Aerodrome offers strong liquidity, an active ecosystem on Base, and a governance model that rewards committed holders.

Aerodrome Finance has become one of the busiest decentralized exchanges on Base.

It gives users deep liquidity, fast swaps, and a clear reward structure for both traders and long-term token holders.

AERO plays a central role in this system because it controls governance, rewards, and liquidity incentives.

The protocol continues to attract users with a growing TVL, active markets, and a proven AMM design.

So, is AERO a good buy? Here are five reasons investors are buying Aerodrome Finance.

Reasons To Buy Aerodrome Before 2026

If you are looking to invest in AERO but are unsure if it’s a good fit for your portfolio, the following reasons should help you make a decision.

1. Strong Liquidity On Base With High TVL

Aerodrome holds hundreds of millions in Total Value Locked.

This scale gives traders smoother swaps, fewer price swings during large trades, and a more reliable trading experience.

Strong TVL also means liquidity providers earn consistent fees because more users interact with the exchange every day.

Projects launching on Base often choose Aerodrome for their liquidity pools because it already has deep capital and a strong user base.

While TVL can rise or fall with market conditions, the current level shows real demand, active usage, and steady participation from large and small liquidity providers.

It is one of the clearest signs that the protocol is widely trusted.

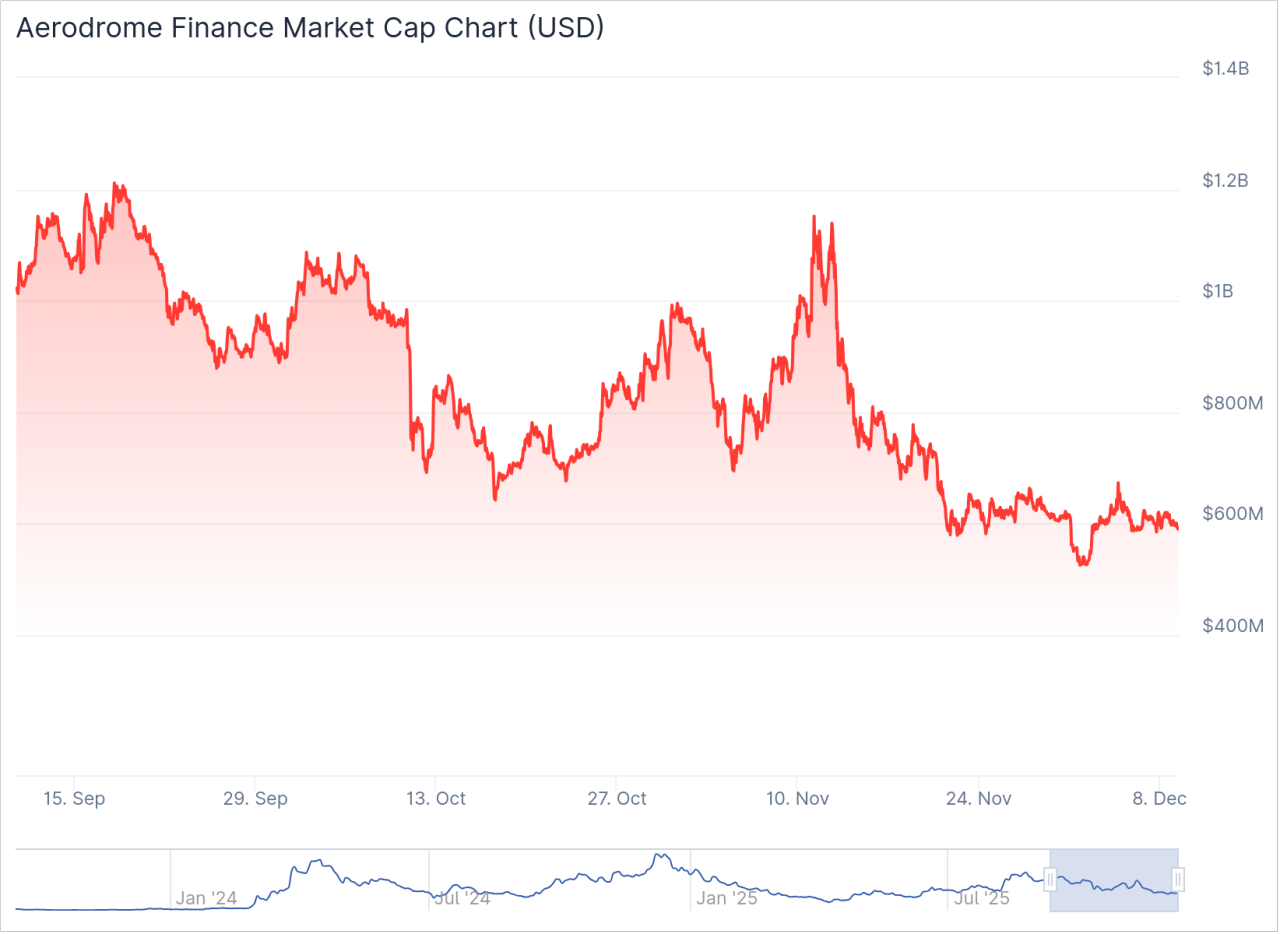

2. Meaningful Market Size And Tradability

AERO has a circulating supply of roughly 900 million tokens and a market cap in the mid-hundreds of millions.

This gives the token enough liquidity on exchanges for everyday traders and larger buyers.

A healthy circulating supply also helps price stability because it avoids the extreme swings often seen in tiny-float tokens.

Still, you should keep an eye on the difference between circulating supply and total supply because future unlocks affect market conditions.

AERO’s current market size shows that it has reached a level where trading is accessible, order books are active, and liquidity is deep enough for consistent activity.

3. Vote Lock Governance With veAERO

Aerodrome uses a vote lock system where holders lock AERO to receive veAERO.

This gives them voting rights on how emissions are allocated across liquidity pools. Locking also gives access to rewards like fees and boosted incentives.

This structure attracts long-term holders because locking reduces selling pressure and creates a committed community that helps guide the protocol.

When many users lock tokens for extended periods, it shows confidence in the project’s future and reduces the amount of liquid supply that can hit the market.

For investors, it is a model that rewards patience and participation instead of short-term speculation.

4. Proven AMM Mechanics And Base Integration

Aerodrome uses the same tested AMM design that worked on Velodrome, including gauges, emissions, fee sharing, and clear incentives.

This removes the uncertainty that often comes with brand new DeFi models.

The protocol is built for Base, which offers low fees and quick transaction times.

This helps Aerodrome attract high trading activity, new token launches, and daily retail users.

The combination of a proven design and a fast, low-cost chain improves the user experience.

It also helps the protocol scale as Base continues growing.

This reduces technical risk because the core system has already been battle tested on other networks.

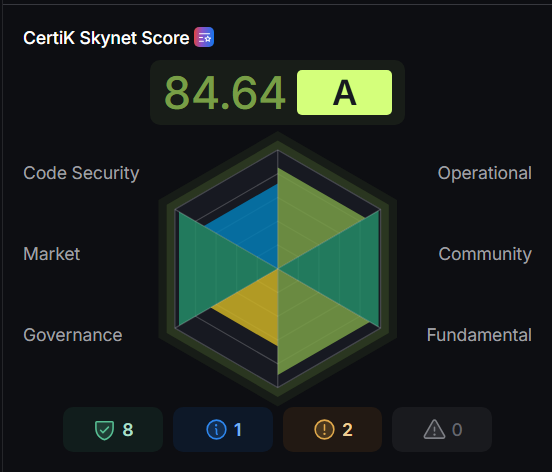

5. Visible Security Signals And Monitoring

Aerodrome appears on well-known monitoring platforms that track security risks and provide real-time alerts.

The protocol also shares audit information and other security details through public channels.

These signals help investors evaluate risk and stay updated on contract changes or upgrades.

While audits and monitoring cannot remove all smart contract risk, they show that the team treats security seriously.

This is especially important for AMMs that hold large liquidity pools.

This kind of visible oversight and transparency make the project easier to assess compared with DEXs that offer little or no security information.

Conclusion

Aerodrome offers strong liquidity, a meaningful market presence, vote-lock rewards, a proven AMM model, and visible security signals.

These factors give AERO a solid foundation for long-term holders who want exposure to Base’s growing ecosystem.

Before you buy AERO, check current TVL, monitor lock ratios, read audits, and size positions responsibly while keeping risk in mind.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

-

Proprietary 15-indicator methodology developed over 15+ years of market research.

-

Proven track record of spotting major turning points before markets move.

-

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

Act today and join the original crypto research service — still live and stronger than ever since 2017.

- A Crucial Week & One Critical Level (Dec 7th)

- How We Think About The Current Bounce And What Matters in December (Nov 30th)

- Why This Bounce Matters (30 Crypto Charts) (Nov 23rd)

- What’s Going On With Bitcoin & Alts? (Nov 16th)

- This Is What We Want To See The Next 72 Hours(Nov 9th)