In the ever-changing world of financial markets, staying ahead of trends and predicting future movements is vital… and equally challenging. In our role as financial market forecasters, we strive to provide investors with accurate and data-driven analyses to navigate the complexities of the market. In this article, we focus on a powerful leading indicator – the NYSE Composite Index, a broad basket of stocks with a significant representation of value stocks. We will explore its chart in detail, revealing insights that bode well for the remainder of 2023 which is consistent with all our 2023 forecasts. Furthermore, this indicator confirms the enduring dominance of market rotation, a crucial market forecast and dynamic informing investment strategies in the current landscape.

Readers interested in better understanding methodology are recommended to read: The Rule of Three and Your Investing Methodology.

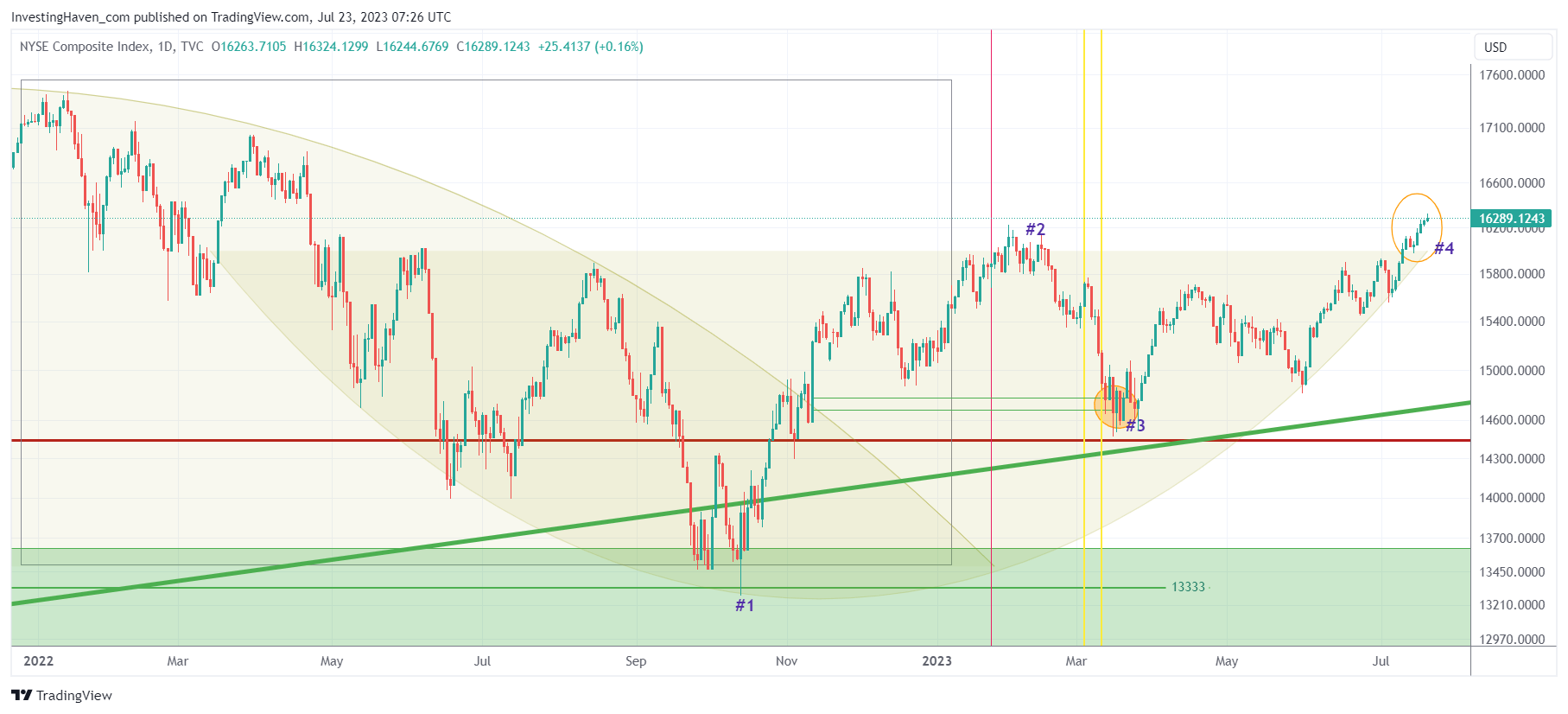

Analyzing the NYSE Composite Index Chart

The NYSE Composite Index, comprising a diverse range of stocks and weighted towards value stocks, serves as a robust representation of the overall stock market. A detailed analysis of its chart offers essential insights into its current and future performance.

As observed from the chart, the NYSE Composite Index is displaying relative strength, indicating that it is outperforming other major indices. This relative strength showcases the resilience of the broader market despite potential challenges. The sustained positive trajectory of the index indicates a positive outlook for the remainder of 2023. Needless to say, this is a critical 2023 market forecast.

NYSE Composite Index as a Leading Indicator

The NYSE Composite Index’s relative strength positions it as a leading indicator for future market trends. As a broad representation of stocks, it provides a comprehensive view of the market’s health and potential direction. Its favorable performance bolsters confidence in the market’s ability to continue its upward trajectory.

Confirmation of Market Rotation Dynamics

Market rotation, a prominent feature since 2022, continues to play a significant role in shaping the investment landscape. The NYSE Composite Index’s robust performance further confirms the enduring nature of market rotation. This dynamic signifies that specific groups of stocks will continue to make significant moves while others remain relatively stagnant. Investors can leverage this insight to strategically allocate their investments, ensuring they stay patient with quality portfolio positions throughout 2023.

2023 Market Forecast Implications

The NYSE Composite Index’s favorable chart and relative strength act as a positive signal for the remainder of 2023. Investors can interpret this as an encouraging sign of potential market growth. Moreover, its confirmation of market rotation dynamics allows investors to identify potential winning sectors and industries. Understanding the dominant rotation trends empowers investors to make informed decisions and adapt their strategies accordingly.

Conclusion

The NYSE Composite Index, acting as a leading indicator, serves as a guiding light for investors in financial markets. Its relative strength and favorable chart signal a positive outlook for the remainder of 2023. Moreover, its confirmation of market rotation underscores the importance of strategic allocation and patience with quality portfolio positions.

As forecasters, we recognize the significance of such indicators in predicting market trends and guiding investment decisions. The insights from the NYSE Composite Index suggest that some exciting opportunities lie ahead in 2023, that being selective is imperative and that being patient might make a world of a difference.

We see lots of opportunities in AI & Robotics, as well as Lithium & Graphite. We created in-depth reports from which our members can pick out top quality. As value stocks will get a bid, we expect industrials (we included a section in the AI & Robotics report) to start outperforming soon, and lithium stocks to follow soon after.