Our 2026 cryptocurrency forecasts are directionally bullish. In this article, we share forecasted highs and lows for +20 cryptocurrencies. These crypto predictions for 2026 focus on leading cryptocurrencies.

The cryptocurrency market continues to evolve with innovations and, above all, volatility. Here’s a glimpse into what 2026 might hold for some of the leading cryptocurrencies.

We strongly recommend tracking our forecasted support areas (periods of retracement) as well as forecasted bullish targets (when there is bullish momentum) per crypto price predictions outlined in this article.

If you are a serious Cryptocurrency investor, or require additional support, consider joining our premium cryptocurrency and blockchain service here where you will get weekly analysis and alerts or become a VIP annual member and you can request custom analysis, charts and AI prompting service as part of the service.

1. Bitcoin (BTC)

In 2026, Bitcoin is projected to trade between $80,440 and $151,200. Stretched target: $175,000 to $185,000.

The midpoint suggests a strong bullish trend, driven by ongoing institutional adoption and broader acceptance. Bitcoin’s potential to exceed previous highs remains robust, contingent on sustained market momentum in $BTC.

Read – BTC price prediction 2026 >>

What’s equally important is the fact that Bitcoin dominance is breaking out. What does this mean?

- Bitcoin is stronger than the rest of the altcoin space.

- This is good because altcoins need Bitcoin to take the lead initially.

- This dynamic allows for profits to rotate into altcoins once Bitcoin has experienced a strong rally.

- The same happened in 2017, 2020, 2023, 2024 and 2025. We expect 2026 to be no exception.

BTC News

Headlines, though a lagging indicator, contribute to a bullish sentiment (summer 2025):

- Michael Saylor Signals New Bitcoin Acquisition For Strategy

- Bitcoin (BTC) Price to Look Bullish as Donald Trump Praises Bitcoin

- Bitcoin Rebounds Amid June 2025 Geopolitical Tensions

- Bitcoin Price Watch: Can Bitcoin Smash Through the $110K Barrier?

Headlines more recently have turned Bearish, again fueling sentiment (Winter 2025)

A word of wisdom, take these headlines with a pinch of salt. It’s important to see through the noise and understand when the market presents an opportunity.

Although it’s not always the case there is an argument to be greedy when others are fearful and fearful when others are greedy. Time will tell if this an example of that being true.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

BTC chart analysis for 2026 – The longest term Bitcoin price chart shows that BTC poised for a breakout in 2026. Our overall price forecast for BTC remains bullish.

2. Ethereum (ETH)

In 2026, Ethereum is expected to trade in a wide range with a minimum price of $1,667 and maximum price of $4,495. If and whenever bullish momentum in crypto markets accelerates, ETH may push to our stretched price target of $5,190.

2026 looks pivotal for Ethereum. According to InvestingHaven’s analysis, ETH may first retest the $4,111 level. If bullish momentum continues, Ethereum could reach a new all-time high in the next 3 months.

Read – ETH price prediction 2026 >>

3. Solana (SOL)

Solana could see its price range from $121 to $495 in 2026. Stretched target: $590 (low probability).

Continued development and scalability improvements will be essential for SOL to approach the upper end of this forecast. The $270 mark will be a key psychological level.

Read – SOL price prediction 2026 >>

Based on chart analysis, Solana is showing signs of a reversal after two months of drops. If momentum picks up, SOL could finish the year strongly, with the possibility of reaching new all-time highs in 2026.

4. XRP

Our XRP outlook 2026 predicts a range from $1.80 to $4.14. Stretched target: $5.25 (low probability).

Regulatory clarity and market acceptance will be crucial for XRP to reach the higher end of this spectrum. The expected positive resolution of the battle between Ripple and the SEC is clearly positively impact its trajectory.

Read – XRP price prediction 2026 >>

XRP bounced off support and started 2026 with bullish momentum, we expect 2026 to be a bullish year for XRP . Charting trends suggest the rally could start in January 2026.

5. Binance Coin (BNB)

BNB is expected to range from $582 to $970 in 2026.

The token’s performance will be influenced by Binance’s continued market expansion combined with its successful blockchain upgrades. A critical level for $BNB is $675, with bullish outcomes anticipated if this support holds.

If momentum continues into 2026 for BNB, Binance Coin could reach its $970 price target. Chart analysis also suggests that dips toward $750 may present a key entry point. ( As expected)

<<<<Read our BNB prediction 2026>>>>

6. Cardano (ADA)

Cardano’s price in 2026 could fluctuate between $0.56 to $1.81. Stretched target: $2.36 (low probability).

Read – Cardano prediction 2026 >>

The Cardano chart indicates that a breakout above $1.32 is needed to target new all-time highs in 2026. Key support is identified at $0.40. If ADA see’s a renewed bullish trend, we may see Cardano hit $1 again before the end of 2026.

7. Polkadot (DOT)

For 2026, Polkadot is forecasted to range between $4.01 and $13.91. Stretched target: $19 (low probability).

Read – Polkadot prediction for 2026 >>

Polkadot’s 2025 was disappointing to say the least. All 2024 gains were erased for DOT. Deep support is being tested, a catalyst to change sentiment at this stage could result in significant gains, but will it happen in 2026?

8. Avalanche (AVAX)

Avalanche is anticipated to see a price range from $13.70 to $91.10 in 2026. Stretched target: $113 (low probability).

The critical 50% Fibonacci level of $13.76 will be significant for future gains. Institutional adoption and tokenization could drive AVAX towards the upper end of this range.

Read – Avalanche prediction for 2026 >>

Avalanche (AVAX) has been trading sideways with limited momentum. Chart analysis suggests that a monthly close above $20 would be required to shift the trend and signal the potential for renewed bullish momentum.

9. Dogecoin (DOGE)

Dogecoin’s forecast for 2026 suggests a price range from $0.15 to $0.66. Stretched target: $1.14 (low probability).

The key will be whether Dogecoin can sustain gains and potentially reach higher targets if broader adoption and market sentiment improve.

Read – Dogecoin price prediction 2026 >>

A sustained move above $0.27 for Dogecoin (DOGE) could give bulls control and trigger renewed momentum in 2026.

10. Chainlink (LINK)

Chainlink is projected to range from $12.5 to $36.9 in 2026. Stretched target: $44 (low probability).

The critical Fibonacci retracement levels and its leadership role in expanding its ecosystem with financial institutions will play a significant role in driving LINK’s price within this range.

Read – Chainlink prediction for 2026 >>

11. Shiba Inu Coin (SHIB)

Shiba Inu (SHIB) is expected to see a price range between $0.0000123 to $0.000055 in 2026. Stretched target: $0.0001 (low probability).

The crucial Fibonacci level of $0.00012 will be significant for SHIB bullish momentum. Continued development and community support will be key drivers, alongside potential integrations and partnerships.

Read – Shiba Inu Coin prediction 2026 >>

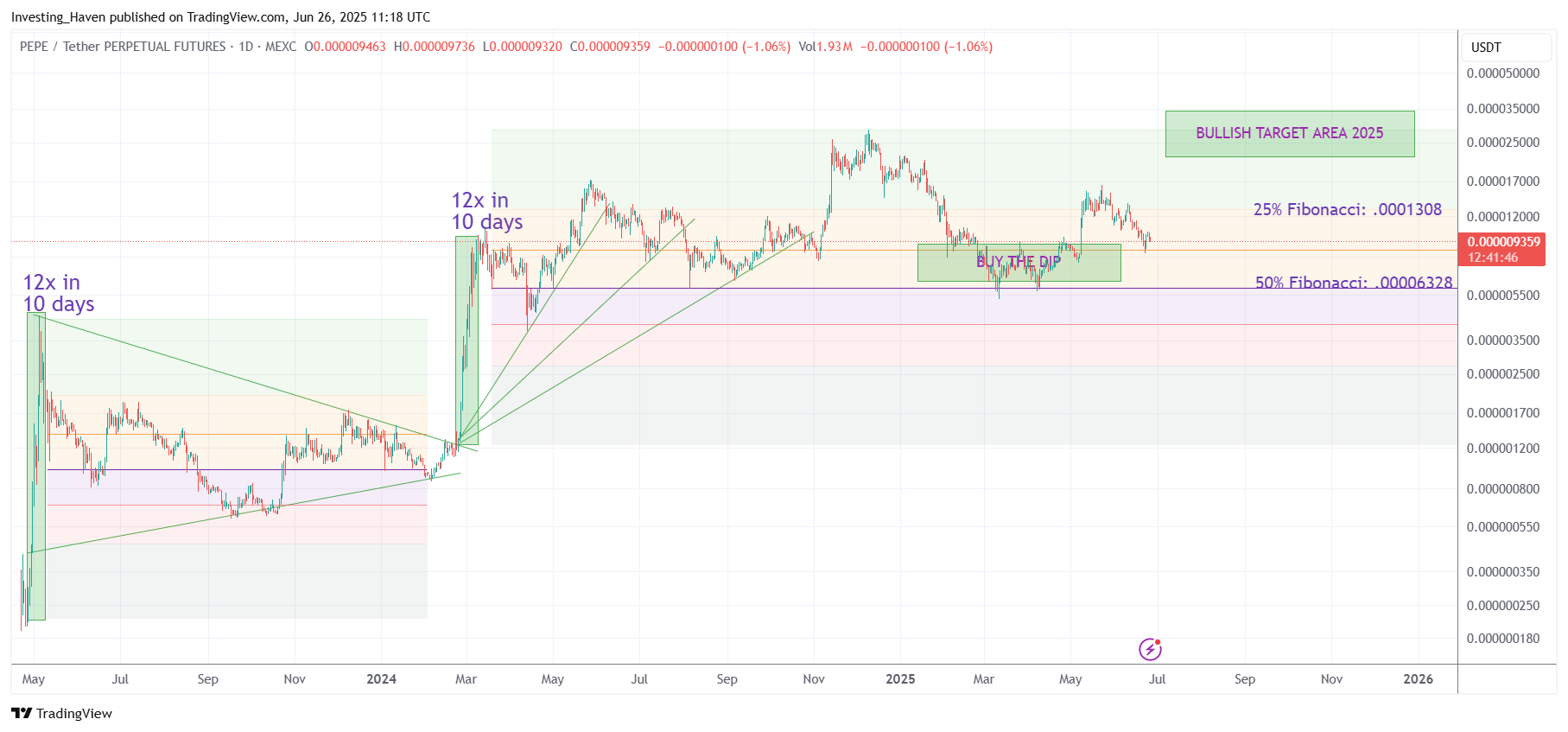

12. PEPE (PEPE)

Pepe (PEPE) is projected to range from $0.0000040 to $0.0000330 in 2026. Stretched target: $0.0000444 (low probability).

The key level to watch for PEPE is $0.0000040, which represents PEPE’s critical support and potential rebound point. A successful rebound from this level could confirm a lasting bottom. The meme coin’s performance will largely depend on market sentiment and social media trends.

In the last 2 years we have seen PEPE increase in value by 1200% in just 10 days on two occasions, if you can get in early on a trend this sort of movement is entirely possible again in 2026.

Read – PEPE prediction for 2026 >>

13. ICP (Internet Computer)

ICP is projected to range from $3.00 to $20.10 in 2026. Stretched target: $30 (low probability).

The critical support level for ICEP is $3.00 which it recently tested. Seeing some consecutive weeks in the green will be significant for its bullish potential. Institutional adoption (Dfinity) and network upgrades will be key drivers of ICP’s performance.

Read – ICP prediction 2026 >>

14. Bitcoin Cash (BCH)

Bitcoin Cash could see its price range from $313 to $745 in 2026. Stretched target: $1,099 if bullish momentum continues to stay strong.

The Fibonacci level at $536 will be important for forecasting higher targets. BCH’s adoption and use case developments will be crucial for reaching these projections.

Read – Bitcoin Cash prediction 2026 >>

15. Stellar Lumens (XLM)

Stellar Lumens (XLM) is predicted range between $0.21 and $0.81 in 2026. Stretched target: $1.44 (low probability).

The 38.2% Fibonacci level of $0.24 will need to act as key support for bullish momentum to develop. Moreover, with great advancements on Stellar’s blockchain platform, from cross border payments to Defi and RWA, Stellar is fundamentally ready for a stellar year.

Read – XLM prediction 2026 >>

16. NEAR Protocol (NEAR)

NEAR Protocol (NEAR) is predicted to move in a wide range in 2025 between $1.7 and $7.1. Stretched target of $11.2 (low probability).

Broader market trends may heavily influence the price performance of NEAR. First and foremost, institutional adoption will be pivotal in driving demand for NEAR. This interest from institutions is a pre-requisite for NEAR to move to our higher target, but also potentially exceed it and move well beyond $7 in 2025.

Read – NEAR price prediction 2026 >>

17. Stacks (STX)

A Stacks (STX) price forecast for 2026 between $0.30 and $2.22 with an average price of $1.44 (low probability).

The Stacks long term chart looks bullish. It is printing a series of bullish reversal in the context of a long term uptrend. An acceleration point will be hit, sooner or later, presumably on BTC bullish momentum somewhere in 2026.

Read – Stacks prediction 2026 >>

18. Sui (SUI)

Throughout 2026, SUI is predicted to trade between $1.51 and $8.80 based on SUI upward revised price targets. Key drivers: institutional adoption and technological advancements. If market conditions remain favorable, SUI could experience significant growth. SUI still signals long term value giving you many reasons to considering buying SUI.

Read our SUI prediction for 2026 >>

19. Kaspa (KAS)

For 2026, Kaspa’s price is expected to fluctuate between $0.040 and $0.19, with a stretched target of $0.25. Investor sentiment and potential partnerships in Kaspa’s ecosystem, combined with institutional interest, may push price towards its stretched target.

Read – Kaspa prediction for 2026 >>

20. Litecoin (LTC)

Litecoin is forecasted to trade between $76.50 and $191.10 in 2026. Litecoin’s 50% Fibonacci retracement level at $128.6 will be essential for confirming bullish trends. Stretched target: $250 (low probability).

Ultimately, very long term, beyond 2026, LTC will need to revisit $384.4, even though it might be a one-day test. That’s, ultimately, where LTC is headed.

Read – Litecoin prediction for 2026 >>

21. Floki (FLOKI)

In 2026, FLOKI is forecasted to range between $0.000040 and $0.000335. Drivers for FLOKI in 2026: continued community support and investor interest confirming the continuation of the meme coin mega cycle.

Read – Floki prediction for 2026 >>

22. Dogwifhat (WIF)

The 2026 Dogwifhat (WIF) prediction is a range from $0.30 to $2.25. Community support and crypto market interest will remain key drivers. If favorable conditions persist, WIF could see its price inflate substantially in 2026.

Read – Dogwifhat prediction 2026 >>

23. Ondo (ONDO)

Ondo (ONDO) is projected to have a price range from $0.45 to $2.55 in 2026. Stretched target: $5.53 (low probability).

The important Fibonacci level of $0.62 will play a pivotal role in determining its bullish potential. Institutional adoption and advancements in real-world asset integration could drive ONDO‘s growth, with significant upside potential if key levels are surpassed.

Read – ONDO prediction 2026 >>

[Question] Which token will deliver the highest returns in 2026?

That’s the million dollar question top of mind of every crypto investors. We address this question, in a detailed way in our crypto research service. You may want to check out our recent alerts (by scrolling down); they emphasize our focus on finding the best tokens, way before they start running higher, looking for the best timing to enter top tokens.

No financial advice. These projections are based on the current data at hand; predictions are subject to change especially if significant changes occur in market conditions.