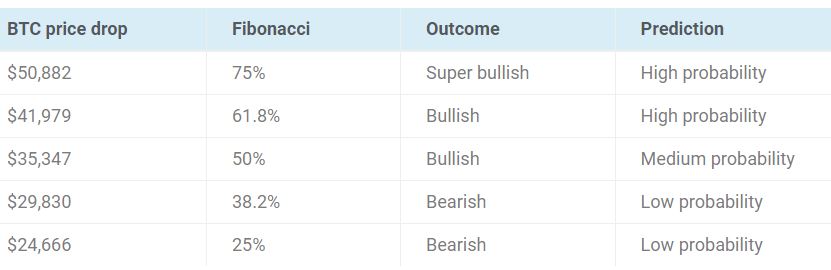

If weakness in Bitcoin continues, the market will be decisively on a path push Bitcoin to support which will likely coincide with one of its Fibonacci levels: $50,882, $41,979, $35,347.

Related – Bitcoin price predictions

Bitcoin’s price weakness should be looked at in two ways: a potential downtrend vs. regular soft retracement, potential levels to which the Bitcoin price may drop.

Bitcoin price – trendline violation

First and foremost, what matters is the question whether Bitcoin’s weakness is pushing BTC into a downtrend vs. a soft pullback.

At this point in time, BTC’s price drop qualifies as a pullback.

But it will become a downtrend once the current rising trendline is broken to the downside.

As explained in great detail in our premium crypto alert, in particular this week’s edition Bitcoin ‘In The Box’ Now, As Expected; This Might Be Its Next ‘Stop’ For September, any market and any cryptocurrency typically initiate a downtrend after 3 rising trendlines are violated.

Based on the chart shown below, a chart typically shared in our premium crypto research service, the 3d and last rising trendline should hold. If not, Bitcoin will start a downtrend for an undetermined period of time (it might take weeks, months or quarters).

Chart – TradingView

Bitcoin price drops – potential support

How low can Bitcoin drop?

We covered this topic in great detail in our Bitcoin predictions research section.

The short version – these are the Bitcoin price drop levels: $50,882, $41,979, $35,347.

Bitcoin price weakness suggesting $44k underway?

If we now add the longest term Bitcoin bull market trendline, in green, shown below, we see that Bitcoin’s rising trendline will cross $45k late summer 2024.

If you believe that Bitcoin might get volatile, initiate a downtrend that will last two to three months, you might reasonably expect BTC to drop to the $44k area. This, believe or not, would be a bullish support level as that’s where the longest term bull market trendline comes in.

In our premium crypto research service, we will provide extensive coverage as BTC heads into what we expect to be the summer dip. More importantly, we will be on the lookout to find relative strength which might be future 10-baggers (think 2025).