As it stands, a Solana (SOL) breakout is in the making, specifically since January 16th, 2025.

In our Solana predictions for 2025 we write, in great detail, about our Solana predictions:

In 2025, Solana’s bullish cup and handle pattern is forecasted to resolve higher. SOL should find support around $166 and hit resistance at $555. Realistically, Solana can go as high as $750 in 2025.

Understanding when Solana (SOL) might break out involves closely monitoring several key factors.

Analyzing these data points allows anyone to better predict the timing and likelihood of Solana reaching new heights.

SOL to new ATH?

Here are 7 points to take into account when forecasting whether SOL will break out to print new ATH.

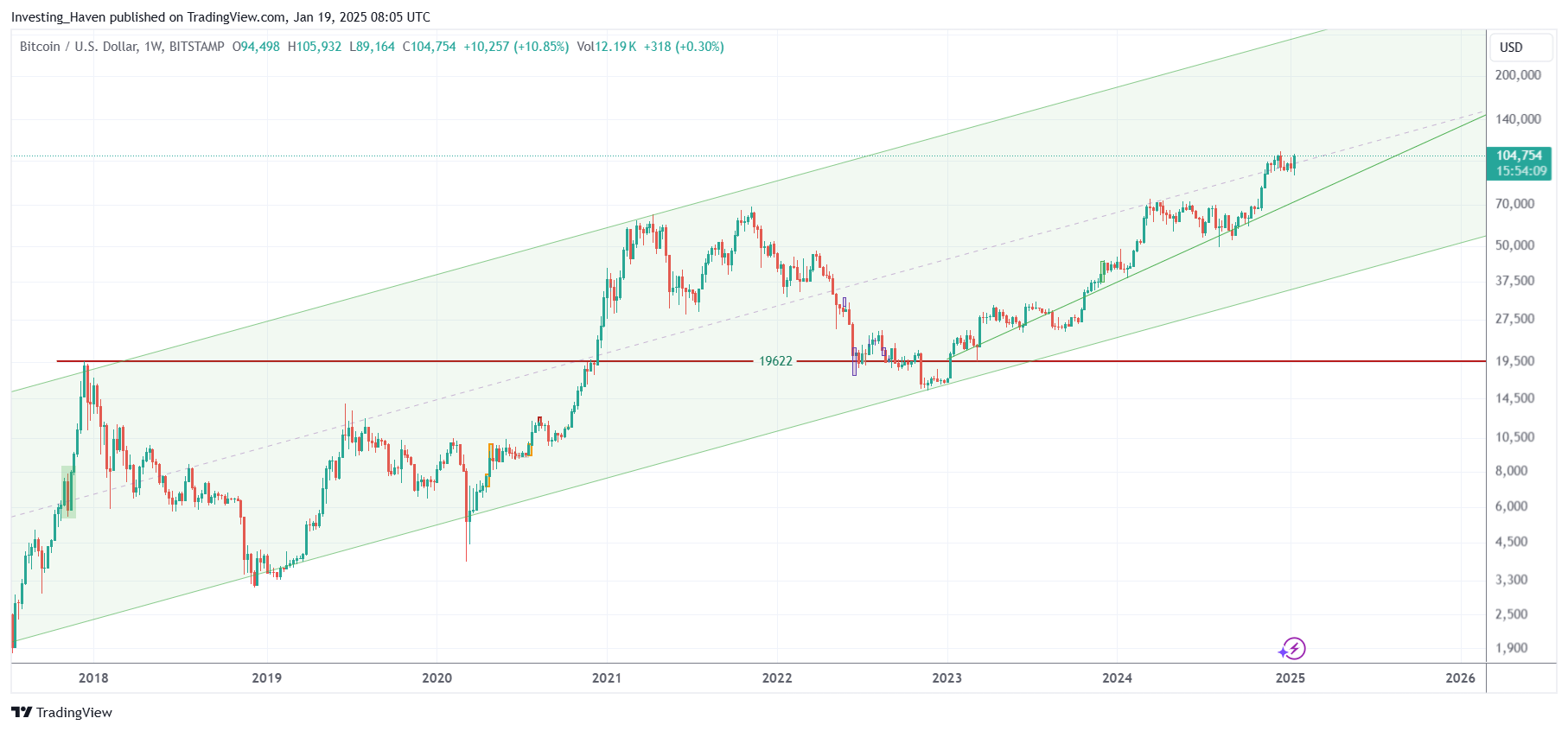

1. A Solana breakout requires Bitcoin’s secular uptrend to remain intact

Solana’s breakout heavily depends on Bitcoin’s momentum.

As noted:

For Solana to move higher, Bitcoin needs to continue its upward trend.

Bitcoin’s performance acts as a barometer for the entire crypto market.

When Bitcoin exhibits a long-term uptrend, represented by its rising channel on weekly charts, it creates a conducive environment for Solana to follow suit.

January 19th – The weekly BTC chart features a long term channel. Solana requires BTC to continue moving within this long term channel; an uptrend continuation in BTC will confirm that a Solana breakout is going to be a matter of time (when, not if).

2. Market dynamics: Bi-furcation in crypto markets

The current bifurcated state of the crypto market plays a significant role.

We are in a bifurcated crypto market where not all tokens participate in the upside.

While Solana has performed well, there is no consistent uptrend among all altcoins.

The key is for Solana to reset while maintaining its strong fundamentals and favorable chart patterns.

Since 2023, we have been forecasting that the crypto bull market would be highly bi-furcated. This implies that many tokens do not rise amid strength in BTC. This feels awkward, as a market participant, but it’s the new normal.

RELATED – Can The Price Of Solana (SOL) Ever Hit $1,000?

For Solana to continue to do well, amid bi-furcated crypto markets, it should foster its great fundamentals and continue to move in a long term bullish chart reversal.

3. Solana’s bullish reversal pattern

One critical chart structure to watch for is a bullish reversal.

For a positive outcome, Solana’s chart structure should show a bullish reversal.

This reversal pattern, similar to the one between 2022 and 2024, indicates potential for upward momentum. Specifically, the recent mini cup and handle structure is sending a strong bullish signal (January 2025).

January 19th – Below is the bullish reversal that SOL created in the last 36 months. This is bullish, and a SOL breakout to new ATH seems a matter of time.

4. Key support determined by one important weekly candle

Solana’s ability to hold specific support levels is crucial.

The critical level to watch is around $85.

Solana dropped to $120, in 2024, and this level did hold.

January 19th – Below is the SOL chart published mid-2024. We wrote: “The key to a Solana breakout in the future is that the weekly candle depicted on the chart must be respected, at all times.” It did, which bodes very well for 2025!

5. Periods of uncertainty

In 2024, we made the point that Solana would enter a “Twilight Zone” period of uncertainty, especially in the last part of the year.

If Solana respects the key support level, we may enter a ‘Twilight Zone’ period of uncertainty, characterized by a battle between bulls and bears.

Solana did an amazing job respecting support during the 2024 Twilight Zone period.

Impact – strong bullish potential in 2025.

6. Ripple vs. SEC matters also to Solana

The legal battle between Ripple and the SEC also impacts Solana’s breakout potential. This is what we wrote in 2024:

If Ripple wins against the SEC, it would be favorable for Solana, reducing regulatory risks.

Conversely, an SEC victory could pose challenges for Solana. Monitoring this case is essential, as its outcome will influence Solana’s regulatory environment and market confidence.

Remember, the SEC sued Solana, saying it is an unregistered security. Solana wants Ripple to win the case, to set a precedent, supporting the case that SOL is not a security.

Impact – with a Ripple victory, Solana is one of the beneficiaries. This underpins the thesis that a SOL breakout is likely going to materialize in 2025!

7. SOL breakout: Validation

To anticipate a breakout, certain validation points must be met:

- Solana must stay above $30, preferably also above $85 > check

- Bitcoin should remain in its long-term rising channel > check

- The SEC should lose its case against Ripple > check

January 19th – These conditions created a strong foundation for Solana’s breakout in 2025. Growing adoption in 2025 is underpinning a SOL breakout.

Conclusion: Solana breakout?

In conclusion, with all data points mentioned above, a SOL breakout in 2025 is the highest probability outcome.