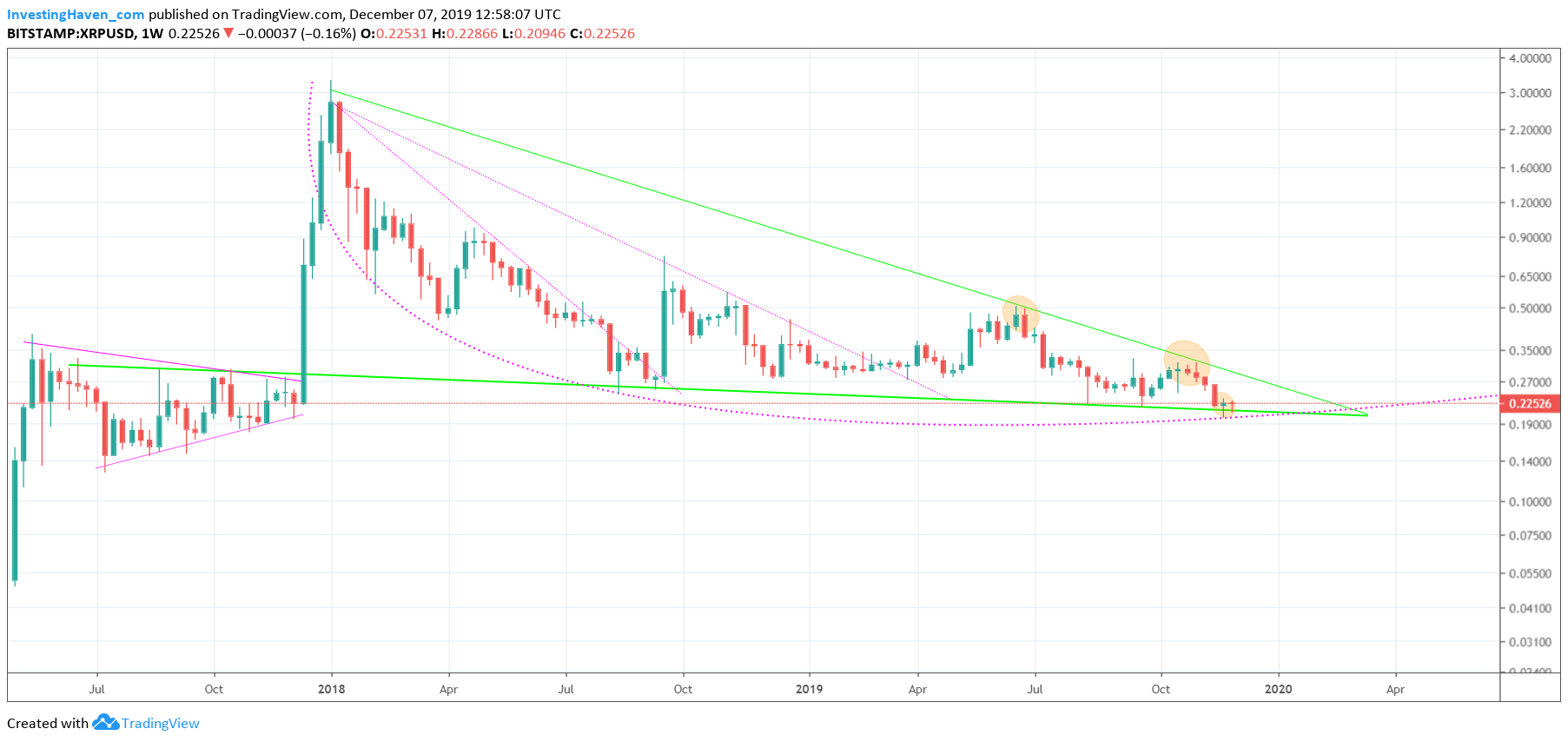

The price of XRP was bullish in October, bearish in November and started the month of December on a bullish note. Taking a step back, looking at the bigger picture which is very tough with content overload in financial and social media we observe a very interesting phenomenon. On the one hand the chart is still in a long term bullish pattern no matter if XRP trades a multi-year lows at a time when lots of people have become on XRP. And the latter is exactly the other observation pessimism surrounding XRP is probably at all-time highs. This is a very interesting divergence, and we are getting increasingly convinced there will be a bullish outcome.

Our long standing XRP forecast may seem unrealistic right now but let’s face it when crypto went up in 2017 nobody would have believed a bullish XRP forecast of a 50x increase in 12 months.

And that’s the whole point.

When nobody believes something to happen the probability increases. Let’s put it differently: the consensus view never wins, never.

Look around you, the number of folks being negative on XRP is growing. That’s what we realized when we wrote this XRP message on Twitter a few days ago:

So let’s find a counter argument for this viewpoint.

If a stock is so bad that the company cannot survive the future you would do a good thing investing in it? Obviously the answer is no.

But it’s besides the point. Ripple’s ecosystem is the fastest growing in crypto land. XRP is the largest cryptocurrency reaching scale.

That’s different, very different. Ripple and XRP are only now starting to get traction, they solve a huge real life problem and customer testimonials are amazingly promising.

If an investment with a great outlook solving a global problem is perceived negative by a growing number of people just because of its price not going up it might be time to invoke the contrarian principle.

At the same time on XRP’s long term chart we start seeing a pattern that has a bullish outcome. This rounding bottom or saucer base has proven over and over again to become bullish after the 3d falling trendline is broken to the upside. You see the apex of this chart setup is expiring in March of 2020.

In other words in the next 3 months we’ll know for sure if XRP will move to our projected long term bullish price target or if our forecast will invalidate.

We tend to apply the rule of 3 when investing. If 3 conditions coincide we have a validation of an investing thesis.

We can apply the rule of 3 to XRP as well, and we did in this weekend’s crypto alert to premium members. We wrote a very detailed update on the 3 trends we see in crypto and XRP that support our forecast. We did translate this into 3 conditions for our forecast to come true.

Obviously in times when XRP is testing multi-year lows this is the type of insight you need as an investor to make a buy or sell decision. A buy decision may turn this into your best positive investment ever in your life. A sell decision too early will become catastrophic because you will be chasing prices higher at a later point in time or even miss entirely the uptrend. A sell decision too late will also be catastrophic.

We consider this weekend’s XRP update the most important one we have ever written. No coincidence its subject is “A must-read update on XRP”. We compare the XRP chart setup with another high profile market that became outrageously bullish. We define the conditions on when our XRP forecast will be confirmed.

All the details are there for crypto investors to know exactly what to do in which circumstances. Nobody else offers this type of insight. Get instant access to our crypto alerts >>