The price of Stacks (STX) is in a long term positive uptrend. That’s why the medium term STX price prediction is $5 to $10 with a peak price around $21.

Stacks (STX) is a layer 2 protocol that uses Bitcoin as the base layer. As an additional layer on Bitcoin, it adds increased functionality through smart contracts and offers the potential of Bitcoin scalability.

Stacks might appeal to many cryptocurrency diehards as it upholds the original values of Bitcoin while dealing with many of the main criticisms – that Bitcoin is slow, costly, and with limited functionality. Stacks has its own blockchain and allows for decentralized applications on Bitcoin.

RELATED – Can Stacks (STX) Ever Rise To $66?

This guide will outline a Stacks price prediction for 2024, 2025, and 2026. Some analysts are contending that it could hit $66, though we have a more conservative (realistic?) estimate of an ATH nearing $21 around 2026. Presently, it trades for about $1.60.

Stacks – an overview

In a nutshell, Stacks extends the Bitcoin network with a faster execution layer, offering smart contracts for Bitcoin. Older blockchains focus on security and decentralized while modern blockchains focus on scalability. This is known as the blockchain trilemma, where only two of the three attributes (security, scalability, decentralization) can be acquired.

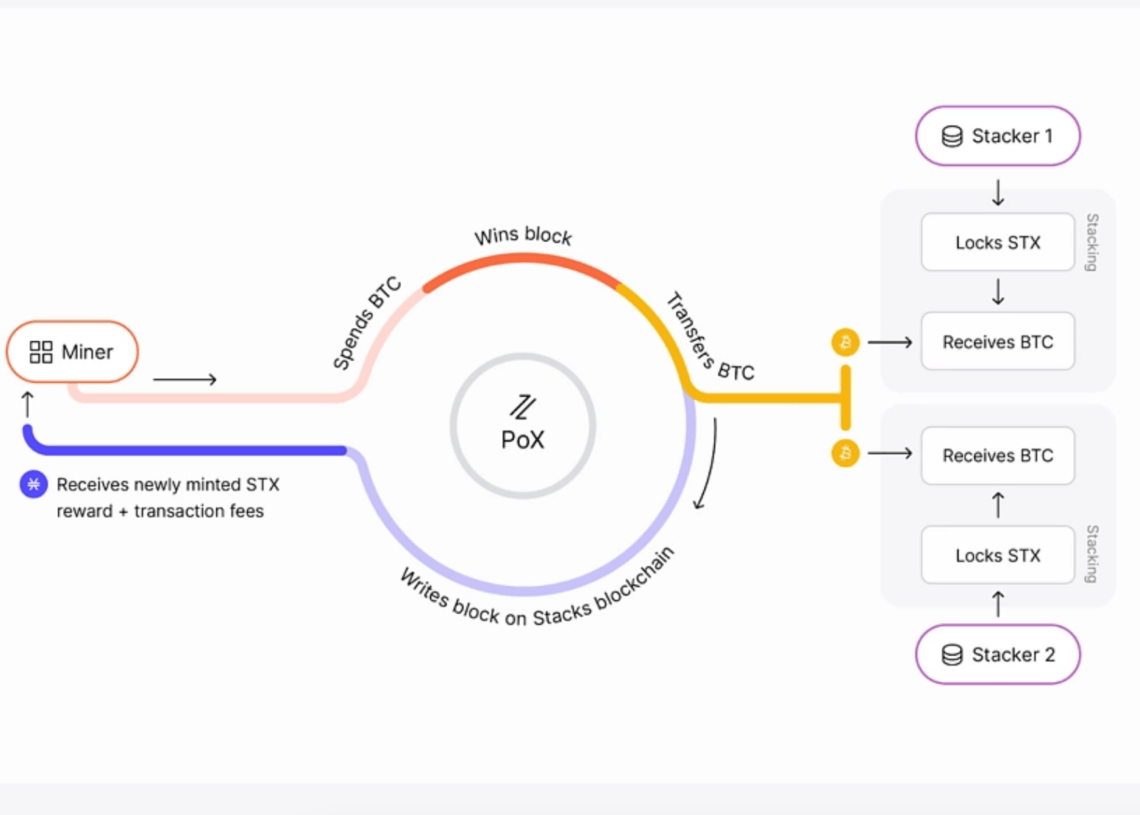

With stacks, transactions are published to the older Bitcoin blockchain, in a proof of transfer (POX) consensus mechanism. POX chains are anchored to a proof of work (POW) chain for increased security but better functionality.

It’s different from the Bitcoin Lightning Network as it expands the functionality of Bitcoin, as opposed to making it scalable. Noteworthy projects building on Stacks include Alex, StackingDAO, Velar, Zest, Hermetic, Bitflow Finance, and Uwu protocol.

Stacks brings DeFi and NFTs to the Bitcoin blockchain. While Ethereum offers wrapped Bitcoin (wBTC) on its network, Stacks has its own token on its own network- sBTC. sBTC is what will be used to access the billion-dollar DeFi money markets.

Stacks brings DeFi and NFTs to the Bitcoin blockchain. While Ethereum offers wrapped Bitcoin (wBTC) on its network, Stacks has its own token on its own network- sBTC. sBTC is what will be used to access the billion-dollar DeFi money markets.

The STX token can be staked, with rewards paid out in Bitcoin. Stacks halves every four years, just like Bitcoin, with similar tokenomics. The Bitcoin halving event is also coming up this April, which might prove bullish for the market.

Bitcoin’s blossoming ecosystem

A bullish Stacks (STX) price prediction requires a growing ecosystem, as a minimum requirement.

Bitcoin has traditionally been associated with the leading indicator characteristic, representing the general direction of the crypto market.

Ethereum has been holding the top spot in functional innovation. It’s on Ethereum’s network, primarily, that new innovative trends came to life: ICOs, NFTs, Layer2, and so on.

That’s changing now. Stacks is one of the leaders in the space of what we would call ‘the Bitcoin ecosystem.’

Bitcoin’s blossoming ecosystem 🧡

The Bitcoin L2 Report by @TheSpartanGroup shows a snapshot of all Bitcoin apps. Today, we’re discussing the latest news around these apps with @TychoOnnasch @philiphacks @ALEXLabBTC & @kyleellicott

Starting in 1 hour 👇https://t.co/p6wefck3GR pic.twitter.com/d87raYp5YK

— @Stacks January 23, 2024

Stacks price prediction: summary

The Stacks ecosystem is growing. With a positive long term BTC forecast the expectation for Stacks is to follow on Bitcoin’s path, higher. That’s why we conclude the following:

Stacks (STX) price forecast for the coming years:

- 2024: STX price prediction of $2.

- 2025: STX price prediction of $5.

- 2026: STX price prediction of $10.

- 2030: STX peak prediction of $21.

Let’s break it down, looking at charts which helped us get to this forecast.

Chart analysis – Stacks price prediction

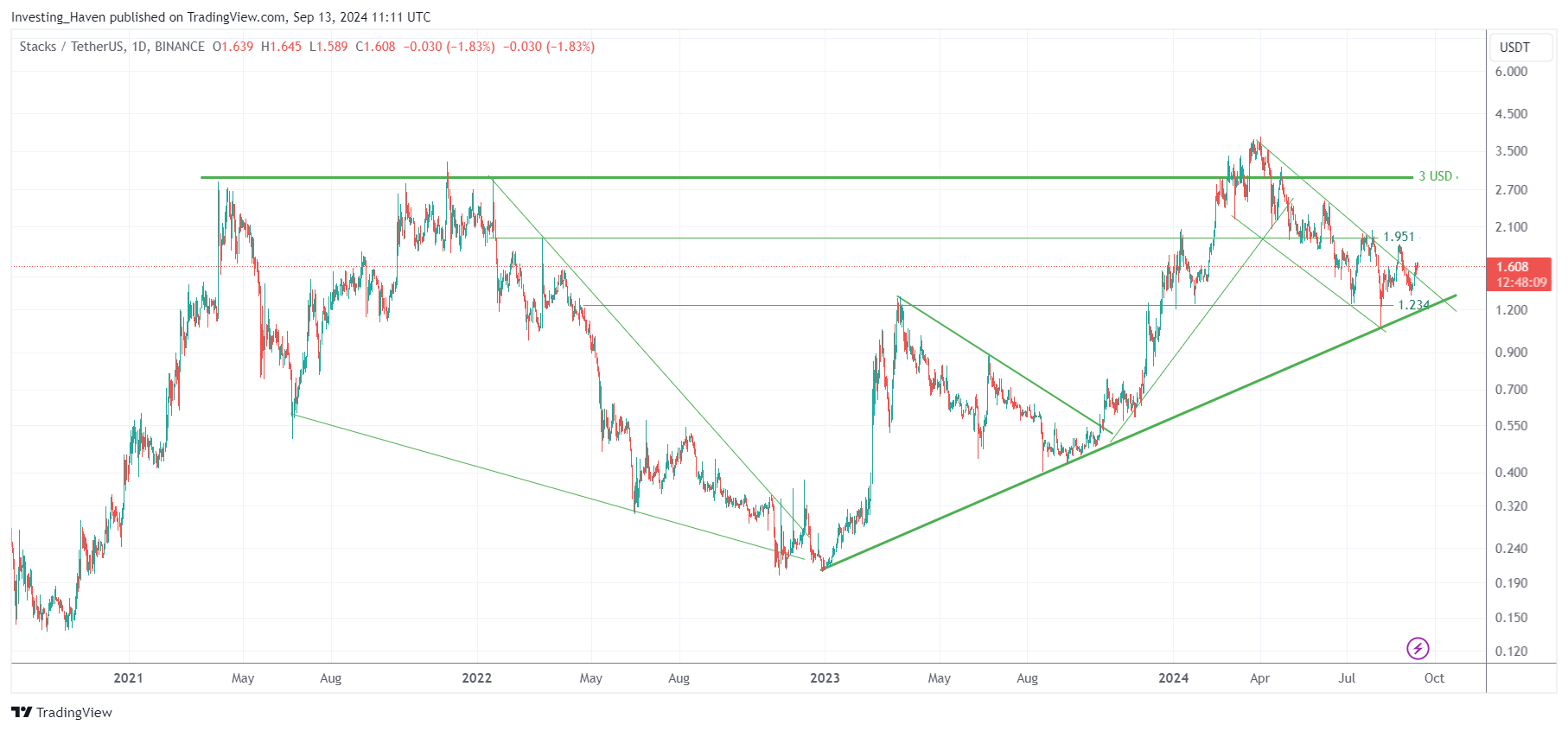

Stacks fell back to $1.23, former resistance became support, which is absolutely great. This setup sets the stage for a rally in 2025, hit and exceed all-time high in 2025, continue moving higher in 2026.

There is certainly a bullish pattern emerging on the Stacks daily chart.

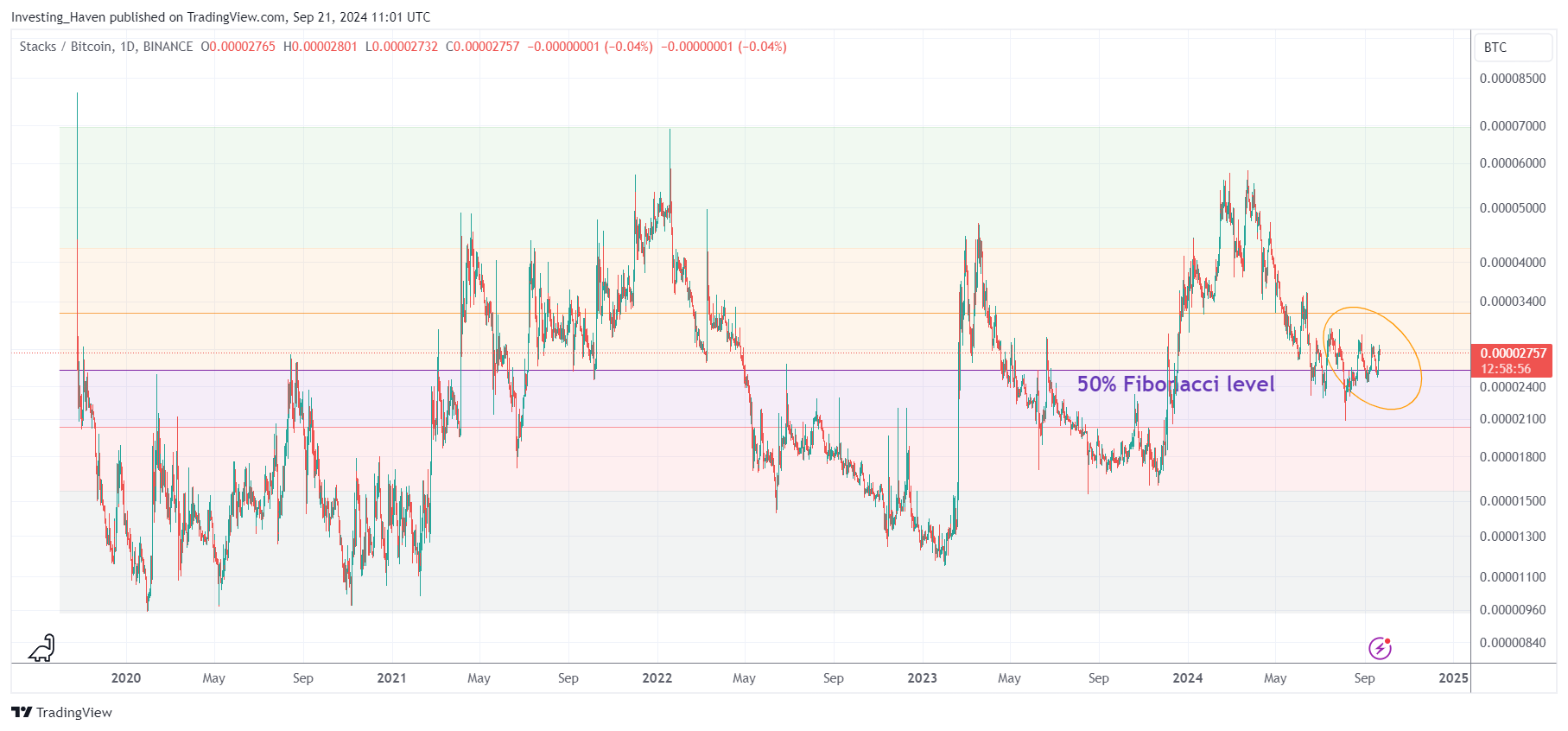

The STXBTC weekly chart (long-term view) has a very long-term strong W-reversal. This confirms the previously made points and STCBTC will go higher in 2025/2026, after STXUSD completes a pullback followed by a bullish reversal.

Stacks fundamentals vs. Stacks price forecast

One important topic for crypto investors is how fundamentals influence price.

Similarly, how does our fundamental Stacks overview impact (influence?) our Stacks price forecast?

It is very simple: strong fundamentals tend to influence price during what we call ‘bullish windows.’ It should go without saying that prices tend to rise when circumstances are bullish. The tokens with strongest fundamentals tend to move higher.

Combine this with our ‘hidden bull market’ forecast, and you have a great combination of Stacks fundamentals acting as a catalyst during bullish time windows.

That’s why we believe that our Stacks price forecast will be fulfilled, though long term. We see great Stacks. Stacks is a leader in a new mega trend: Bitcoin’s ecosystem. Our Stacks price forecast for 2024, 2025, 2026 will eventually be fulfilled.

InvestingHaven’s premium service

At Investing Haven, we set ourselves apart by combining both time and price, taking wider crypto market cycles into account to find optimal entry and exit points.

We recommended STX at $0.55 before a 400% price increase in 2023.

The premium crypto research service offers a breakdown of tokens. It discusses the rationale behind the recommendation, and specific entry and exit points for investors. It provides precise information for those looking for premium insights into the wider cryptocurrency arena.

Stacks price prediction 2024, 2025, 2026

We are long term bullish on STX. We believe that $21 is a very bullish target as well as a realistic target. That’s more than 10x against its current price (last update Oct 2024).

Stacks (STX) price forecast summary:

| Year | STX price prediction |

|---|---|

| 2024 | $2 |

| 2025 | $5 |

| 2026 | $10 |

| 2030 | $21 |

The $21 peak price prediction, a price point potentially to be hit somewhere before 2030, in the very best case, would represent a 100x increase from STX lows in 2022. A bull market top is to be expected in this time range.

Disclaimer: This is not financial advice. Please consult with a licensed financial advisor prior to making any investments.