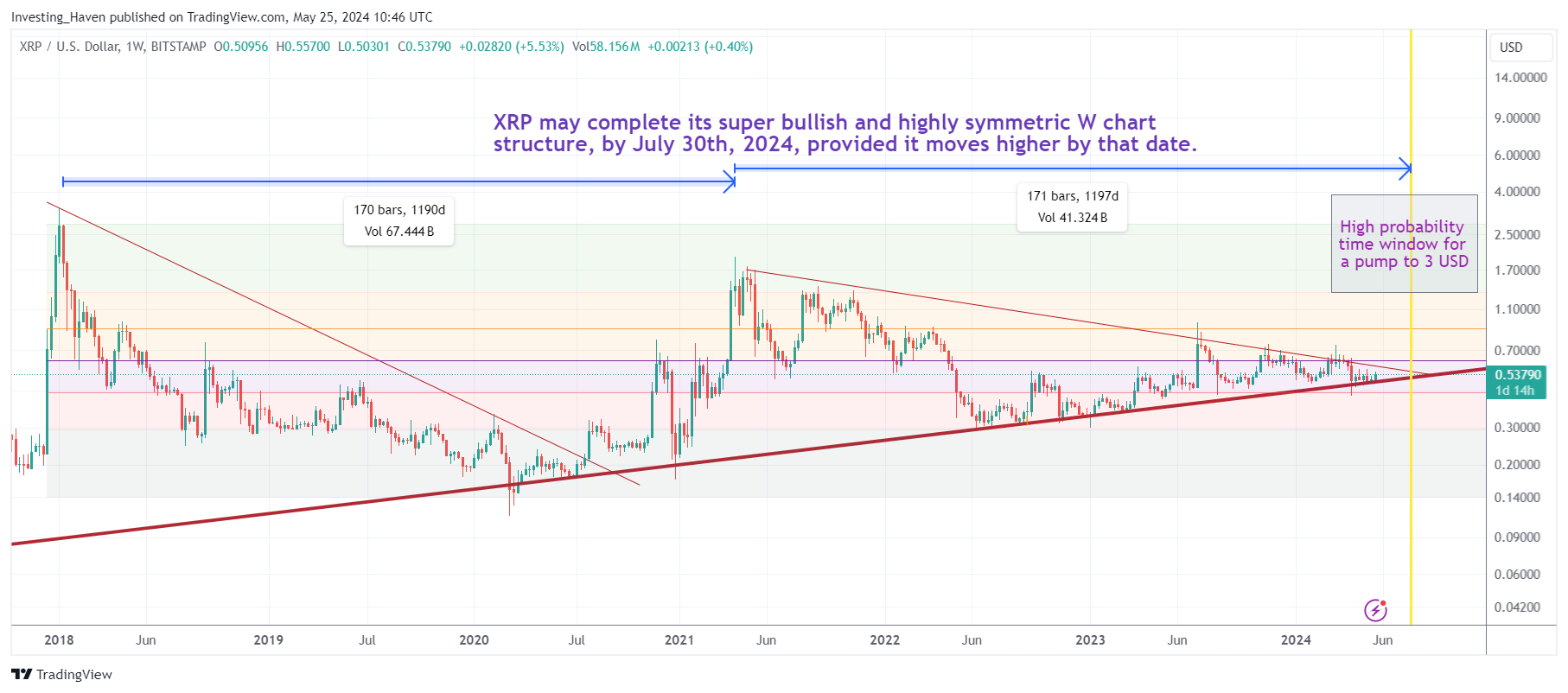

The one token that truly nobody expects ever to move higher is XRP. The long term bullish reversal structure on the XRP chart makes the case for a wild and unexpected bullish XRP price target for July 2024 so interesting.

RELATED – Which Blue-Chip Crypto Will Outperform This Summer?

XRP has been a controversial token, often surrounded by skepticism (by the critics) and regulatory challenges (between Ripple and the SEC).

Despite these hurdles, the chart formation indicates a potential for significant movement: the current chart formations suggest that July 2024 could be that pivotal time. The alignment of various chart patterns is setting the stage for what could be a surprising and substantial price increase, catching many off guard.

SOURCE – XRP forecast 2024 & 2025.

Expect the unexpected

Markets have a way of surprising even the most seasoned investors. The concept of expecting the unexpected is crucial in investing.

Historical data shows that markets often move in the opposite direction of the prevailing sentiment. When the majority believes an asset is doomed to underperform, that’s often when it stages an unexpected rally. Unexpected – what about a bullish XRP price target of $3 when some are calling for $0.10.

This phenomenon is not just about market mechanics but also about investor psychology. When everyone is convinced of a particular outcome, they position themselves accordingly. This positioning can lead to an overcrowded trade, where any slight change in sentiment can cause a dramatic shift in the opposite direction. Therefore, solid chart structures become essential as they provide a more objective basis for anticipating market moves.

Investing is as much a mental game as it is about numbers and charts. Successful investors often excel because they can control their emotions and think independently of the crowd. They rely on data and patterns, which, in the case of XRP, indicate a potential bullish reversal. This contrarian approach, supported by solid technical analysis, positions them to capitalize on unexpected market movements.

Moreover, the market tends to overreact to news and events, both positive and negative. These overreactions create opportunities for those who can maintain a level head and focus on the underlying data. The XRP chart’s current formation is a classic example of how a seemingly stagnant asset can be on the verge of a significant breakout, defying general expectations.

XRP chart: giant bullish reversal resolves in July 2024

The XRP chart has been building a giant bullish reversal pattern over an extended period. This type of pattern often precedes substantial price movements as it represents a significant shift in market sentiment.

The reversal pattern indicates that the prolonged downtrend may be coming to an end. This is characterized by a series of higher lows which signal that sellers are exhausted. For XRP, the key levels to watch are $0.66 followed by $0.88. Breaking through the first level will mark a secular breakout, breaking through the second level will open the door for a test of ATH.

The accumulation phase appears to be nearing its end, and the transition to the markup phase could propel XRP to new heights. The targets of $1.6, $1.9, $2.7, and possibly $3.3 are based on Fibonacci retracement levels and historical resistance points, providing a roadmap for potential price movements.

Investors should remain cautious and realistic. While the charts suggest a potential for significant gains, the market can be unpredictable. It’s essential to have a plan in place for various scenarios, including the possibility that the breakout may not happen as expected.

Human XRP price targets vs. AI price target

The debate between human analysis and AI predictions is ongoing, especially in the financial markets. AI can process vast amounts of data and identify patterns that might be missed by human analysts. However, it lacks the intuition and experience that come with years of market observation.

Human analysts bring a unique perspective to the table. They can interpret charts and market signals in a way that AI currently cannot. This is particularly true for assets like XRP, where regulatory news and market sentiment play significant roles. AI might overlook these nuances, leading to less accurate predictions.

Moreover, human analysts can adapt their strategies based on changing conditions and new information. They can question their assumptions and make adjustments, a level of flexibility that AI systems have yet to achieve. This adaptability is crucial in dynamic and fast-moving markets like cryptocurrency.

Look, AI is so much smarter than I am. But I know how to analyze the XRP chart in a way AI cannot. It is simple for me: AI is absolutely clueless when it comes to predicting XRP. I have full confidence in my XRP time forecast.