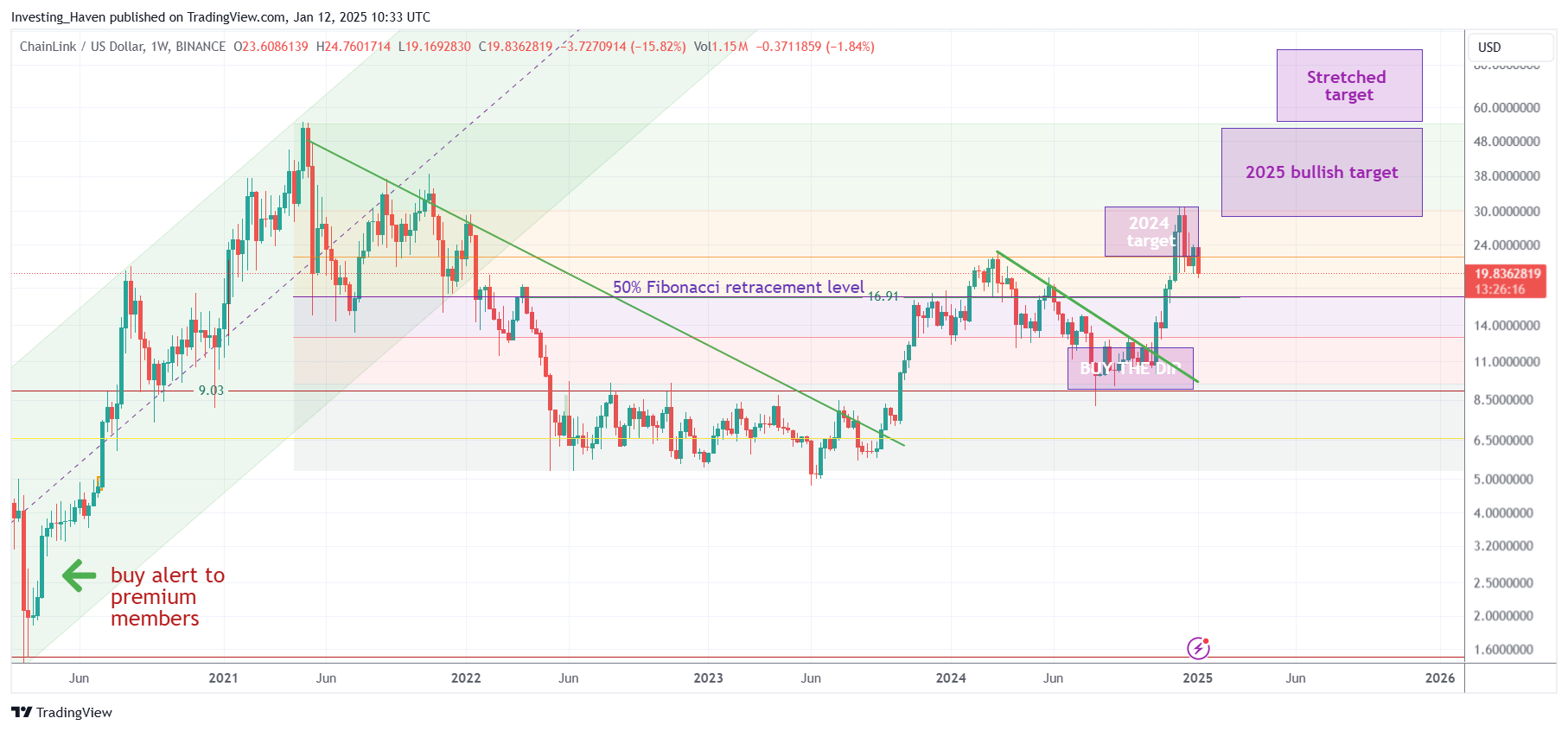

With LINK’s price trading above its 50% Fibonacci retracement level, it looks like Chainlink (LINK) will be among the winners once this pullback will be complete. The Chainlink bullish foundation is visible everywhere.

RELATED – 15 crypto predictions for 2025

What’s interesting, when carefully analyzing the Chainlink chart, is that it perfectly respects Fibonacci retracement levels. There is a very strong correlation between Chainlink price trends and Fibonacci levels.

The only ‘tiny’ detail is that you need to get the chart right, that’s both the timeframe and the selection of appropriate Fibonacci levels. Arguably, that’s more than a detail.

Chainlink’s bullish fundamentals

When it comes to fundamentals, it goes without saying that Chainlink is working an amazingly bullish foundation.

Again, that’s fundamentals (we discuss chart in the next section).

Here are some illustrations across domains.

Payment services (source):

“Swift payment flows can be used to trigger onchain digital asset movements.” How Swift (@swiftcommunity) and the Chainlink standard can enable onchain and offchain payment flows ↓

Financial market data infrastructure (source)

@EuroclearGroup CEO Valérie Urbain noted that highly regulated FMIs like Euroclear are increasingly collaborating with “more innovative companies like Chainlink.” Chainlink, Euroclear, @SBI_DAH, and @Temasek on the next generation of financial markets.

Security in dapps (source):

Offloading security to dApp devs via an isolated security model is a systemic risk to the onchain ecosystem. CCIP is the only cross-chain solution that offers full-scale, level-5 security with no additional security assumptions for dApps already using Chainlink.

Cross chain collaborations (source):

@Ripple x @Chainlink: $RLUSD has adopted the Chainlink standard for verifiable data to fuel DeFi adoption with real-time, secure pricing data. The future of stablecoins is here: ripple.com/ripple-press/r

It’ not just fascinating.

It’s mind boggling.

This Chainlink bullish foundation is enabling a new era in finance and digitization through the blockchain.

Chainlink bullish chart foundation

Arguably, the bullish foundation in terms of adoption (outlined above) is reflected on Chainlink’s chart.

The weekly LINK chart is also astonishing:

- A cup and handle formation over nearly 3 years – bullish.

- Fibonacci levels are perfectly respected – bullish.

- LINK trades above its 50% Fibonacci level – the bullish side of the retracement area.

How much more does an investor desire to get excited, right?

RELATED – Chainlink (LINK) prediction 2025 – 2030

Our viewpoint is simple – Chainlink bullish foundation is here for LINK to become very bullish once this consolidation (correction?) is over.

Chainlink needs a bullish crypto environment

LINK will require a crypto friendly environment.

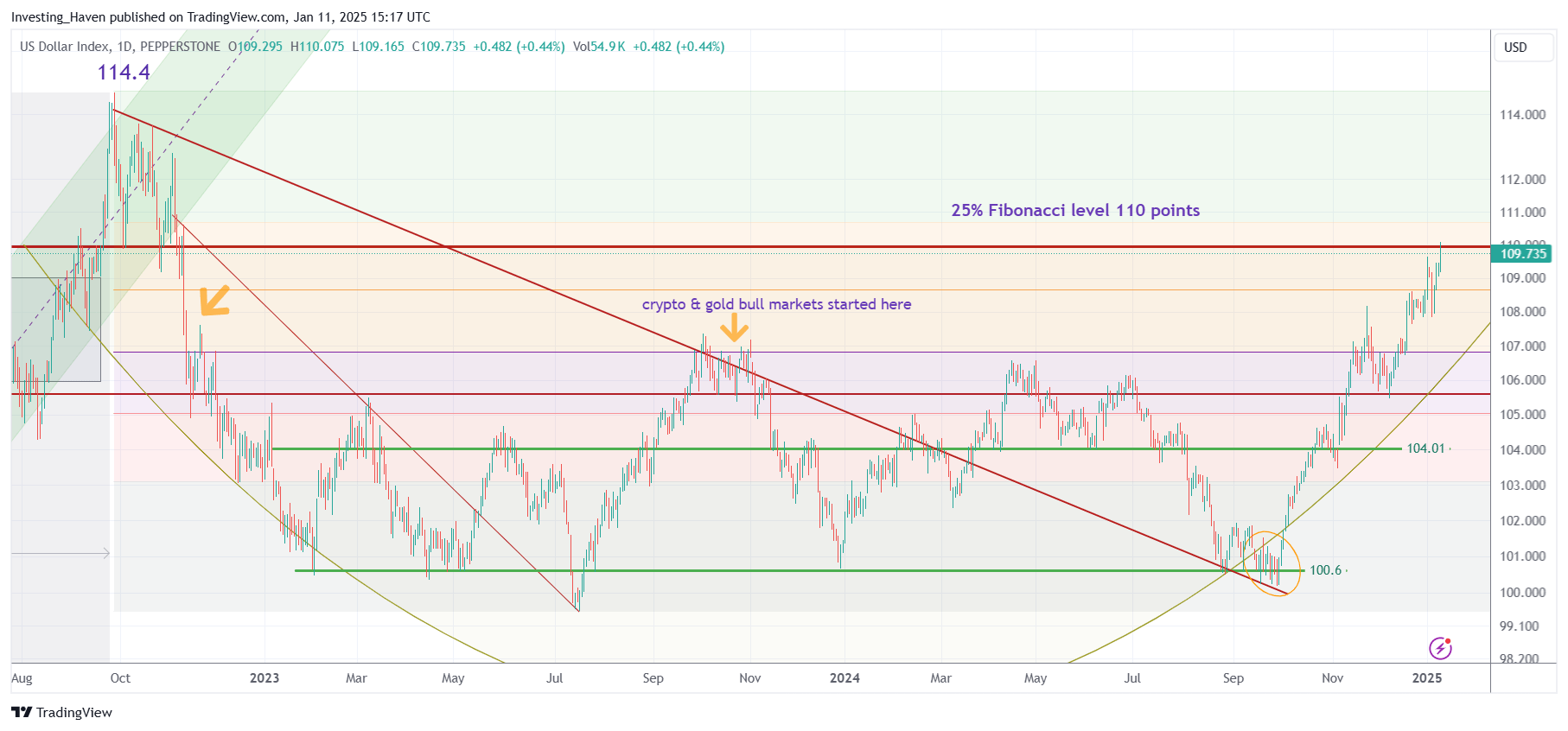

The problem with the current market environment is that the USD is way too strong to allow for bullish momentum to develop in crypto markets.

Below is the USD chart – too much strength – this is not good for crypto.

We firmly believe that once the USD sets and confirms a top, crypto will become bullish again. That’s when Chainlink will be ready to outperform… it’s clear from its Chainlink bullish foundation.