There is a lot of fear for a decline in the Ethereum price. While the expectation of a drop is justified, confirmed by our latest Ethereum outlook research, it would not be a bad thing. Here is why an Ethereum price drop could be very bullish, long term that is.

Related – Can Ethereum Hit $100,000? An In-depth Analysis.

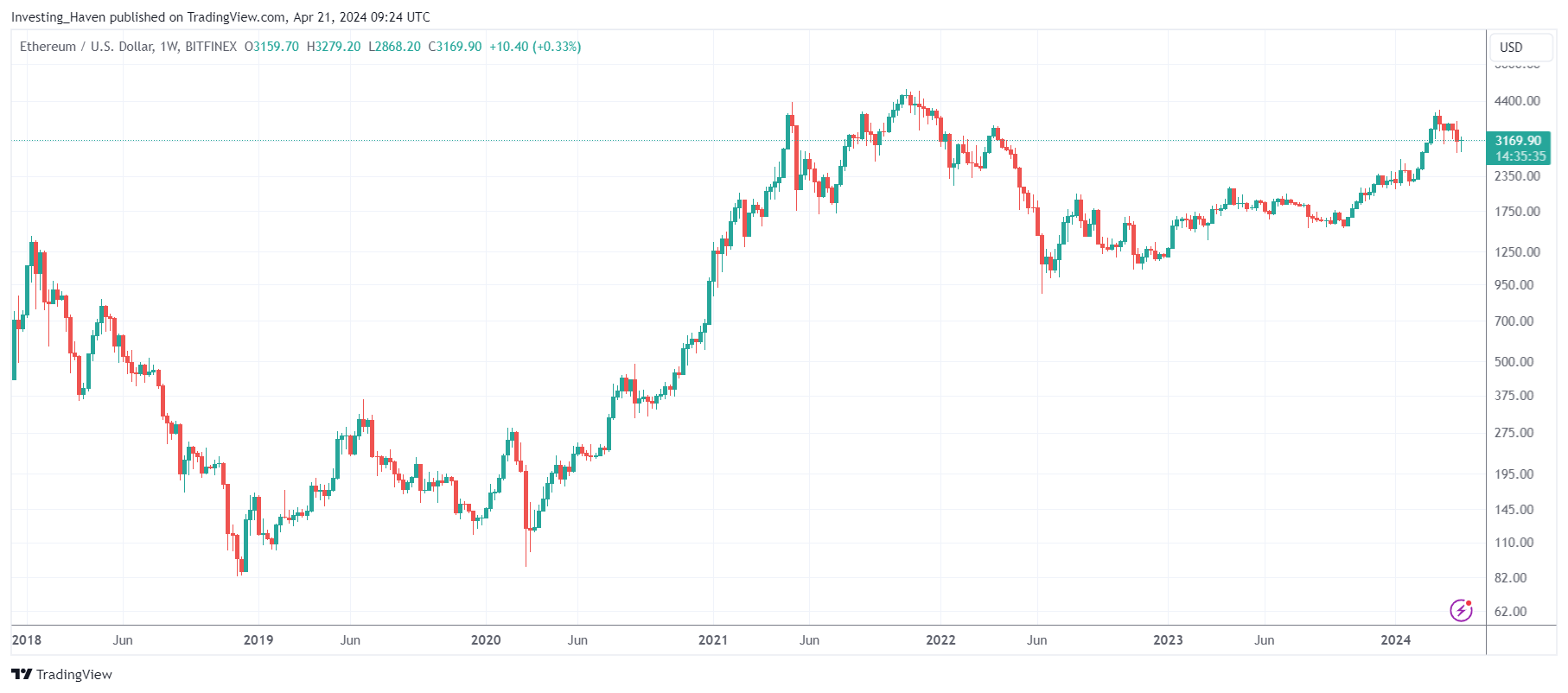

The way to think of financial markets, Ethereum being no exception, is in terms of structures. Particularly, chart structures with areas defined by support and resistance is the most simplified way to approach financial market analysis.

Ethereum’s 2024 support and resistance

We highly recommend not getting lost in the wild wild west of social media. Check this, it’s pure noise.

Everyone has an opinion nowadays. Those who are able to collect lots of likes seem to be the smartest in the room. Very often it’s the exact opposite.

In order to understand the investment opportunity for Ethereum, we do the simplest possible thing, i.e. zoom out and remove all annotations.

Below is the weekly chart, no trendlines nor annotations.

What do you see? How does it compare to the pattern in 2019?

There is tons of resistance even if ETH would rise to $4400. There is amazing support right above $1750, arguably in the $2200 area.

In case ETH drops in the coming months, it could be setting a gigantic cup and handle pattern. That’s not bullish, that’s a very bullish pattern!

From our ETH predictions page:

InvestingHaven’s Ethereum price forecast for 2024 is based on the bullish cup and handle chart formation. ETH should drop to its 50% Fibonacci level $2,250 in order to be bullish. A drop to $2,250 should offer an epic buy opportunity in 2024.

Ethereum’s 2025 chart pattern

As explained above, the $2250 area is a key Fibonacci level.

Now, what follows may be counterintuitive to most, but it’s a reality – a drop may not feel good, but a drop to specific levels may be very good!

Provided Ethereum respects $2250, on an 8 to 13 day closing basis, it will come with a very bullish outcome in 2025.

A bullish cup and handle formation, which is what we forecast will be the outcome in case of an Ethereum price drop, has the intention to move much higher than resistance. For ETH, we expect a breakout to ATH, with targets well above former highs.

From our Ethereum predictions page:

InvestingHaven’s top analyst has a very bullish ETH forecast 2025. If the area $2,050 to $2,300 holds strong on a 3-week closing basis, ETH will resolve higher in 2025. The current long term bullish chart pattern has bullish targets in the $5,000 to $9,000 area provided support is respected.

Invalidation considerations

Now, there is always the possibility of an invalidation. In the case of ETH, what if it continues to rise to $5000 in 2024?

We don’t see this happening, there is not enough momentum in markets.

Moreover, a rise to $5000 would qualify as a breakout, so the targets in that scenario would be much higher.

It’s one thing to rise to $5000, it’s another thing to continue to rise well above $5000.

A rise to $5000 will be confusing for investors and traders alike – which decision do you take at $5000 in 2024?

However, with a cup and handle formation, a rise to $5000 (which we anticipate will occur in 2025) will be very bullish. The take-away: it will continue to rise well above $5000.

When does our bullish cup and handle forecast invalidate? If ETH will have risen well above $5000 by Sept of 2024. Unlikely to happen, also not good, long term, if it would happen.