However, it isn’t realistic to expect ETH to rise to 100k before 2030. Nevertheless, we remain strongly bullish on ETH, and firmly believe that ETH will exceed 10k well before 2030.

RELATED – Ethereum (ETH) prediction 2025

In this article, we explore why ETH cannot rise to $100k in the coming 5 years. We apply a rational method to assess what would happen if ETH were to hit $100k. The outcome, clearly, is that a world in which ETH hits $100k is simply not realistic relative to world economies, market capitalization and valuation of leadings assets and cryptocurrencies.

The answer to this existential question is certainly not to be found in traditional communication channels which are very short term oriented (case in point: $ETH). Similarly, an ETH peak price prediction search is not helpful neither.

We have to establish the answer ourselves by using common sense.

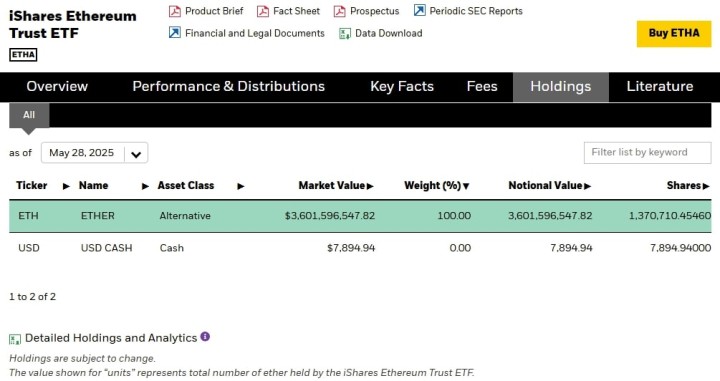

Financial institutions like Blackrock, Fidelity, and Goldman Sachs have committed billions of dollars to “buying the dip’ in Ethereum by accumulating many ETH tokens and ETH ETFs.

Ethereum – Institutional interest growing

Institutional interest in Ethereum is rising.

Even Blackrock is ‘buying the dip’ in Ethereum by accumulating many ETH tokens.

$ETH tumbles, Blackrock buys $155MM on the lows.

— zerohedge (@zerohedge) December 10, 2024

While this is very promising, and a catalyst for ETH prices over the long run, there is still a steep road for ETH to ever hit $100k. Let’s dive deeper into the scenario of Ethereum’s potential path to $100k.

Can Ethereum hit $100,000? Market cap implications.

Should Ethereum reach the $100,000 mark, its market capitalization would soar to an astounding $13.7 trillion, based on the current circulating supply. This figure is not just monumental; it is transformative.

For perspective, this would dwarf the market cap of:

- Many of the world’s most valuable companies combined;

- Surpass the GDP of all world economies (except the US and China).

Such a valuation would signify Ethereum’s transition from a digital asset to a global economic powerhouse.

‘What If’ analysis: Can Ethereum hit $100,000

The possibility of Ethereum reaching a valuation of $100,000 per unit is a scenario that is often discussed on the web. We see all sorts of opinions and ‘analysis’, from decent to speculative.

Such a monumental rise, equating to approximately a 40-fold increase from Ethereum’s current value, requires a deep dive into the implications. To understand the magnitude and feasibility of this scenario, we must analyze it through various lenses:

- Market capitalization;

- Comparison with Bitcoin;

- The temporal aspect of such growth.

We take a very structured and analytical approach to answer the question whether ETH can rise to $100k in the coming 5 years.

1. Market cap implications

A $13.7 market cap which will be the result of a scenario in which Ethereum hits $100,000 seems really unrealistic:

- First, it would reflect an unprecedented level of adoption and utilization of the Ethereum platform, far beyond what we see today. This could mean that Ethereum has become the backbone of a new digital economy, underpinning everything from finance to supply chains, and even governmental systems.

- The technical challenges of scalability, security, and sustainability would need to be fully addressed to support this level of adoption, necessitating groundbreaking advancements in blockchain technology.

The implications of a $13.7 trillion market cap are vast.

2. Comparison with Bitcoin

In this scenario, ETH to 100k, Bitcoin’s market cap would be projected at $42 trillion, assuming it maintains its current dominance, also assuming no change in the current BTCETH ratio.

This would result in a BTC price of around $2 million dollar per unit. That’s not going to happen in the next 5 years.

While Bitcoin is often seen as digital gold, a store of value, Ethereum’s positioning as a platform for decentralized applications offers a different kind of value proposition.

Ethereum’s growth to a $13.7 trillion market cap suggests a broader range of use cases and a deeper integration into the fabric of the digital economy.

3. Temporal considerations

Predicting such a significant increase in Ethereum’s value before 2030 presents a considerable challenge. The impact of technological innovations, regulatory developments, and global economic conditions over this period is highly uncertain because this scenario is so far out in the future.

Take-aways

Thus, while not impossible, the data points suggest that Ethereum to $100k is an unlikely outcome in the mid to long-term.

Looking beyond 2030, the forecast becomes even more speculative. The rapid pace of change in technology and society makes long-term predictions notoriously difficult. However, if we consider the potential for blockchain technology to revolutionize multiple sectors, the ongoing evolution of Ethereum, and its ability to address current limitations, the prospect, while still ambitious, cannot be entirely dismissed.

ETH to $100k chart implications

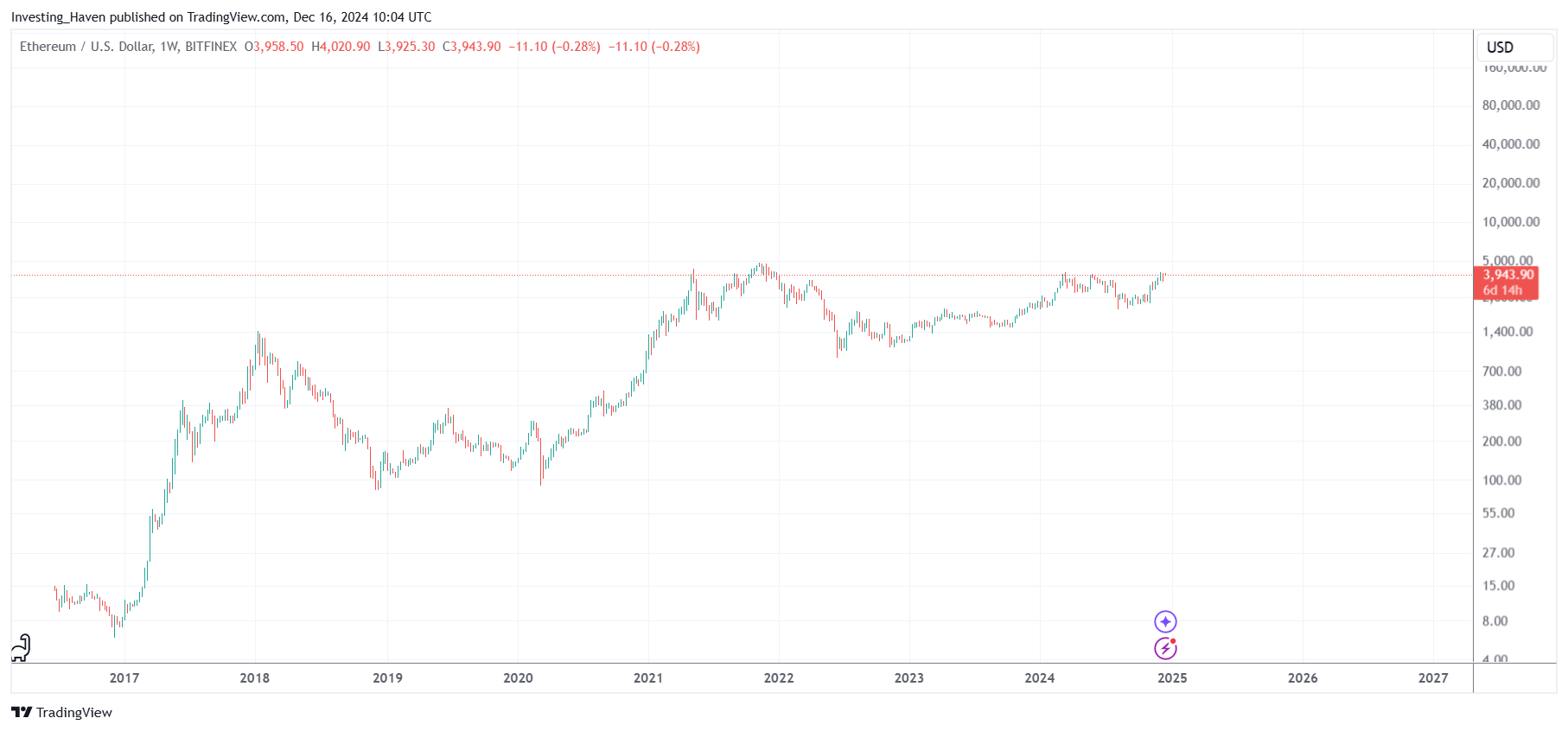

Let’s chart out the hypothetical scenario in which Ethereum hits $100k in the coming years.

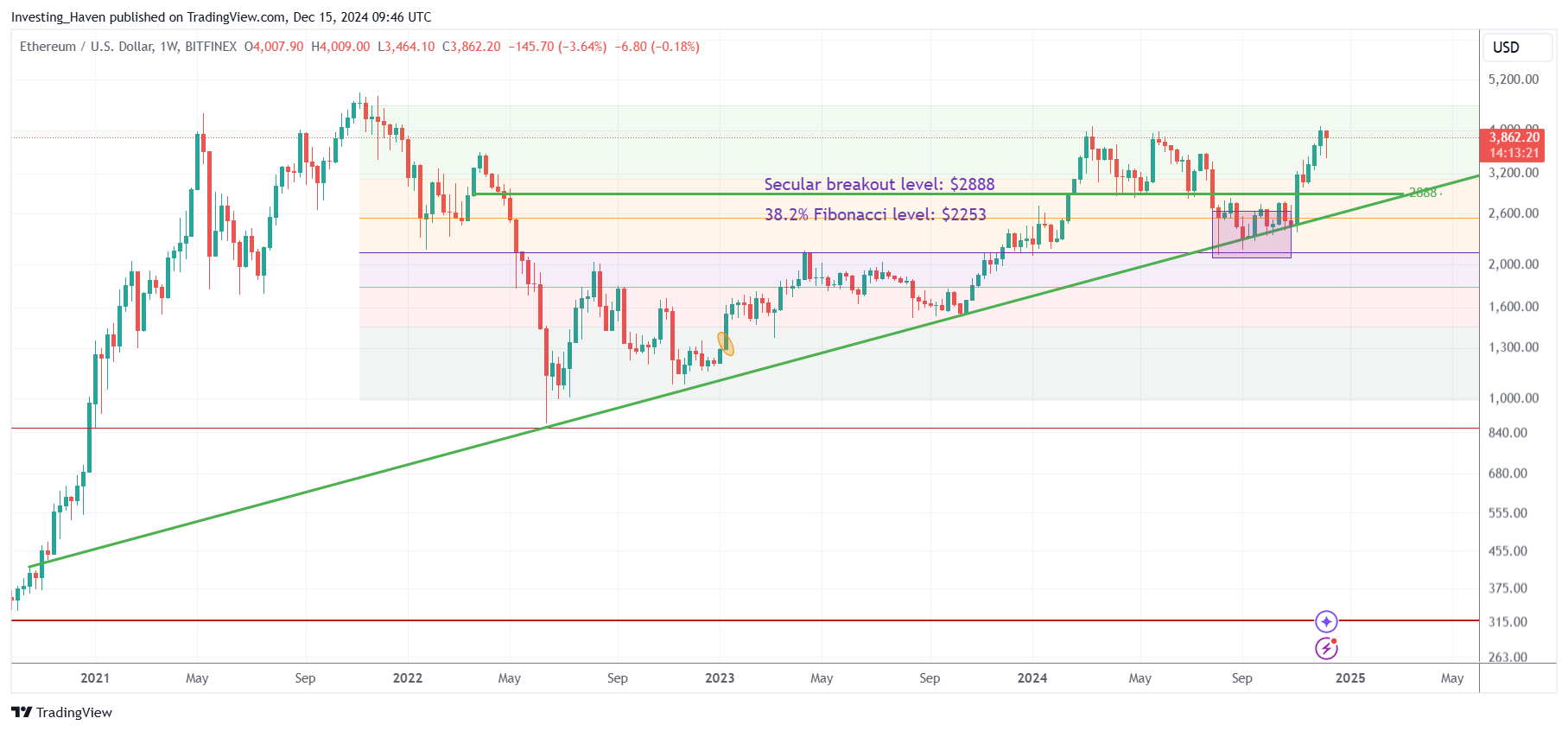

This is the current daily ETH price chart, with our projected target area for 2024.

July 2nd – While we remain bullish cryptocurrencies, including ETH, long term, the current chart setup shows why crypto investors need to remain realistic about expectations on valuations. A 3.8x rise in ETH will bring ETH to $10k, a realistic target in the not too distant future. But considering the pace at which this ETH chart is evolving, it simply is not realistic to expect $100k ETH as this would require a 38x rise from current levels.

We now visualize where the $100,000 mark comes in for ETH, see next chart. You don’t need a PhD, you can see it with your own eyes: ETH to hit $100k is very unlikely to be hit in the next 5 years, before 2030.

July 2nd – Our most recent Ethereum prediction suggests that ETH will need some time to recapture the all time high. The journey here gets especially tough when you consider the many challenges dogging its price action in the first half of 2025. Nevertheless, we remain confident that our most bullish ETH target of $10,000 will be hit in the coming 3 years provided key support levels outlined in our predictive research will be respected. But $100,000 seems a very, very ambitious level for the next 5 years.

Conclusion: can Ethereum hit $100,000?

The scenario of Ethereum reaching a $100,000 valuation and achieving a market cap of $13.7 trillion is a fascinating “What If” analysis. It stretches the boundaries of current thinking around cryptocurrency and blockchain technology’s potential.

This hypothetical scenario underscores the transformative impact Ethereum could have on the global economy, should it overcome existing challenges and fulfill the promise of widespread adoption and utility.

Crypto markets aren’t ready for such a stretched valuation. Ethereum’s chart doesn’t support moving to $100k in the coming years.

While ETH to $100,000 might happen at a certain point in time, it won’t happen before 2030, is what we confidently can say.

ETH fundamentals supportive of a $100k scenario?

The analysis discussed before was essentially a ‘What If’ analysis.

While we had clear conclusions from the ‘What If ETH hits $100k’ analysis, we still want to understand a scenario in which Ethereum rises 38x from current levels.

Ethereum is not just a cryptocurrency; it’s a platform for decentralized applications (dApps), smart contracts, and decentralized finance (DeFi) projects. The recent transition to Ethereum 2.0, moving from proof-of-work (PoW) to proof-of-stake (PoS), aims to improve scalability, security, and sustainability – key factors that could boost Ethereum’s adoption and value.

Technical advancements and scalability

Ethereum’s ability to scale and meet the growing demand for its platform is critical.

- The success of Ethereum 2.0, including the implementation of layer 2 solutions like Optimism and Arbitrum, could significantly reduce gas fees and increase transaction throughput.

- These advancements are essential for Ethereum’s long-term viability and its potential to increase in value.

From a technological perspective, it looks like Ethereum is not ready to reach a $13.7 trillion market cap, not yet.

Regulatory environment

Regulation poses a significant risk to all cryptocurrencies, including Ethereum.

- Positive regulatory frameworks could pave the way for institutional investment and wider adoption, while stringent regulations could limit growth or even pose existential threats.

- In the medium to long term, however, the lack of regulatory clarity, certainly as it relates to exchanges and trading/investing cryptocurrencies, will hold a massive inflow of capital back.

This is subject to change over time, but much more time will be needed to justify Ethereum to rise to a $13.7 trillion market cap token.

Economic and market dynamics

Cryptocurrency markets are very volatile, influenced by factors like investor sentiment, market liquidity, and macroeconomic trends.

Ethereum reaching $100,000 would not only require technological success and widespread adoption but also favorable economic conditions and market dynamics.

With so much uncertainty post-Covid, driven by inflationary fear and tight monetary policies, it is unlikely that economic conditions will ignite a tremendous bullish momentum wave in markets and crypto to justify a 38x rise in ETH.

Potential pathways for ETH to hit $100,000

For Ethereum to reach a valuation of $100,000, several factors would likely need to converge:

- Massive institutional adoption: Large-scale investment from institutional investors could drive significant demand.

- Mainstream use cases: Ethereum becoming the backbone for major applications in finance, supply chain, and beyond.

- Technological success: Successful implementation of Ethereum 2.0, leading to widespread adoption due to improved scalability and efficiency.

- Favorable regulatory environment: Supportive regulatory frameworks that encourage innovation while providing clear guidelines.

Conclusion: ETH to $100k

While the potential for Ethereum to reach $100,000 exists, it is likely many years out, at least 7 years (if not more).

With a $13.7 trillion market cap of Ethereum, if and when it hits $100k, massive changes need to occur, first and foremost fundamental, technological, regulatory. Moreover, institutions will need to be buying massive amounts of Ethereum.

We prefer to stick to our ETH to $10k target, that’s already a big one. It will happen in the coming 3 years. Let’s enjoy the ride, and not be too concerned about wild targets like ETH to $100k.