Clarity Through Noise (April 27th)

- Highly Unusual Readings In Gold & Silver Markets (April 20th)

- Gold Miners Breaking Out, Here Are A Few Gold Stock Tips. What About Silver & Miners? (April 13)

- Gold, Silver, Miners – Bottoming or More Downside? (April 5th)

- Why Next Week Matters for Gold — But Less So for Silver (March 29th)

- Is the USD About to Bounce? What Are the Implications? (March 22nd)

<a style=”display: inline-block; padding: 14px 28px; font-size: 16px; font-weight: bold; color: #ffffff; background-color: #002060; border-radius: 6px; text-decoration: none;” href=”https://investinghaven.com/premium-service-sp-500-analysis-gold-silver-price-analysis/” target=”_blank” rel=”noopener”>Unlock Premium Market Insights

</a>