For years, Web3 enthusiasts spoke about breaking the large cap Bitcoin correlation. Practically all altcoins are positively correlated to Bitcoin, meaning that markets rise and fall in line with the world’s first cryptocurrency. Correlation is measured between -1.0 and +1.0.

See related: What Happens When BTC Dominance Goes Below 50%?

A score of +1.0 means that an asset completely moves in tandem with Bitcoin, while a score of -1.0 means that a crypto asset moves 100% in the opposite direction. The correlation is typically somewhere between +0.5 and +0.9 but will be different if there is a breakout, for a given period.

Why break the bitcoin correlation?

The reason why many proponents wished to break the correlation was to usher in a new, organic, decentralized economy that was not the sole domain of the financial marketplace. Instead of trading for profits, coins would have real utility based on their merit and their specific use cases.

It would demonstrate that the industry itself has much to offer. The correlation between Bitcoin and other assets was also a factor in asserting the sovereignty of Web3.

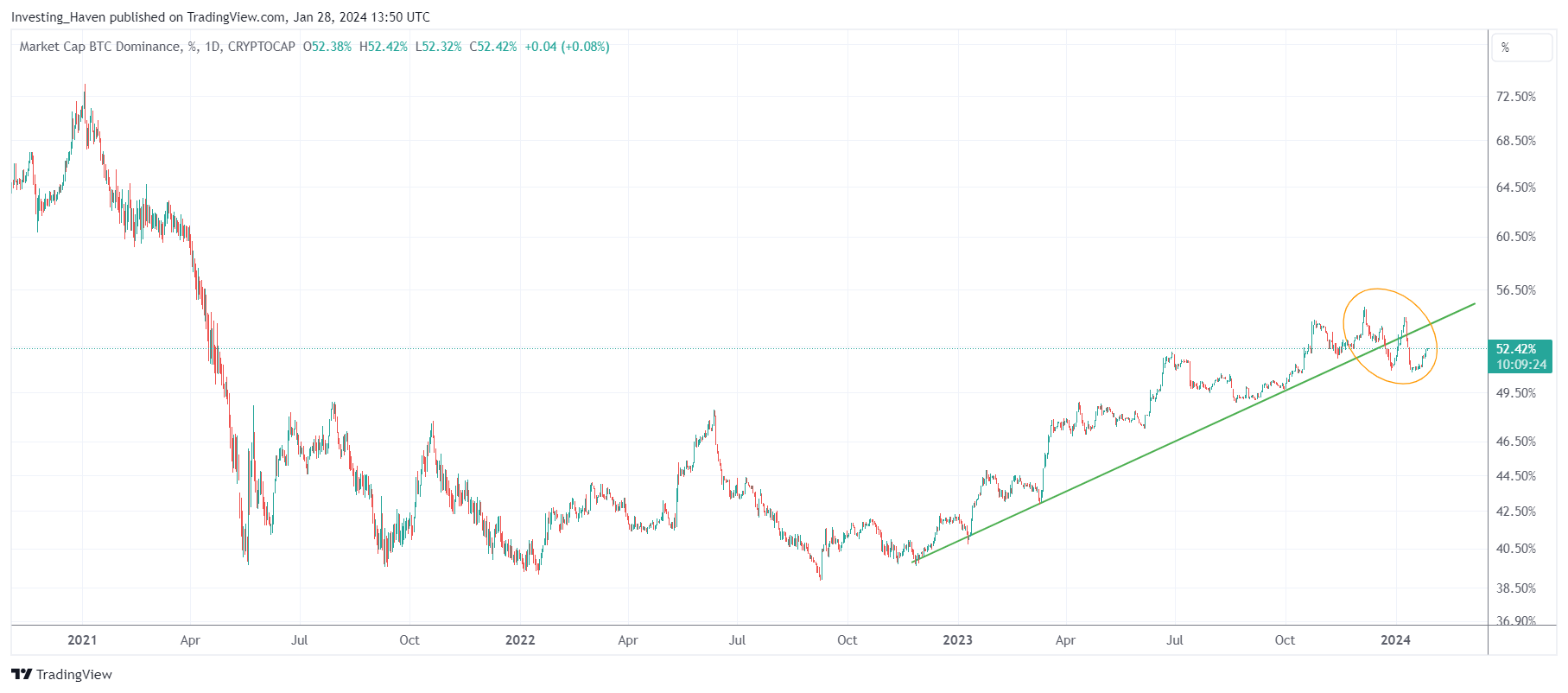

Ironically, in true contrarian fashion, just when nobody is interested in the idea anymore, it actually happens. Large cap dominance, which includes both Bitcoin and Ethereum, is now fading. 2024 is indeed the year of the asymmetric returns in altcoins.

Previously, winners had to be chosen carefully for breakouts, or entered in the ICO stage. Other than that, you could invest in most coins and they would rise or fall if Bitcoin rose or fell. This is not the case in 2024, which is a hidden bull market in disguise.

Picking the small cap crypto winners

Due to the fact that returns in crypto will be far less uniform in 2024, coins have to be selected much more carefully. However, the long-term potential of large cap crypto like Ethereum remains bullish.

We still think ETH is going to $10K, nearly 5x at the time of this writing. Though 2025/2026 is the year this is likely to occur. Certain segments might do better than others, but specific coins have to be selected within this industry for optimal rewards.

Even better opportunities are revealed in our premium charting service, with returns of up to 10x – 50x, in a shorter time frame. Small and micro cap crypto (less than $50M) are more likely to generate these returns.

IH has a dedicated charting service designed specifically to pick out small cap crypto winners based on chart analysis. While the majority of online reports and crypto media have no skin in the game, our recommendations are tailored to our premium services. We like to win, and focus on what actually matters.

Another critical element to keep in mind is that you might not make money if Bitcoin or Ethereum rises in the new market. The lack of price correlation means individual crypto assets can go their own way. The crypto market might more closely resemble the traditional financial markets, requiring far more savvy.

What to expect in 2024

2024 is going to be an exciting year for the evolution of crypto. We could finally see a much looser correlation between large and small cap crypto, happening when few expect it to.

Markets do this quite often. It’s very important to filter out all of the noise and focus on the expert analysis if you want to thrive, not merely survive, in this hidden bull market.

There will be winners in 2024, and it’s likely to be the small cap tokens, revealed in our premium service.

Disclaimer: This is not financial advice. Please consult with a licensed financial advisor prior to making any investments.