Bitcoin offers stable long-term gains, but XRP’s lower price and breakout potential make it a riskier yet millionaire-making contender.

If you are looking to become a crypto millionaire, Bitcoin and XRP are compelling choices—but through very different pathways.

Bitcoin, trading near $107K, benefits from institutional acceptance, halving-induced supply discipline, and soaring market‑cap forecasts. XRP, priced around $2.18, leverages legal resolutions, real‑world utility, and technical momentum.

This comparison explores which asset is more likely to turn investors into millionaires through supply dynamics, adoption trends, price momentum, and scale.

Supply Dynamics & Institutional Validation

Bitcoin’s strict 21 million max supply and declining volatility enhance its appeal as “digital gold.” Billionaire Philippe Laffont projects its market cap could more than double to $5 trillion (~$250–300K per BTC), noting reduced volatility and growing global asset flows.

Other analysts see institutional inflows via ETFs pushing Bitcoin toward $200–250K by end‑2025. That means a $100K position could easily double or triple—though achieving $1 million solo demands substantial capital.

Utility-Led Upside & Chart Breakouts in XRP

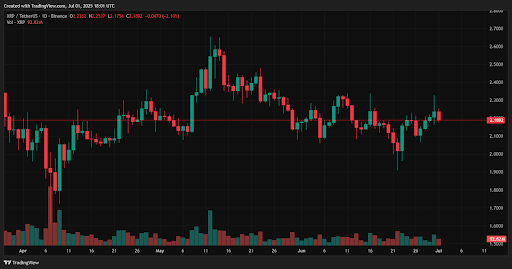

XRP’s main narrative revolves around on‑chain utility and regulatory clarity. After pulling its SEC cross‑appeal, Ripple removed a major obstacle and triggered a technical breakout above $2.19 with MACD support.

Analysts forecast short‑term rallies to $3–$5—some bullish voices even anticipate $5 by year‑end.

Brave New Coin sees a $15 target by end‑2025 under full ETF and partnership scenarios. Because XRP trades around $2, reaching $10–15 would multiply capital by 5×–7×—leaving smaller portfolios more likely to hit seven figures.

Millionaire Scenarios: Stability vs. Reach

A $250K Bitcoin investment at $107K today could grow to $500K–$750K if BTC hits $250–300K—good, but shy of millionaire status. In contrast, investing $250K in XRP at $2.18, and riding a $10 surge, yields $1.15 million.

Still, XRP’s path is more speculative—reliant on catalysts like ETF adoption, Re‑legal coverage, and technical breakouts—making it a higher‑risk, higher‑reward play.

Conclusion

Bitcoin offers steadfast long‑term capital growth fuelled by scarcity and institutional trust—but reaching millionaire territory demands significant investment.

XRP, by contrast, offers a more aggressive trajectory with smaller capital, though it hinges on speculative catalysts. For cautious investors seeking steadier returns, Bitcoin is the go‑to. But if you’re chasing rapid upside with elevated risk, XRP might deliver the biggest bang for your buck.

Our latest crypto alerts – instantly accessible

This is how we are guiding our premium members (log in required):