WLFI offers real governance power, wide exchange access, strong institutional interest, disciplined token management, and a growing stablecoin use case.

WLFI is the governance token for the World Liberty Financial ecosystem, which includes the USD1 stablecoin.

Holding WLFI means having a voice in how the platform develops, how reserves are managed, and how new features roll out. This gives the token practical utility beyond price speculation.

WLFI has gained attention through listings on major exchanges and rising institutional use, which shows growing trust in the project. Here are five reasons to buy WLFI today.

Reasons To Buy WLFI

1. Governance Rights That Add Real Value

WLFI gives holders a vote on key areas such as reserve management, platform upgrades, and ecosystem partnerships. This means holders influence how the stablecoin and related financial tools evolve.

When governance has a real say in policy, token ownership becomes more than a trading position; it becomes part of the system’s direction. So, as more users and institutions adopt USD1 and related products, governance power could become even more important.

Investors who value influence and participation may find this structure appealing since it ties decision-making directly to token ownership.

2. Strong Exchange Coverage And Liquidity

WLFI is listed on major global exchanges, making it easier to buy, sell, and trade. This broad access helps maintain consistent trading volume, improves liquidity, and reduces price slippage during large orders.

Liquidity is a vital quality for any long-term asset, because it allows investors to enter or exit positions efficiently. The fact that WLFI trades on multiple regulated platforms also signals a level of legitimacy that can attract both retail and institutional investors.

Easy access and strong trading activity help ensure that WLFI stays relevant and usable for years to come.

3. Growing Institutional And Sovereign Interest

WLFI and its related stablecoin have already caught the attention of institutional players. Reports show large token purchases by Middle Eastern funds and USD1 being used for multi-billion-dollar settlements.

Such activity shows that the project is being tested and used for real transactions. Institutional involvement often brings credibility, deeper liquidity, and longer-term capital. If adoption continues, it can build a stable demand for WLFI, supporting the token’s value over time.

For investors, these developments indicate that WLFI could evolve into an asset with both retail and institutional appeal.

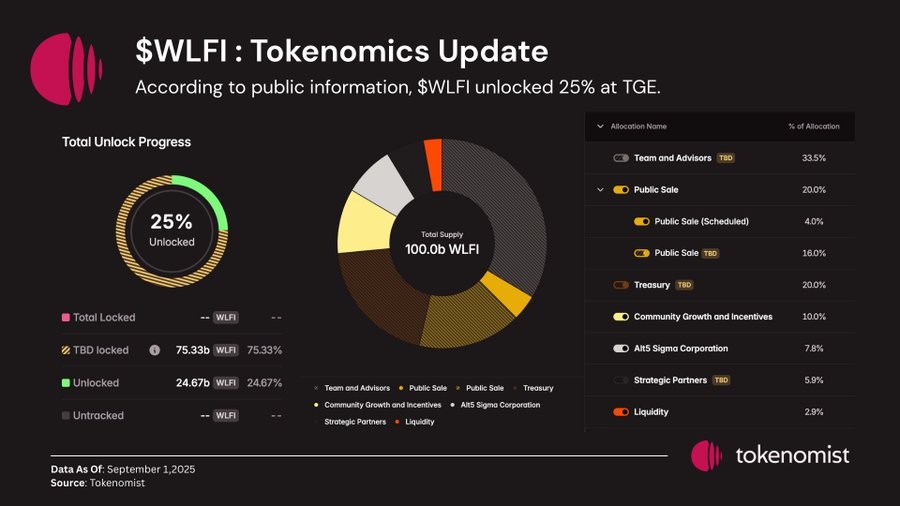

4. Clear Tokenomics And Supply Management

WLFI has a transparent token structure that shows how tokens are distributed and released. Founder and partner allocations follow multi-year vesting schedules, which prevents large amounts of tokens from flooding the market suddenly.

This approach supports a more predictable supply and fairer price movement. Investors can see when new tokens will unlock and plan accordingly. Over time, such supply discipline helps separate serious projects from short-lived ones.

We like WLFI’s clear tokenomics because it builds confidence that the team is focused on long-term growth, not short-term speculation.

5. Stablecoin Integration Creates Real Utility

The USD1 stablecoin is central to the World Liberty Financial ecosystem, and WLFI plays a governance role in it. USD1 allows on-chain payments, cross-border transfers, and treasury management for institutions and developers.

If USD1 adoption grows, the demand for WLFI naturally rises, since it controls how the stablecoin operates. This connection gives WLFI a purpose beyond trading as it ties the token to an active, functional product used in real financial settings.

These WLFI use cases give it more value and long-term relevance compared to tokens based purely on hype.

Conclusion

We believe you should invest in WLFI because of these five strengths: genuine governance power, broad exchange access, growing institutional use, transparent tokenomics, and real utility through USD1. Together, these create a foundation that few tokens can match.

While crypto investments always carry risk, WLFI offers exposure to a project working to connect traditional finance with decentralized systems. However, before investing, review updated token data and exchange options, and ensure your portfolio reflects your risk tolerance.

Join eToro today and receive $10 in free crypto on your first deposit. Trade crypto, stocks, and ETFs with powerful tools and social investing features like CopyTrader™

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here