While Bonk (BONK), a popular meme coin built on the Solana blockchain, has gained significant attention in the cryptocurrency market due to its remarkable price performance over the past year, recent geopolitical events and market trends have affected its momentum and outlook.

The meme coin is currently one of the largest losers among the largest 100 cryptocurrencies by market cap seeing that it has dropped by over 16% from a high of $0.00002575 registered on October 1, 2024.

RELATED – 15 Cryptocurrency Forecasts For 2025

In this article we are looking into the current state of Bonk, examining its future price dynamics based on the market metrics and broader market correlations.

Bonk hits resistance amid geopolitical impact

Despite its impressive yearly performance where it has seen a 10,476%, Bonk recently faced challenges in breaking through the critical resistance level of $0.00002400. This resistance has proven significant, especially amid escalating geopolitical tensions.

RELATED – Meme Coin Alert: Will SHIB and DOGE Pump Or Dump?

Notably, the recent missile strikes from Iran into Israel have adversely affected not just Bonk but the entire cryptocurrency market, including Bitcoin, which has seen its price dip to around $60k after briefly touching $66k.

The Chaikin Money Flow (CMF) indicator, which had been observing an uptick since early September, signaling increased capital inflows into Bonk, has recently begun to show a downtick. This suggests a withdrawal of investor confidence, as traders pull back from the coin.

Consequently, Bonk’s bullish momentum has stalled, preventing it from capitalizing on potential rally opportunities.

The failed descending wedge pattern breakout

Looking ahead, Bonk is at a crucial juncture.

It has been trading within an ascending triangle accumulation pattern since mid-May and was on the verge of a significant breakout that could have propelled its price toward its all-time high of $0.00004800.

#BONK/USDT

Ascending Triangle accumulation is on the table🧐

Looking for a rally on this one✈️

✔️TP1 – 0.00004795$

✔️TP2 – 0.00007205$

✔️TP3 – 0.00011045$ pic.twitter.com/e515w5HZe8— Daniel Ramsey (@ramseycrypto) September 30, 2024

However, the failed breakout has dampened these expectations.

Should Bonk fail to maintain its current support at $0.000021, it may enter a phase of consolidation above $0.00001732, further delaying any potential bullish momentum.

For Bonk to regain its upward trajectory, it will need stronger bullish cues from the broader market. A breakout would be confirmed if the resistance at $0.00002748 is flipped into support, which could invalidate the bearish outlook and potentially spark a rally toward previous highs.

Derivatives data points to a tumultuous time for Bonk

A look at Bonk’s derivatives data reveals that the trading volume is approximately $215.07 million, reflecting a significant decrease of 35.13% according to Coinglass data. This decrease in trading volume shows Bonk is increasingly losing taste among traders, possibly because of its incapability to continue with its rally.

Additionally, the open interest currently stands at $10.35 million, down 23.84% from $13.59 million hit on September 29, 2024.

Bonk’s OI | Source: Coinglass

The long/short ratio in the derivatives data is currently at around 0.9501, indicating a slightly bearish sentiment among traders although on the OKX platform, the long/short ratio is more optimistic at 1.31, suggesting a higher confidence level among those trading on that exchange.

These metrics indicate that while there is still considerable interest in trading Bonk, market sentiment is cautious as traders adjust their strategies in response to the current economic climate.

Declining correlation with Bitcoin (BTC)

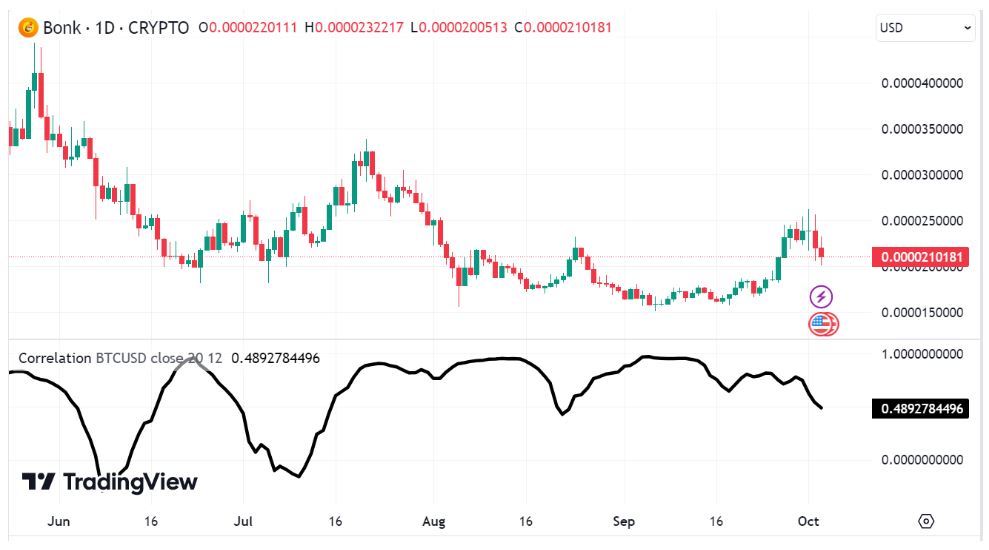

Another critical aspect affecting Bonk’s performance is its declining correlation with Bitcoin, which currently stands at 0.4892.

This reduced correlation is concerning as it suggests that Bonk is not benefiting from Bitcoin’s recent recoveries.

Typically, altcoins with stronger correlations to Bitcoin tend to ride the waves of the market leader’s rallies. However, Bonk appears to be missing out on this upward momentum.

Conclusion: how far do we expect Bonk’s price to drop?

While Bonk has shown resilience in the past, its ability to navigate these turbulent market conditions will be crucial for its future success.

Investors should keep a close eye on broader market trends and the coin’s ability to maintain critical support levels in the coming weeks.

Seeing that the price has already breached the 0.382 Fibonacci retracement level, all eyes are on the 0.5 retracement level at $0.0000206362, which if breached could see BONK price drop to the 0.618 retracement level at $0.0000193237.

However, if Bonk holds above the 0.382 retracement level, traders will be watching for a breakout at the resistance level at the 0.236 retracement level at $0.0000235726.