Is the magic fire in crypto markets gone? When will it return? It’s the question top of mind of crypto investors. In recent months, we who have only seen a few meaningless bounces, they got sold rather fast. In the meantime, however, we see the emergence of a new trend in crypto: blockchain gaming #playtoearn. Yes, this is a great illustration of the unicorn strategy we started applying in our blockchain research service, exactly in line with our 2022 crypto predictions. But, the really important question is when BTC will create momentum to push the entire market higher (again).

In order to answer this question we really have to zoom out.

The daily chart does not help, it only shows a giant trendless setup which very simple conclusions: 2 breakdown levels (37k and 33.3k) as well as giant resistance in the 49-51k area. Yet, it is so tempting to get sidetracked by so many details on the chart, all of them pretty pointless and distracting.

What we really need is a long term view and intermarket correlation.

We created this for our members, and the chart below gives a sense of the type of charting and insights we share in our premium crypto service.

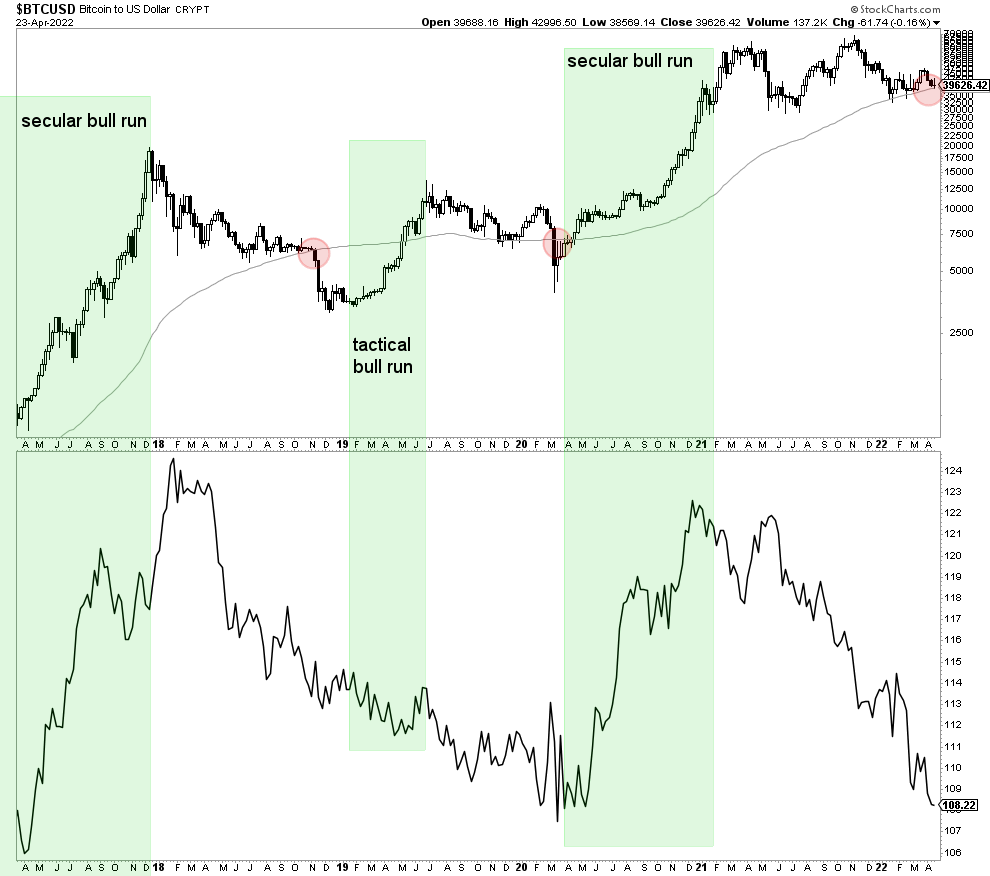

The long term BTC chart combined with the bigger trends in the Euro. No, we are not talking about BTC denominated in Euros. We are talking about correlations between BTC and the Euro which is a currency that tends to rise whenever there is ‘risk on’ in markets.

Can the picture get any clearer?

BTC needs a big run in the Euro before it can start rising. The big run might come this year, but right now the Euro is really weak. This might mark the start of a turning point, but without a strongly rising Euro there is no change that BTC will clear the 50k area (set aside print new ATH).

Note that there was only one tactical bull run in BTC without a strong uptrend in the Euro, it started in April of 2019 but that’s after a violent breakdown in BTC some 5 months earlier. Also, there are a few other juicy details out of this chart which we shared in our crypto weekend alert for members.