An Ethereum buy the dip opportunity might come up in 2024 provided ETH respects its 38.2% ($2,500) and 50% Fibonacci levels ($2,250). In case of a late summer ETH pullback, investors should be patient to assess Ethereum’s buy the dip opportunity.

As we approach late 2024, analysts predict a shift in Ethereum’s forecasted price trends. It may present a compelling buy-the-dip opportunity for investors looking ahead to 2025.

Ethereum in 2024

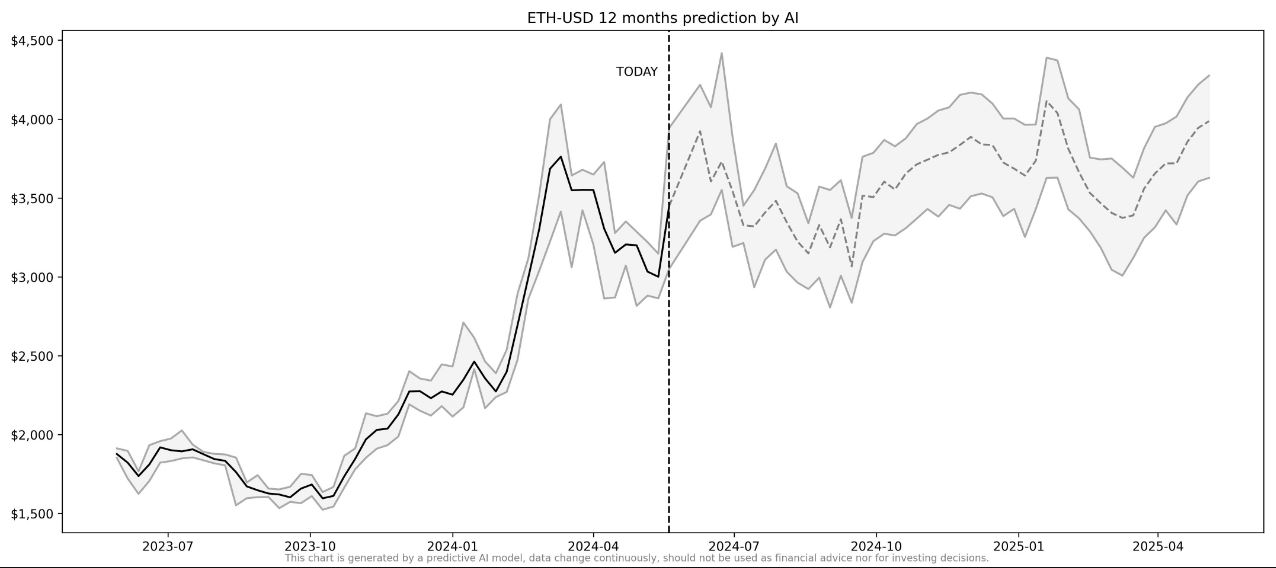

According to InvestingHaven’s predictive ETH model:

In 2024, Ethereum (ETH) is expected to see a support level at $3,007.53 and a resistance level up to $4,389.27. With an average price projection of $3.698,4, Ethereum might experience a downward adjustment from its current price, suggesting a potential buy opportunity.

On the flipside, insights from 10 industry experts suggest that ETH may need to move higher in order to be fairly priced:

Analyzing 10 top crypto experts’ Ethereum price forecast for 2024, their average forecasted price is $6962.1. Excluding a $20,000 outlier, it adjusts to $5,513.44, reflecting varied predictions. Some experts believe ETH is fairly priced currently, however most of them believe ETH should rise some 40% in order to be fairly priced in 2024.

Interestingly, crypto experts align on InvestingHaven’s ETH forecasts:

ETH may rise to $4,800 by July 2024, drop to its Fibonacci level $2,560 by October 2024. In doing so, it will create a bullish cup and handle, a buy opportunity before ETH takes off in 2025. InvestingHaven’s ETH price forecast 2025: $5,000 to $10,000.

ETH in 2025

As the year 2025 unfolds, Ethereum’s price is projected to stabilize, maintaining its 2024 support level at $2,163.33. An incremental rise is expected before summer of 2025 indicating a recovery phase.

Interestingly, the chart generated by one of the most accurate predictive crypto algorithms. Although not generated by a human, but calculated by AI based on 10-years of historical price data, it is clear to the human eye that this expected price structure is creating a bullish reversal.

This underscores the importance of considering 2025 as a strategic point to ‘buy the dip.’

InvestingHaven’s forecaster confirms ETH’s outlook

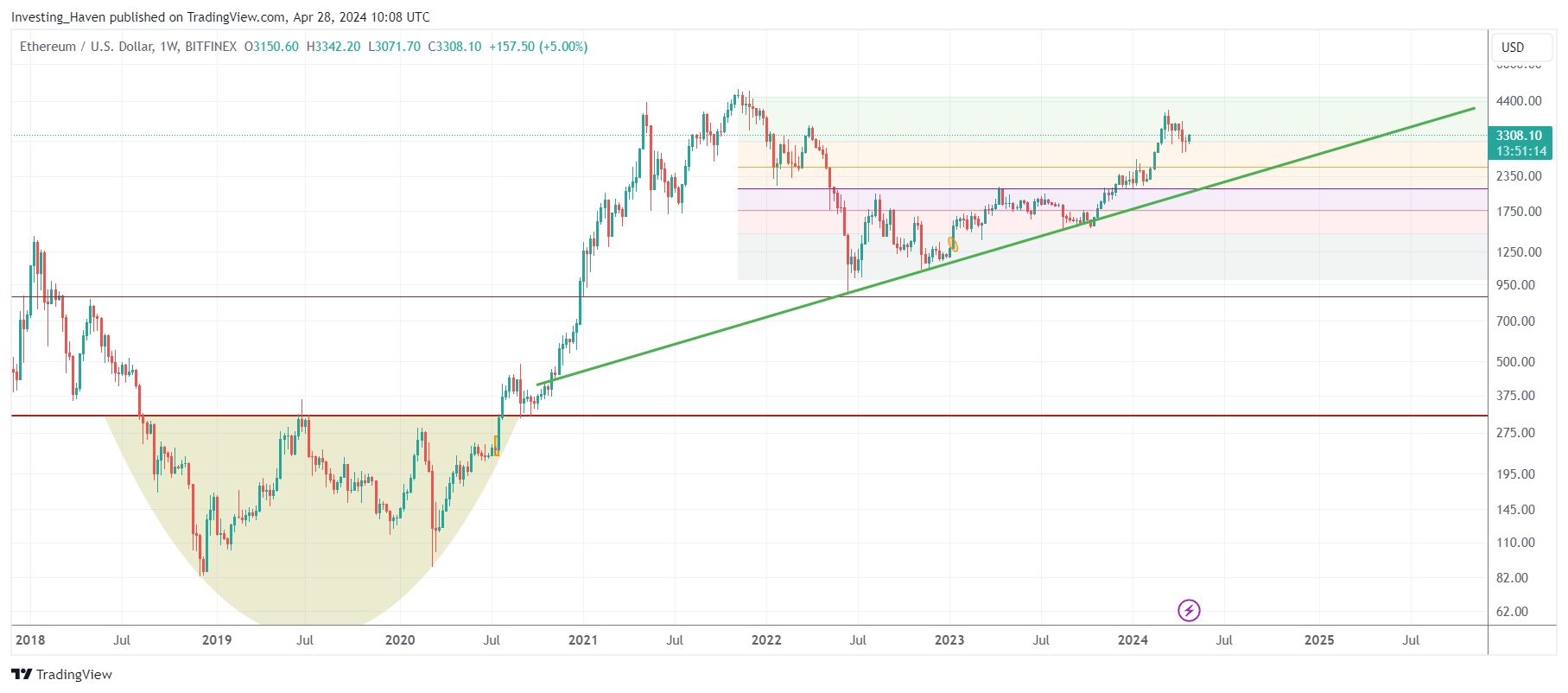

The analyst at InvestingHaven confirms the buy the dip expectation, and adds to it that the long term rising trendline on Ethereum’s chart has to hold.

If so, the setup on the long term chart is likely going to qualify as an epic cup and handle formation which is a very bullish pattern. The outcome of this pattern, in 2025, will likely push ETH well above its former ATH. In fact, InvestingHaven’s analyst predicts that IF the cup and handle materializes properly a potential bullish target of ETH $10k is achievable in the period 2025-2026.

Ethereum buy the dip underway?

For investors, understanding the price dynamics of Ethereum between 2024 and 2025 is crucial.

The late 2024 anticipated dip could be viewed as a reaction to market adjustments or broader economic factors impacting the cryptocurrency landscape. However, the stability in Ethereum’s price in the first half of 2025—coupled with the bullish impact on its chart—suggests that the market sentiments are favorably aligned for recovery.

The concept of ‘buying the dip’ is centered around purchasing an asset when its price has dropped, with the expectation that it will increase in value later. For Ethereum, the late 2024 dip presents such an opportunity, especially when analyzed in conjunction with the expected stabilization and modest growth in 2025.

Investors should closely monitor Ethereum’s chart pattern as it nears its support levels and consider whether it aligns with their risk tolerance and investment timeline.

Conclusion

In conclusion, while the dip in late 2024 might seem unfavorable, it potentially offers an epic buying opportunity for those looking to capitalize on the cyclical nature of cryptocurrencies.

By 2025, the gradual price recovery of Ethereum could well reward those who strategically position themselves during these lower price points. The answer to the question “how profitable can the buy the dip opportunity become” will entirely depend on how ETH will behave around key support at $2,250 and $2,550, and how accurate the cup and handle formation will become.

Follow our premium work to receive timely crypto alerts in 2024 and 2025 >>